Reference no: EM131247410

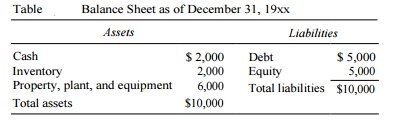

The balance sheet of the Universal Sour Candy Company is given in Table. Assume that all balance sheet items are expressed in terms of market values. The company has decided to pay a $2000 dividend to shareholders. There are four ways to do it:

1) Pay a cash dividend.

2) Issue $2000 of new debt and equity in equal proportions ($1000 each) and use the proceeds to pay the dividend.

3) Issue $2000 of new equity and use the proceeds to pay the dividend.

4) Use the $2000 of cash to repurchase equity.

What impact will each of the four policies above have on the following?

a) The systematic risk of the portfolio of assets held by the firm,

b) The market value of original bondholders' wealth,

c) The market value ratio of debt to equity,

d) The market value of the firm in a world without taxes.