Reference no: EM131310413

Woodmere Products

Judith M. Schmitz

John Smith had just returned from what may prove to be one of his most important sales calls. John, a sales representative for a top furniture manufacturer, had been meeting with a representative from HomeHelp, a major home decorating retailer. It seems the buyer, Nan Peterson, and the product team she heads had just returned from the annual Council of Logistics Management Conference.

At the conference, Nans team had attended several sessions on time-based logistics strategies. Even though Nan and her team had just been exposed to the new strategies, they felt it had the potential for significant competitive advantage in their industry. At the meeting with John, Nan explained that HomeHelp is an entrepreneurial company that encourages product teams to try new products and channel relations. The few rules a team has to follow are simple:

(1) deal only with manufacturers (no independent distributors are contacted) and

(2) keep costs low and service high.

The second rule highlights HomeHelps basic business philosophy. Homel-lelp is a design and home decorating retail chain that follows the warehouse club format. As such, a premium is placed on maintaining low overhead to support an everyday low price (EDLP) strategy. Service is also a premium since HomeHelp targets two distinct customer segments: do-it-yourself consumers, who need special in-store guidance; and interior decorators, who need speedy checkouts and convenient delivery or pickup. Nan explained that the team has been considering applying time-based logistics strategies to furniture.

Such an arrangement had the potential to improve product availability for in-store customers while reducing overall inventory. HomeHelps close relationship with professional decorators required continued attention to improve its profitability and to ensure long-term growth. Interior decorators need convenient and exacting service, and HomeHelp feels that time-based logistics applied to furniture could be an important step to improving profitability. HomeHelps main concern is that the furniture industry as a whole appears to be trailing other industries in terms of sophisticated logistics operations.

For example. the furniture industry has invested little in information technology and maintains high inventories throughout the channel, including at the retail level. The results other firms reported for their innovative logistics applications gave HomeHelp a new insight into how an alliance with a furniture manufacturer might create a best practice distribution system with lower costs and less inventory. Nan told John that his company, Woodmere, had the potential to achieve an exclusive distribution arrangement with HomeHelp if the two companies could create time-based logistical capability. Woodmere was chosen since the business press had recently featured articles on its new organiration plan that focused on channels of distribution and leading-edge logistics strategies.

In addition, Woodmere was beginning to invest in information technology. Nan felt both companies should be able to reduce overall channel costs and offer customers superior product availability. Her specific request was for John to formulate a tentative proposal within 3 weeks to strike while the iron was hot. Nan knew the timing and unexpected opportunity created a great challenge for Woodmere, but she explained that HomeHelp strives to remain leading edge.

Furthermore, HomeHelp wants to increase annual growth to 20 percent and feels that furniture offers the best opportunities. As such, top management attention is on this potential business arrangement. As John walked to his regional sales managers office, it was hard to conceal his excitement. The potential agreement HomeHelp offered was enormous.

However, the effort required to get all groups at Woodmere involved would be great. The first step was to convince top management of the unique opportunity so that a team could be formed to create the proposal HomeHelp was expecting. Johns boss, Frank Harrison, was on the phone as John walked in. John carefully planned his words while Frank finished his conversation. As Frank hung up the phone, John blurted out, "We've got the potential for an exclusive with HomeHelp, but they want a customized delivery system. The proposals due in 3 weeks. 1 think we need the top brass in on this one. Its big." Franks reply was typical.

"It's not April I again already, is it John? Whats the problem with our current system? Three weeks! It will never happen." After John explained the meeting with Nan, Frank got on the phone to arrange a senior management review. Surprisingly, a business planning meeting was scheduled for the coming Friday. Frank and John could get on the agenda under new business. What a break! It was Wednesday and John began to reorganize his calendar to concentrate on the Friday meeting. The first item John focused on was researching HomeHelp. He discovered that HomeHelp operated over 200 warehouse-style stores in 18 states with the average store being over 100,000 square feet and offering 25,000 different products.

Typical sales breakdown is 50 percent wallpaper and draperies, 25 percent accessory pieces, 20 percent lighting and electrical fixtures. and 5 percent furniture. The potential for growth in furniture was clear. Furniture included fhbric covered items such as sofas, loveseats, and reclining chairs as well as wooden products such as tables, dinettes, and end pieces. Home Help was the industry leader with 10 percent of the $120 billion home decorating retail market. Forecasts indicate that the market will reach $150 billion by 2006. Industry observers predict that Home Help is positioned to enjoy up to 20 percent of total industry sales.

