Reference no: EM131247066

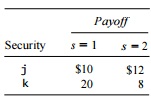

Ms. Mary Kelley has initial wealth W0 = $1200 and faces an uncertain future that she partitions into two states, s = 1 and s = 2. She can invest in two securities, j and k, with initial prices of pi = $10 and pk = $12, and the following payoff table:

a) If she buys only security j, how many shares can she buy? If she buys only security k, how many can she buy? What would her final wealth, Ws, be in both cases and each state?

b) Suppose Ms. Kelley can issue as well as buy securities; however, she must be able to meet all claims under the occurrence of either state. What is the maximum number of shares of security j she could sell to buy security k? What is the maximum number of shares of security k she could sell to buy security j? What would her final wealth be in both cases and in each state?

c) What are the prices of the pure securities implicit in the payoff table?

d) What is the initial price of a third security i for which Q„ = $5 and Qi2 = $12?

e) Summarize the results of (a) through (d) on a graph with axes W1 and W2.

f) Suppose Ms. Kelley has a utility function of the form U Wt. Find the optimal portfolio, assuming the issuance of securities is possible, if she restricts herself to a portfolio consisting only of j and k. How do you interpret your results?

|

What makes an effective presentation

: Determine what has been written on a topic. Provide an overview of key concepts from the sources and identify major relationships or patterns - What makes an effective presentation?

|

|

Calculate the players'' best-response functions

: Finish the calculation of the negotiation equilibrium by calculating the maximized joint value of the relationship (call it v*), the surplus, and the players' equilibrium payoffs. What are the equilibrium values of p, t, x, and y?

|

|

How would the drag associated with the system scale

: ME4604: Design for Manufacturing Assignment. If a system is characterized by requiring that the ratio between gravity and inertia forces remain constant, how would the drag associated with the system scale with respect to system size

|

|

What is the original source of the folktale

: What is the original source of the folktale? Is the plot simple and direct? Give a summary of the story/events. Does a theme emerge from the telling of the tale? What is the story's message or moral?

|

|

What are the prices of the pure securities

: If she buys only security j, how many shares can she buy? If she buys only security k, how many can she buy? - What are the prices of the pure securities implicit in the payoff table?

|

|

Cognitive overload is a problem in work or education

: Create a 8 - 12 slide power point that discusses whether cognitive overload is a problem in work or education. What personal and organizational solutions can you recommend for this problem?

|

|

Starbucks social media campaign

: Conduct research on a company that heavily uses electronic media and e-mail. You may need to visit the company's website policy page or other sources, in addition to the library article, in order to provide a complete response to the points listed..

|

|

What lines from song of myself describe in your view

: What lines from "Song of Myself" describe, in your view, something important or unique about American identity? Copy and paste the lines here and then discuss your reason for selecting them in a paragraph.

|

|

Strategic analysis of the coca-cola company

: Visit the official website of the Coca-Cola Company and identify the company's vision, mission, values, and goals - Critically evaluate the mission, vision, values, and goals - Determine which (if any) of the elements consider the goals and needs of ..

|