Reference no: EM131200585

Question 1

Valuation Using Comparable

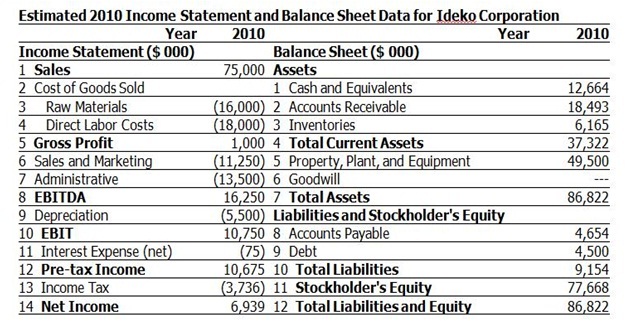

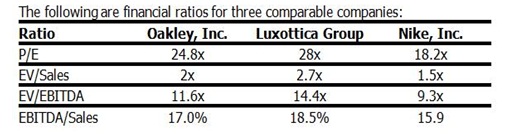

Use the following tables to answer questions:

a) Based upon the average P/E ratio of the comparable firms, what is Ideko's target market value of equity?

b) Based upon the average EV/Sales ratio of the comparable firms, what is Ideko's target economic value, if it holds $6.5 million of cash in excess of its working capital needs?

c) Based upon the average EV/EBITDA ratio of the comparable firms, what is Ideko's target market value of equity, if it holds $6.5 million of cash in excess of its working capital needs?

d) What range for the market value of equity for Ideko is implied by the range of EV/Sales multiples for the comparable firms if Ideko holds $6.5 million of cash in excess of its working capital needs?

e) Briefly discuss the limitations of using the comparables approach for valuation?

Question 2

What has Microsoft done for Skype? You'd be surprised

( By Andreas Bernstrom (CEO - RebTel), July 9, 2012)

Roughly a year after Microsoft's spectacular $8.5 billion acquisition of Skype, technology pundits across the globe continue to scratch their heads in bewilderment trying to figure out what the behemoth from Redmond has done to justify the hefty price tag paid for the Swedish VoIP giant. With the company's questionable acquisition history of businesses in the consumer internet space, it's safe to say the question is nothing but warranted. 14 months down the line from the initial announcement, what does Microsoft and Skype actually have to show in terms of development?

The answers might surprise you.

Read more at

https://venturebeat.com/2012/07/09/what-has-microsoft-done-for-skype-youd-be-surprised/#RVC9ZMwry5ywM4am.99

Using the above information brief, as well as additional (relevant) information from credible sources you may identify, critically examine Microsoft's takeover of Skype.

Your examination should address the following:

1. Examine the strategic reasons that led Microsoft to buy Skype.

2. Analyze the synergies gained or to be gained from the takeover, Considering the amount paid to purchase Skype.

3. In your opinion, do you see this acquisition as value-creating? Please explain.

Question 3

Citing suitable examples, critically examine the effects of leveraged buyouts on the investment and performance of privately held targets, pointing out any Distinctions with the effects on public firms.

|

How long will it take for your funds to triple

: You have $5,000 invested in a bank that pays 3.8% annually. How long will it take for your funds to triple?- If you invest $5,000 today, how many years will it take for your investment to grow to $9,140.20?

|

|

Find the second-law efficiency for combined system

: what is second-law efficiency for combined system?

|

|

Where does valley medical center have strengths

: As an OD practitioner, what recommendations would you make to support Robert in achieving his goals? How would you ensure these are included in the contracting process?

|

|

What is second-law efficiency for the combined system

: what is second-law efficiency for the combined system?

|

|

What is idekos target market value of equity

: Based upon the average P/E ratio of the comparable firms, what is Ideko's target market value of equity? - Based upon the average EV/Sales ratio of the comparable firms, what is Ideko's target economic value.

|

|

Who goes first and who goes last and why

: The one remaining is nearly blocked. Quickly develop a plan to get your classmates out. Who goes first and who goes last? Why?

|

|

What are some of the non-quantitative factors

: When making business decisions of this sort, some factors are quantitative and some are not. What are some of the non-quantitative factors related to this case?

|

|

Describe four symptoms that a child with adhd might exhibit

: In your own words, define ADHD. Then, identify and briefly describe four symptoms that a child with ADHD might exhibit. Describe at least three specific implications (e.g., financial, political, psychological, educational, etc.) of autism and/or AD..

|

|

Prepare a statement of cash flow using the indirect method

: Prepare a Statement of Cash Flow using the indirect method for 2015 using the above statements and the following additional information: Equipment costing $30,000 was purchased in 2015

|