Home Help is dedicated to service. In-store classes illustrate design techniques, repair and installation procedures on wallpaper, drapes, and lighting and electrical fixtures. The classes are taught by Home Helps employees, most of whom are retired or part-time professional decorators and contractors. Home Help provides installation service in a majority of its stores as well as professional decorating services. Both services are offered on a fee basis. Forty percent of HomeHelps sales involve professional decorators. The remaining 60 percent come from do-it-yourself consumers.

The professional segment is quite large, and Home Help works closely with this group to meet service requirements. Affiliated professionals, called Propartners, have separate checkout lanes, a commercial credit program, and delivery services. Currently, Propartners customers purchase only 10 percent of Home Helps home furniture. Nan feels that this low sales level results from two factors. First, the delivery service offered by HomeHelp is contracted out to local moving companies, with the cost to Home Help passed on to the customer. Delivery for a piece of furniture typically adds 8 percent to the price Home Help charges for the product. This increase makes the overall price of purchase within $10 to $30 of the price charged by the competition, which offers free delivery.

The close price range, accompanied by the psychological effect of free delivery, prompts many Propartners customers to purchase furniture elsewhere. While not a major concern, the use of moving companies sometimes also creates delays so delivery promises are not always met. Second, each HomeHelp stores inventory is restricted to display items plus a limited stock of fast-moving products. Typically, only 7 percent of all customer orders can be filled from store inventory. As such, if a store does not have a specific piece of furniture, an order for the item is forwarded to a regional warehouse where the item is taken from inventory and sent to the store the following day. Furniture is available for delivery or customers can pick it up 2 days after the original order, assuming the regional warehouse has stock.

If the regional warehouse is out of stock, the piece is typically not available for shipment or pickup for 5 to 7 days because an interfacility transfer or manufacturer shipment is required. Since many Propartners are working on remodeling/redecorating projects, unexpected problems and delays can easily cause schedule changes. On a day-in and day-out basis, the exact time of furniture delivery and installation is difficult to accurately gauge. Propartners would like to be able to place an order 48 hours (or less) before the expected completion to reduce cost of rescheduling. Working on shorter timetables would improve their efficiency and cash tlow and is perceived by Propartners as a major benefit.

Currently, Propartners buy mostly from independent distributors who have more tlexible delivery programs. Friday's meeting was long. Frank and John weren't scheduled to present until near the end and they hoped it wouldn't run overtime, forcing them to be rescheduled. Finally, it was their turn. Frank started the presentation and discussed how long and hard a struggle it had been to develop a relationship with HomeHelp. Then John spoke of the benefits. He built on the need to develop new business relationships because Woodmere was involved in an alliance with a retailer in financial trouble.

This retailer, Happy Home & Living, had historically accounted for 25 percent of Woodmeres sales, but this figure was dropping dramatically. Happy Home & Livings erratic purchases were creating undercapacity in Woodmeres manufacturing facilities.

Furthermore, Home Help had a relationship with decorators, a customer group that Woodmere had been targeting under its reorganization plan. Woodmeres image was as a value leader good quality furniture at a low price. Attracting professional decorators to its products would definitely enhance Woodmeres image.

Furthermore, Woodmere hoped to have some direct contact with professional decorators to get firsthand information on upcoming fashion trends. Finally, an exclusive arrangement with Home Help appeared critical for the future. Home furniture manufacturing is heavily consolidated among a few key players, meaning stiff competition. While the home decorating industry remains heavily fragmented, Home Help is a leader and appears positioned to grow faster than competitors. Even though Home Help currently only has 10 percent of the market share, they have unlimited growth potential and are often referred to as the Wal9rMart of the home decorating industry. Reaction from senior management was mixed.

While many were excited about the potential, they were also cautious. The long-term relationship with Happy Home & Living that had prospered for 50 years was clearly becoming a potential problem for Woodmere. Relying on Happy Home & Living had created a false sense of security, and when Happy Home & Living suffered financially during the recessions of the eighties, Woodmere also suffered. Furthermore, Happy Home & Livings reputation as a quality retailer was beginning to decline.

In fact, it was getting the reputation for providing low-quality, outdated products. Top management was afraid to launch another close relationship that tied Woodmeres success to another company. Frank responded that HomeHelp had achieved at least 10 percent growth each year for the last 15 years, even through the recessions. The main reason for this growth was its advertising strategy, which convinced consumers who couldnt afford a new home that they could afford to remodel1 redesign their current one. Another concern was the shift in traditional operations necessary to support a customized delivery system. While no concrete evidence was available on the exact requirements of customized delivery, it was still apparent that the service being requested was unique and nontraditional and might require major reorganization and financial investment.

