Reference no: EM131222647

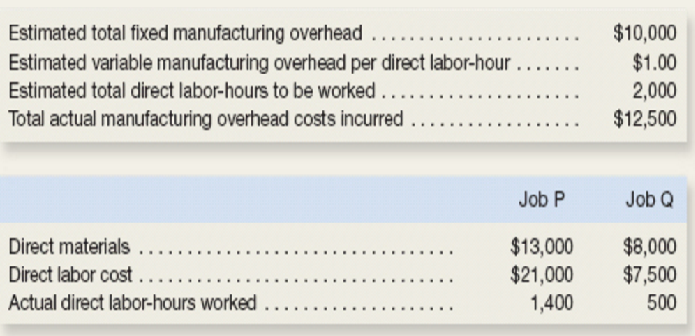

Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. It started only two jobs during March—Job P and Job Q. Job P was completed and sold by the end of the March and Job Q was incomplete at the end of the March. The company uses a plantwide predetermined overhead rate based on direct labor-hours. The following additional information is available for the company as a whole and for Jobs P and Q (all data and questions relate to the month of March):

1-What is the company’s predetermined overhead rate?

2-How much manufacturing overhead was applied to Job P and Job Q?

3-What is the direct labor hourly wage rate?

4-If Job P includes 20 units, what is its unit product cost? What is the total amount of manufacturing cost assigned to Job Q as of the end of March (including applied overhead)?

5-Assume the ending raw materials inventory is $1,000 and the company does not use any indirect materials. Prepare the journal entries to record raw materials purchases and the issuance of direct materials for use in production.

6-Assume that the company does not use any indirect labor. Prepare the journal entry to record the direct labor costs added to production.

7-Prepare the journal entry to apply manufacturing overhead costs to production.

8-Assume the ending raw materials inventory is $1,000 and the company does not use any indirect materials. Prepare a schedule of cost of goods manufactured.

9-Prepare the journal entry to transfer costs from Work in Process to Finished Goods.

10-Prepare a completed Work in Process T-account including the beginning and ending balances and all debits and credits posted to the account.

11-Prepare a schedule of cost of goods sold. (Stop after computing the unadjusted cost of goods sold.)

12-Prepare the journal entry to transfer costs from Finished Goods to Cost of Goods Sold.

13-What is the amount of underapplied or overapplied overhead?

14-Prepare the journal entry to close the amount of underapplied or overapplied overhead to Cost of Goods Sold.

15-Assume that Job P includes 20 units that each sell for $3,000 and that the company’s selling and administrative expenses in March were $14,000. Prepare an absorption costing income statement for March.

|

What was his annual rate of return on this sculpture

: Although appealing to more refined tastes, art as a collectible has not always performed so profitably. During 2003, an auction house sold a sculpture at auction for a price of $10,351,500. Unfortunately for the previous owner, he had purchased it in..

|

|

Prepare summary of the preceding transactions

: Ag Bio Tech (ABT) was organized on January 1, 2013, by four friends. Each organizer invested $12,500 in the company and, in turn, was issued 10,000 shares of common stock. During the first month, the records of the company were inadequate. You were a..

|

|

Defined benefit pension plan

: Sachs Brands' defined benefit pension plan specifies annual retirement benefits equal to: 1.2% × service years × final year's salary, payable at the end of each year. What is the company's prior service cost at the beginning of 2017 with respect to D..

|

|

What is the contribution margin ratio

: What is contribution margin per unit? What is the contribution margin ratio? What is the break-even point in units? What are the sales in dollars needed to obtain an operating income of $20,000

|

|

What is the direct labor hourly wage rate

: Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. It started only two jobs during March—Job P and Job Q. What is the company’s predetermined overhead rate? How much manufacturing overhead was applied to J..

|

|

Determine the taxable amount of social security benefits

: Determine the taxable amount of social security benefits for the following situations. Erwin and Eleanor are married and file a joint tax return. They have adjusted gross income of $39,600, no tax-exempt interest, and $13,860 of Social Security benef..

|

|

Used for direct comparison because each company sales

: You have been asked to compare the sales and assets of four companies that make computer chips to determine which company is the largest in each category. You have gathered the following data, but they cannot be used for direct comparison because eac..

|

|

Beneficiaries to reduce the tax burden on the beneficiaries

: Assuming you have identified a specific type of trusts you would like to establish for your family, please provide the key points to consider when setting up the trust for your beneficiaries to reduce the tax burden on the beneficiaries.

|

|

Accounts and amounts in its financial statements

: Pope’s Garage had the following accounts and amounts in its financial statements on December 31, 2013. Assume that all balance sheet items reflect account balances at December 31, 2013, and that all income statement items reflect activities that occu..

|