Reference no: EM131219471

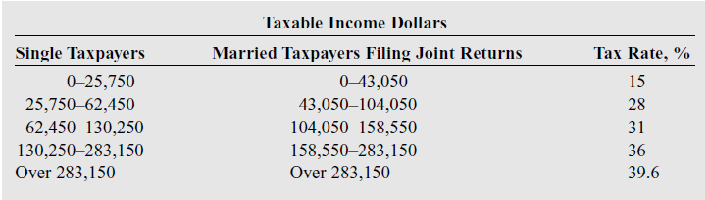

What are the average and marginal tax rates for a single taxpayer with a taxable income of $70,000? What are the average and marginal tax rates for married taxpayers filing joint returns if their joint taxable income is also $70,000?

|

Job order costing to capture the costs of reviews performed

: Louis, Toi, Alonzo, and Sylvia, (L, T, A, and S) a local public accounting firm, uses job order costing to capture the costs of reviews performed. There were no review jobs in process on July 1. Total estimated overhead for reviews for the year is $1..

|

|

About the business trip

: After his first business trip to a major city, Herman is alarmed when he reviews his credit card receipts. Both the hotel bill and the car rental charge are in excess of the price he was quoted. Was Herman overcharged, or is there an explanation for ..

|

|

What are the ending assets for the year

: Beginning assets were $437,600, beginning liabilities were $262,560, common stock issued during the year totaled $45,000, revenue for the year was $414,250, expenses for the year were $280,000, dividends declared was $22,700, and ending liabilities i..

|

|

Prepare a retained earnings statement for the year

: On January 1, 2014, Eddy Corporation had retained earnings of $545,310. During the year, Eddy had the following selected transactions. Prepare a retained earnings statement for the year.

|

|

What are average and marginal tax rates for single taxpayer

: What are the average and marginal tax rates for a single taxpayer with a taxable income of $70,000? What are the average and marginal tax rates for married taxpayers filing joint returns if their joint taxable income is also $70,000?

|

|

Stakeholders might be affected by terceks media release

: Nancy Tercek, the financial vice president, and Margaret Lilly, the controller, of Romine Manufacturing Company are reviewing the financial ratios of the company for the years 2017 and 2018. What, if any, is the ethical dilemma in this situation? Sho..

|

|

What is the most likely explanation for the difference

: A government’s interest expenditure, as reported in its debt service fund, differs significantly from its interest expense, as reported in its government-wide statements. What is the most likely explanation for the difference?

|

|

What is the income tax expense and current tax liability

: Button Company has two differences between its taxable income and its financial statement reported income, so also between its tax expense and current taxes payable. What is the income tax expense, the current tax liability and the deferred income ta..

|

|

Calculate common-sized inventories

: The asset side of the 2013 balance sheet for Leggett & Platt is below. The company reported cost of sales of $2,998.8 million in 2013 and $2,959.4 million in 2012. Calculate common-sized inventories for both years and comment on any differences that ..

|