Also, several board members wondered how traditional customers, not interested in time-based logistics, would benefit. Their specific concern was that the commitment to HomeHelp would increase the overall cost of doing business with all customers. In short, some customers would be over serviced at a cost penalty. John agreed these were serious concerns, but reminded the group of the potential benefits that could result from a successful shift to time-based logistics. Not only was the exclusive agreement with Home Help important, but this "test case" with a major retailer could forge a leading-edge path for Woodmere, resulting in difficult-to-duplicate competitive advantage. Furthermore, John was convinced that Home Help would make a move to time-based logistics in the furniture segment with or without Woodmere.

After extended discussion, the group decided to assign a task team, with John as the leader, to take the steps necessary to determine if an arrangement with Home Help was in Woodmeres best interest and, if so, to develop the requested business proposal. The proposal would need approval before the presentation to Home Help. A special review meeting was scheduled in 2 weeks. First, John felt the team had to detail Woodmeres current operations. Then. an appropriate time-based system would need to be defined and compared to current operations to isolate changes necessary to offer excellent service support. A modified system would also need to be outlined and the cost and benefits determined. The issue of coexistence of current and time based response capabilities was also a concern.

Current Operations

Woodmere currently has two manufacturing facilities and six regional distribution centers. One manufacturing facility is located in Grand Rapids, Michigan, while the other is in Holland. Michigan. The Grand Rapids facility produces fabric-covered items, such as sofas, cushioned chairs, and recliners. The plant in Holland produces wooden items, such as tables and end pieces. The six distribution centers are located throughout the United States with one adjacent to the manufacturing facilities. Orders are received from customers electronically as well as by phone through sales representatives. Only 40 percent of Woodmeres customers are electronicalIy linked to the ordering system.

Woodmeres manufacturing facilities forecast sales to create the production schedule. Forecasts are locked in 6 weeks prior to assembly. Three of the distribution centers carry a full line of product inventory and seek to maintain a minimum on-hand quantity for each product. When inventory hits the predetermined minimum, a restock order is sent to the appropriate manufacturing facility. The other distribution centers stock only the fast-moving products. When a customer order is received it is assigned to the distribution center closest to the customer.

If the product ordered is not available, the required item is transferred from the closest distribution center that has the required stock. If multiple products are ordered, the original order is held until the out-of-stock item is available to ship so customers receive all requirements in one delivery. No shipments are sent directly from the manufacturing plant to the customer; all orders are processed through a distribution center. Woodmeres customers are dealers at the retail level who maintain their own inventory of Woodmeres products. When customers inventory is low, they place replenishment orders. These orders are transmitted to Woodmeres designated distribution center.

Distribution centers review their orders nightly in an effort to consolidate truckloads and schedule efficient delivery routes. When a full load is available, orders are assembled and loaded to facilitate sequenced delivery. Typical order cycle time is 3 to 6 days when inventory is available at the initially assigned distribution center. Interfacility inventory transfers typically add 2 to 3 days to the order cycle. When an item is backordered to a manufacturing plant, 8 to 12 more days are added to the order cycle. When factory backorders are required, a partial order may be sent to the dealer or retailer; however, no firm policy exists concerning when to ship and when to hold partial orders. Currently Woodmere uses a national for-hire carrier to handle all its outbound deliveries to customers and interfacility movements between distribution centers.

This carrier is already working with food and clothing customers that operate on a time-based logistics system.

Time-Based Logistics

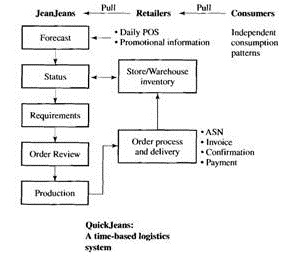

John felt it was important for the task team to talk with a representative from another company concerning its experience with time-based logistics. John contacted an old college roommate working at JeanJean? a clothing manufacturer, to see if he could help. Johns old roommate, Phil Williams, arranged for Johns team to visit JeanJean to discuss QuickJeans, its proprietary timebased system. In JeanJeans system, retailers play a major role. When a product sells in a retail store, the bar code on that product is scanned, and the POS information is transmitted electronically to JeanJean.

POS data detail the size, color, and style of product sold and are transmitted directly to JeanJeans manufacturing facilities where they are used to derive production schedules in response to consumer sales. Rapid movement of information replaces the need to forecast. To the Woodmere team, it looked as though information was being traded for inventory. Product replenishment was exact and done within days of the sale depending on each retail stores volume.

For example, high-volume stores receive daily replenishment shipments whereas lower volume retail outlets are served less frequently. The time-based system was flexible and able to accommodate a variety of different replenishment styles based upon individual retail customer requirements. This type of system reduces response order cycle time and inventory. Since delivery is tied to actual sales, consumer trends are responded to quickly, reducing obsolescence.

