Reference no: EM131328682

TIME VALUE OF MONEY Answer the following questions:

a. Assuming a rate of 10% annually, find the FV of $1,000 after 5 years.

b. What is the investment’s FV at rates of 0%, 5%, and 20% after 0, 1, 2, 3, 4, and 5 years?

c. Find the PV of $1,000 due in 5 years if the discount rate is 10%.

d. What is the rate of return on a security that costs $1,000 and returns $2,000 after 5 years?

e. Suppose California’s population is 36 5 million people and its population is expected to grow by 2% annually. How long will it take for the population to double?

f. Find the PV of an ordinary annuity that pays $1,000 each of the next 5 years if the interest rate is 15%. What is the annuity’s FV?

g. How will the PV and FV of the annuity in Part f change if it is an annuity due?

h. What will the FV and the PV be for $1,000 due in 5 years if the interest rate is 10%, semiannual compounding?

i. What will the annual payments be for an ordinary annuity for 10 years with a PV of $1,000 if the interest rate is 8%? What will the payments be if this is an annuity due?

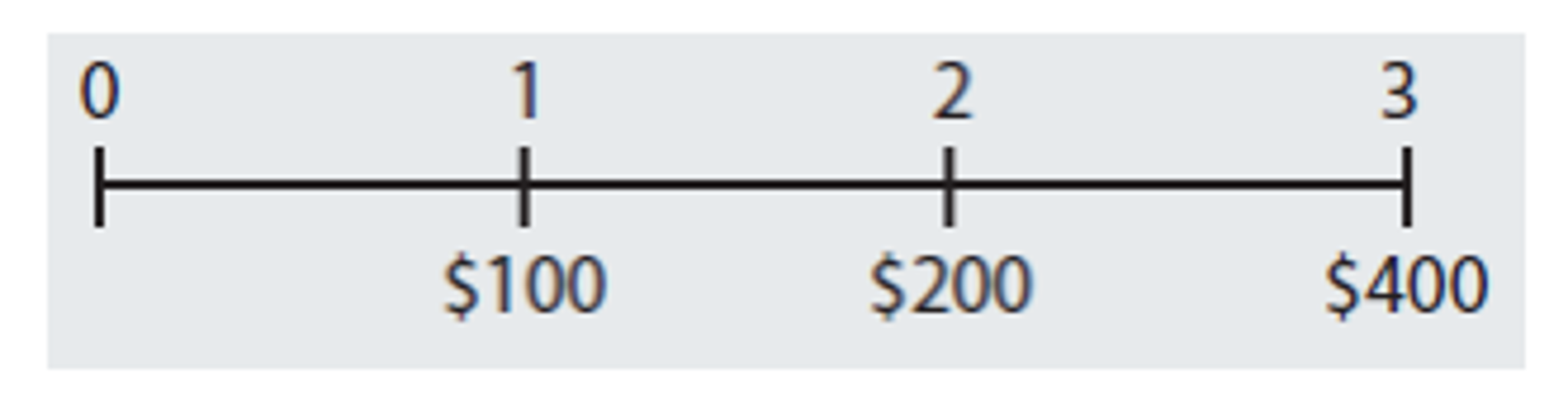

j. Find the PV and the FV of an investment that pays 8% annually and makes the following end-of-year payments:

k. Five banks offer nominal rates of 6% on deposits; but A pays interest annually, B pays semiannually, C pays quarterly, D pays monthly, and E pays daily.

1. What effective annual rate does each bank pay? If you deposit $5,000 in each bank today, how much will you have in each bank at the end of 1 year? 2 years?

2. If all of the banks are insured by the government (the FDIC) and thus are equally risky, will they be equally able to attract funds? If not (and the TVM is the only consideration), what nominal rate will cause all of the banks to provide the same effective annual rate as Bank A?

3. Suppose you don’t have the $5,000 but need it at the end of 1 year. You plan to make a series of deposits—annually for A, semiannually for B, quarterly for C, monthly for D, and daily for E—with payments beginning today. How large must the payments be to each bank?

4. Even if the five banks provided the same effective annual rate, would a rational investor be indifferent between the banks? Explain.

l. Suppose you borrow $15,000. The loan’s annual interest rate is 8%, and it requires four equal end-of-year payments. Set up an amortization schedule that shows the annual payments, interest payments, principal repayments, and beginning and ending loan balances.

|

Examine mccrae and costas five-factor model of personality

: Examine McCrae and Costa's five-factor model of personality. Pick one of the factor's listed (extraversion, neuroticism, openness, agreeableness, or conscientiousness) and describe 1 person in Scripture that you would consider to be high in that a..

|

|

Calculate the payback period for the proposed investment

: Calculate the payback period for the proposed investment.- Calculate the NPV for the proposed investment.- Calculate the IRR for the proposed investment.

|

|

Assumes the actual salvage value at the end of five years

: Uminum, the world's largest producer of feldspar, is considering leasing a sifter that costs $450,0000. The 5 year lease requires 5 beginning of the year payments. The leasing company is depreciating the sifter on a straight-line basis of $90,000 per..

|

|

Derive formula for the difference of a product

: How can this formula be correct, when the left-hand side is symmetric with respect to u and v but the right-hand side is not

|

|

Time value of money-what effective annual rate

: Assuming a rate of 10% annually, find the FV of $1,000 after 5 years. What is the investment’s FV at rates of 0%, 5%, and 20% after 0, 1, 2, 3, 4, and 5 years? Find the PV of $1,000 due in 5 years if the discount rate is 10%. What effective annual r..

|

|

Provide an overview of post partumdepression

: Provide an overview of Post partumdepression including, but not limited to, signs and symptoms, physical exam findings, diagnostics or labs needed, treatments, medication, referrals, and follow-up care

|

|

Compute standard error of estimate and interpret its meaning

: Compute the standard error of estimate, and interpret its meaning. Do you think that the company should use these results from the regression to base any corporate decisions on?....explain fully.

|

|

Provide a brief overview of your selected women health

: Provide a brief overview, of your selected women's health: LUPUS. Make sure to describe the disorders, screening, diagnosis, and management of each issue

|

|

Finance capital structure theory

: In theory, if two companies have identical capital structure, then they should both use the same discount rate for valuing a particular project, i.e., the discount rate does not depend on which company is evaluating the project.

|