Reference no: EM131116182

GBA Company wishes to raise $5,000,000 with debt financing. The funds will be repaid with interest in 1 year. The treasurer of GBA Company is considering three sources:

i. Borrow USD from Citibank at 1.50%

ii. Borrow EUR from Deutsche Bank at 3.00%

iii. Borrow GBP from Barclays at 4.00%

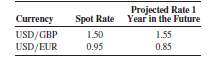

If the company borrows in euros or British pounds, it will not cover the foreign exchange risk; that is, it will change foreign currency for dollars at today's spot rate and buy foreign currency back 1 year later at the spot rate prevailing then. The GBA Company has no operations in Europe. A representative of GBA contacts a local academic to provide projections of the spot rates 1 year in the future. The academic comes up with the following table:

�

a. What is the expected interest rate cost for the loans in EUR and GBP?

b. What are the projected USD/GBP rate and USD/EUR rate for which the expected interest costs would be the same for the three loans?

c. Should the country borrow in the currency with the lowest interest rate cost? Why or why not? Would your answer change if GBA did generate cash flows in the United Kingdom and continentalEurope?

|

Select article that utilizes quantitative research design

: Describe the general advantages and disadvantages of the two research approaches featured in the articles. Use examples from the articles for support.

|

|

Prepare the adjusting entry to report the securities

: Available-for-Sale Securities Entries and Reporting Player Corporation purchases equity securities costing $73,000 and classifies them as available-for-sale securities.

|

|

Differences elimination kinetics in older people

: Knowing you are in a chemistry class, your elderly uncle shows up at your place in a panic. He is about to go a dental procedure for which his oral surgeon suggest light sedation by diazepam(valium). He is concern about how long the effects will l..

|

|

Unsaturated hydrocarbon butadiene

: The unsaturated hydrocarbon butadiene dimerizes to 4-vinylcyclohexene. When data collected in studies of the kinetics of this reaction were plotted against reaction time, plots of [C4H6] or ln[C4H6] produced curved lines, but the plot of 1/[C4H6] ..

|

|

What is the expected interest rate cost for the loans in eur

: What is the expected interest rate cost for the loans in EUR and GBP? What are the projected USD/GBP rate and USD/EUR rate for which the expected interest costs would be the same for the three loans? Should the country borrow in the currency with the..

|

|

Define direct marketing and give some real world examples

: Define direct marketing and give some real world examples

|

|

What mass of tnt would have to explode

: What mass of TNT would have to explode to provide the same energy release? Assume that each mole of TNT liberates 3.4 MJ of energy on exploding.

|

|

Difference in behavior of variable and fixed cost

: Include in your response an explanation of the difference in behavior of variable and fixed cost, including an example to illustrate your explanation. Your initial post should be 200 to 250 words.

|

|

Chemical formula for hydroxide

: What is the chemical formula for hydroxide, carbon dioxide, methane, zinc oxide, nitrate, and polyatomic ions such as hydrogen phosphite and hydrogen sulfate?

|