Reference no: EM133689721

Question:

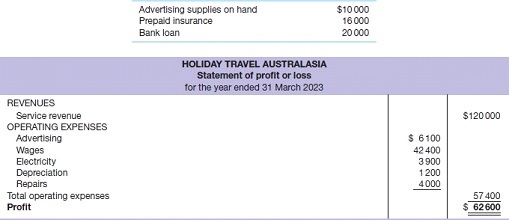

Holiday Travel Australasia commenced business on 1 April 2022. Alice Adare is a good manager but a poor accountant. From the trial balance prepared by a part-time bookkeeper, Alice prepared the following statement of profit or loss for the year ended 31 March 2023. Alice knew something was wrong with the statement because profit up to February had not exceeded $40 000. Knowing that you are an experienced accountant, she asks you to review the statement of profit or loss and other data. You first look at the trial balance. In addition to the account balances reported in the statement of profit or loss, the general ledger contains these selected balances at 31 March 2023.

You then make enquiries and discover the following.

Service revenues include advanced money for holidays after March, $12 000.

There was only $2300 of advertising supplies on hand at 31 March.

Prepaid insurance resulted from the payment of a 1-year policy on 1 July 2022.

The following invoices had not been paid or recorded: advertising for week of 24 March, $2500; repairs made 10 March, $2000; and electricity expense, $800.

At 31 March, 2 days' wages had not been paid or recorded, amounting to $400.

The business took out the loan on 1 October 2022 at an annual interest rate of 5%.

Required

Prepare a correct statement of profit or loss for the year ended 31 March 2023.

Explain to Alice the generally accepted accounting principles that she did not follow in preparing her statement of profit or loss and their effect on her results.

Ling & Jessop is a retail outlet for antique books that provides a book repair service and also sells rare music manuscripts. Ling & Jessop is operated by Cam Ling and Tim Jessop. Mildred Mildew is a repair specialist who works for Ling & Jessop on a fixed salary. Revenues are generated through the sale of antique books (approximately 75% of total revenues), rare manuscripts (10%) and the repair of old books brought to the store (15%). Book sales are made on both a credit and a cash basis. Customers receive prenumbered sales invoices. Credit terms are always net/30 days. All manuscript sales and repair work are cash only.

Inventory is purchased on account from various antique book and manuscript dealers. Virtually all suppliers offer cash discounts for prompt payment, and it is company policy to take all discounts. All cash payments are made by EFT and include payments to suppliers, to transport companies for freight on inventory purchases, and to newspapers, radio and TV stations for advertising. All invoices for advertising are paid as received. Cam and Tim each make a monthly drawing in cash for personal living expenses. The salaried repair woman is paid fortnightly.

Ling & Jessop currently has a manual accounting system. Cam Ling is concerned about the inefficiencies in journalising and posting transactions with the manual system. Two additional bookkeepers were employed a month ago, but the inefficiencies have continued at an even higher rate. However, Tim is old-fashioned and refuses to install an electronic accounting system.

Required

Answer the following.

Identify the special journals that Ling & Jessop should have in its manual system. List the column headings appropriate for each of the special journals.

What control and subsidiary accounts should be included in Ling & Jessop's manual system? Why?

Explain why the additional personnel did not help.

What changes should be made to improve the efficiency of the accounting system?