Furthermore, daily or weekly replenishment cycles allow the retail outlet to carry significantly less inventory while improving stockout performance. JeanJean was also able to reduce inventory by 20 percent by timing production to POS data. This reduction was even more impressive when JeanJean explained that its sales increased by 25 percent. Even though transportation cost doubled, it was more than justified by the savings in inventory and the benefits of knowing for sure that product was needed to service customers. The QuickJeans solution was technology-driven. ED1 used to transmit POS data and bar codes were essential to making the system work. ED1 was also utilized for invoicing and payments, advanced shipment notification, and delivery verification. This reduction in paperwork and clerical tasks benefited both JeanJean and its customers.

To implement QuickJeans, JeanJean had to change its fundamental business processes not just with its customers but also within its manufacturing plants. Flexible manufacturing required quick product changeovers to be fully responsive to the POS data. Furthermore, the ability to produce small runs of necessary product was a key requirement. The management at JeanJean pointed out that one of the most difficult parts of implementing time-based logistics was the sales decline that resulted from "deloading the channel." This "sales hit" was created by the false sense of expected sales and anticipatory inventory that resulted from manufacturing according to forecast, not to actual need.

JeanJean had to wait until inventory at the retail stores, retail warehouses, JeanJean warehouses, and manufacturing facilities moved through the channel system before QuickJeans began to work and show the expected benefits. This created tension among JeanJeans top management because it was a cost not originally expected when they bought into the QuickJeans program. The main cost to implement QuickJeans was the investment in technology.

For example, JeanJean invested over $1 million in scanners, lasers needed to make distribution operations fast

and efficient, and ticket printers to label products with retailers unique bar codes. Key retailers spent close to the same amount to purchase new equipment to scan the bar codes. This investment was not a one-time deal, either. The need to reinvest to upgrade technology has remained constant from the start. Some retailers, especially locally owned stores, didn't want to participate in QuickJeans because of the initial investment.

However, the retailers that participated were so pleased that most have placed JeanJean on their preferred supplier list. JeanJean provided Johns team with a flowchart of its QuickJeans operation as shown in Figure 1. The chart shows that daily transmission of POS data, as well as any promotional specials. is provided by the retailer. This information is used to calculate an initial production schedule. Inventory already on-hand in JeanJeans warehouse as well as in its retail customers storage areas is subtracted from the schedule, creating production requirements for all JeanJeans products.

These requirements are reviewed by an order specialist, who creates a final production schedule that is transmitted to the appropriate manufacturing plant. This order specialist also manages orders from retailers that are not involved in QuickJeans. All products are bar coded after manufacturing as required. Delivery is initiated by an electronic Advanced Shipping Notification (ASN) to tell the retailer what products are on the way. Delivery is direct to the retail store unless an alternative delivery site is specified. When the order is received at the designated location, the bar code is scanned and compared to the ASN and invoice. If the information matches, the retailer pays the invoice electronically.

The Proposal

Johns team was finally ready to present its time-based delivery system to top management and they hoped the proposal would be accepted. The presentation to Home Help was scheduled in 3 days. The Woodmere task team had worked hard and was confident their proposal had strong selling features for both Woodmere and Home Help. The special meeting with top mana, nement was called to order. The task team called the project "Customized Distribution: Creating Time-Based Customer Response" and began discussing how the proposal was developed, including the meeting with JeanJean.

The team felt that Woodmere could benefit greatly from accepting the Home Help challenge. Each Home Help store will transmit POS data on furniture sales at the close of each day. Home Help will not carry any Woodmere inventory in its regional warehouses and will carry only a limited amount of furniture and display items in each store. The POS transmission will include furniture items actually sold from inventory at the store and the furniture ordered, but not in stock. The POS transmission will be sent to a central information service.

The information service will sort the POS data and compare them to inventory on hand at each Woodmere distribution center. Furniture in stock will be consolidated, while those items that are not in stock will be added to the production schedule and manufactured the next day. After manufacturing, the products will be delivered to the distribution center where initial consolidation of instock items will occur, and the entire order will be shipped out to the customer. After shipment, the on-hand quantities at the distribution centers will be examined to determine if a replenishment needs to occur. If the on-hand quantity is too low, a replenishment order will be sent to the appropriate manufacturing plant.

Questions

1. What are the major business propositions for Woodmere and Home Help to consider in evaluating this proposal? Is time-based logistics the right strategy for each company?

2. What are the benefits and barriers (short- and long-term) to this proposal for both Woodmere and Home Help? What other factors need to be considered?

3. If you were Woodmeres top management, what suggestions would you make to improve the current proposal for long-run viability?

4. If you were Home Help would you accept or reject the proposal? Why?