Reference no: EM131697655

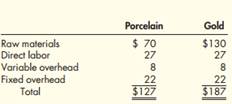

Question: Make or Buy, Qualitative Considerations Hetrick Dentistry Services operates in a large metropolitan area. Currently, Hetrick has its own dental laboratory to produce porcelain and gold crowns. The unit costs to produce the crowns are as follows:

Fixed overhead is detailed as follows:

Salary (supervisor) $26,000

Depreciation 5,000

Rent (lab facility) 32,000

Overhead is applied on the basis of direct labor hours. These rates were computed by using 5,500 direct labor hours. A local dental laboratory has offered to supply Hetrick all the crowns it needs. Its price is $125 for porcelain crowns and $150 for gold crowns; however, the offer is conditional on supplying both types of crowns-it will not supply just one type for the price indicated. If the offer is accepted, the equipment used by Hetrick's laboratory would be scrapped (it is old and has no market value), and the lab facility would be closed. Hetrick uses 2,000 porcelain crowns and 600 gold crowns per year.

Required: 1. Conceptual Connection: Should Hetrick continue to make its own crowns, or should they be purchased from the external supplier? What is the dollar effect of purchasing?

2. Conceptual Connection: What qualitative factors should Hetrick consider in making this decision?

3. Conceptual Connection: Suppose that the lab facility is owned rather than rented and that the $32,000 is depreciation rather than rent. What effect does this have on the analysis in Requirement 1?

4. Conceptual Connection: Refer to the original data. Assume that the volume of crowns used is 3,400 porcelain and 600 gold. Should Hetrick make or buy the crowns? Explain the outcome.