Reference no: EM13315233

PROBLEM 1

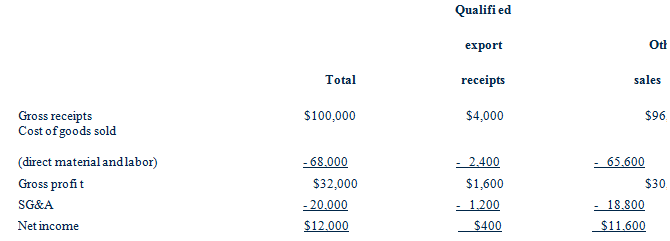

Acme, Inc., a domestic corporation, manufactures goods at its U.S. factory for sale in the United States and abroad. Acme has established an IC-DISC. During the current year, Acme's qualifi ed export receipts are $4,000, and the related cost of goods sold is $2,400. Acme has $1,200 of selling, general and administrative (SG&A) expenses related to the qualifi ed export receipts. Acme's gross receipts from domestic sales are $96,000, the related cost of goods sold is $65,600, and the related SG&A expenses are $18,800. In sum, Acme's results for the year (before considering any income allocated to its IC-DISC via a commission payment), are as follows:

What is the maximum amount of income that Acme can allocate to its IC-DISC? (Assume combined taxable income equals the $400 of net income from qualifi ed export receipts.)

PROBLEM 2

Finco is a wholly owned Finnish manufacturing subsidiary of Winco, a domestic corporation that manufactures and markets residential window products throughout the world. Winco has been Finco's sole shareholder since Finco was organized in 2000. At the end of the current year, Winco sells all of Finco's stock to an unrelated foreign buyer for $25 million. At that time, Finco had $6 million of post-1986 undistributed earnings, and $2 million of post-1986 foreign income taxes that have not yet been deemed paid by Winco. Winco's basis in Finco's stock was $5 million immediately prior to the sale.

Assume Winco's capital gain on the sale of Finco's stock is not subject to any foreign taxes, and that the U.S. corporate tax rate is 35%. What are the U.S. tax consequences of this sale for Winco?

Now assume that instead of selling the stock of Finco, Winco completely liquidates Finco, and receives property with a market value of $25 million in the transaction. As in the previous scenario, at the time of the liquidation, Finco had $6 million of accumulated earnings and profi ts, and $2 million of foreign income taxes that have not yet been deemed paid by Winco. Assume that Winco's basis in Finco's stock was $5 million immediately prior to the liquidation, and that the U.S. corporate tax rate is 35%. What are the U.S. tax consequences of this liquidation for Winco?

|

Explain how to determine the particles velocity at s

: acceleration of a particle traveling along straight line is a=(1/5)s^(1/2), s is in m, if v=0, s=3 when t=0 determine the particles velocity at s=6

|

|

Determine the time required for a car to travel 1 km

: Determine the time required for a car to travel 1 km along a road if the car starts from rest, reaches a max speed at some intermediate point, and then stops at the end of the road. the car can accelerate at 1.5 m/s^2 and decelerates at 2 m/s^2

|

|

What is the total distance traveled during time interval t

: A Particle is traveling on a straight line with velocity v=(3t^2-6t) where t is in sec. if s=4 ft when t=0, determine the position of the particle when t=4s. what is the total distance traveled during time interval t=0 to t=4s

|

|

Compute the increase in the internal energy of the neon

: Suppose a tank contains 737 m3 of neon (Ne) at an absolute pressure of 1.01 105 Pa, What is the increase in the internal energy of the neon

|

|

What are the u.s. tax consequences of liquidation

: What are the U.S. tax consequences of liquidation for Winco and what is the maximum amount of income that Acme can allocate to its IC-DISC? (Assume combined taxable income equals the $400 of net income from qualifi ed export receipts.)

|

|

Calculate the mean-standard deviation and the coefficient

: during construction of the surface layer of asphalt pavement, two samples where taken everyday to measure the asphalt content in the mix to ensure that it is within the specification limits. the target value was set at 5.5 percent with a tolerance..

|

|

What volume flow rate will keep pressures in the two pipes

: A liquid is flowing through a horizontal pipe whose radius is 0.0186 m. What volume flow rate will keep the pressures in the two horizontal pipes

|

|

Use the string input by the user as an argument to open file

: One of these must use preorder traversal, one must use inorder traversal, and one must use postorder traversal. You must decide which to use for each method, but use comments to document the type of traversal used.

|

|

How much will bar deform if it is released from the framwork

: A 24-in.-long copper bar with a yield strength of 30,000 psi is heated to 120°C and immediately fastened securely to a rigid framework. The coefficient of thermal expansion for copper is 16.6x10-6 (1/oC).

|