Reference no: EM131196409

Forecasting Model Questions-

The questions that follow and the article Comparing the Accuracy and Explain ability of Dividend, Free Cash Flow, and Abnormal Earnings Equity Value Estimates will inform your completion of milestone III. An understanding of the models in this assignment will assist you in hypothesizing the incremental impact of a new investment project for the company. The understanding of these models will contribute to your ability to look toward the future when considering the direction of an organization.

Prompt

Once you have read the article "Comparing the Accuracy and Explainability of Dividend, Free Cash Flow, and Abnormal Earnings Equity Value Estimates", review and complete the questions below. Use the article and your text to inform your responses to the questions below.

Assignment Questions:

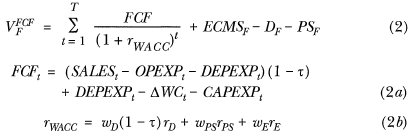

1. For models 2, 2a, and 2b:

where:

VFFCF = market value of equity at time F;

SALESt = sales revenues for year t;

OPEXPt = operating expenses for year t;

DEPEXPt = depreciation expense for year t;

ΔWCt = change in working capital in year t;

CAPEXPt = capital expenditures in year t;

ECMSt = excess cash and marketable securities at time t;

Dt = market value of debt at time t;

PSt = market value of preferred stock at time t;

rWACC = weighted average cost of capital;

rD = cost of debt;

rPS = cost of preferred stock;

wD = proportion of debt in target capital structure;

wPS = proportion of preferred stock in target capital structure;

wE = proportion of equity in target capital structure; and

τ = corporate tax rate.

-What is the best way to minimize the weighted average cost of capital?

-What is the effect of the weighted average cost of capital on the market value?

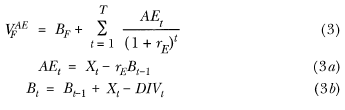

Q2. For models 3, 3a, and 3b:

where:

VtAE = market value of equity at time F;

AEt = abnormal earnings in year t;

Bt = book value of equity at end of year t; and

Xt = earnings in year t.

What is the relationship between book value of equity and time t-1 and the market value of the equity?

3. Discuss model 4 and expand on the importance and the meaning of the market risk premium.

rE = rf + β[E(rm) - rf] (4)

where:

rE = industry-specific discount rate;

rf = intermediate-term Treasury bond yield minus the historical premium on Treasury bonds over Treasury bills (Ibbotson and Sinquefield [1998]);

β = estimate of the systematic risk for the industry to which firm j belongs. Industry betas are calculated by avenging the firm-specific betas of all sample firms in each two-digit SIC code. Firm-specific betas are calculated using daily returns over fiscal year t - 1;

E(rm) - rf = market risk premium = 6%.

4. In your own words, what are the main conclusions for this article, and what could be improved upon in its analysis?

|

What book has to say about advertising-are ads manipulative

: What are your thoughts on what the book has to say about advertising? Are ads manipulative? Or, do they also serve other purposes? Think back however many years since the first iPod was introduced to the market. Would you have known you wanted one if..

|

|

Describe the stages of the life cycle of the blowfly

: When time of death is in question, what is the process by which a forensic entomologist would collect samples? What other information must an FE gather at the scene during the investigation? What does the FE attempt to accomplish after gathering samp..

|

|

Estimates of egr flow that are stored in a computer memory

: Technician B says that some engine computers use sensors to determine EGR flow rates, while others assume EGR flow rates by using estimates of EGR flow that are stored in a computer memory. Who is correct?

|

|

How people become identified historically as heterosexual

: How did people become identified, historically, as heterosexual or homosexual?- How have people become pegged, as it were, to their ethnic group?

|

|

What is the best way to minimize the weighted average cost

: What is the best way to minimize the weighted average cost of capital? What is the effect of the weighted average cost of capital on the market value

|

|

Describe the forensics procedures to collect

: A forensic unit within a federal crime lab has been tasked with the investigation of an individual who is suspected of the manufacturing, transportation, and sale of illegal fireworks explosives. Upon responding to a fire at the suspect's house, f..

|

|

Future global economic and business outlook

: The United States, with about 300 million people, accounts for about 5% of the world population, but it accounts for over 20% of the world GDP and consumes over 20% of global resources. This means, on a per capita basis, Americans consume more than m..

|

|

Views of rauschenbusch or plus

: What evidence from the fiveother documents would support or oppose the views of Rauschenbusch or Pius?What do all of the documents tell you about the issues and problems that were affecting people's behavior around 1900?

|

|

Issues and problems that were affecting people

: What do all of the documents tell you about the issues and problems that were affecting people's behavior around 1900?

|