Reference no: EM13125911

True or False

1. The price elasticities of supply and demand affect both the size of the deadweight loss from a tax and the tax incidence.

2. Buyers of a product will bear the larger part of the tax burden, and sellers will bear a smaller part of the tax burden, when the supply of the product is more elastic than the demand for the product.

3. Suppose a tax of $1 per unit is imposed on a good. The more elastic the supply of the good, other things equal, the larger is the deadweight loss of the tax.

4. A price ceiling is a legal minimum on the price at which a good or service can be sold.

5. A price ceiling set below the equilibrium price causes quantity demanded to exceed quantity supplied.

|

Market

|

Characteristic

|

|

A

|

Demand is very inelastic.

|

|

B

|

Demand is very elastic.

|

|

C

|

Supply is very inelastic.

|

|

D

|

Supply is very elastic.

|

6. Suppose the government is considering levying a tax in one or more of the markets described in the table. Which of the markets will allow the government to minimize the deadweight loss(es) from the tax?

|

a.

|

market A only

|

|

b.

|

markets A and C only

|

|

c.

|

markets B and D only

|

|

d.

|

market C only

7. Suppose the government is considering levying a tax in one or more of the markets described in the table. Which of the markets will maximize the deadweight loss(es) from the tax?

|

a.

|

market B only

|

|

b.

|

markets A and C only

|

|

c.

|

markets B and D only

|

|

d.

|

market D only

|

|

|

|

|

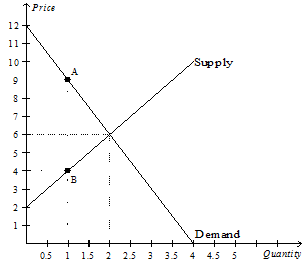

8. The vertical distance between points A and B represents a tax in the market.

a) The imposition of the tax causes the quantity sold to increase or decrease by _____ units?

b) The imposition of the tax causes the price paid by buyers to increase or decrease by $_____

c) The imposition of the tax causes the price received by sellers to increase or decrease by $____

d) The amount of the tax on each unit of the good is $_________

e) The per-unit burden of the tax on buyers is $_________

f) The per-unit burden of the tax on sellers is $ _______

g) The amount of tax revenue received by the government is $ ________

h) The amount of deadweight loss as a result of the tax is $________

i) The loss of consumer surplus as a result of the tax is $_______

j) The loss of producer surplus as a result of the tax is $______

k) Consumer surplus without the tax is $ ______

l) Producer surplus without the tax is $______

m) Total surplus without the tax is $_______

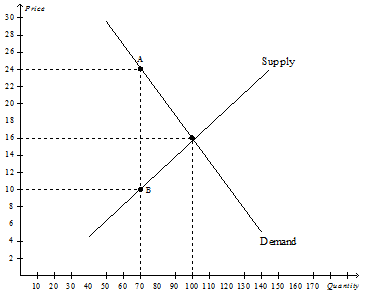

9. The vertical distance between points A and B represents a tax in the market.

a) The equilibrium price before the tax is imposed is $______ and quantity is _______

b) The price that buyers effectively pay after the tax is imposed is $________

c) The price that sellers effectively receive after the tax is imposed is $_______

d) The per-unit burden of the tax on buyers is $________

e) The per-unit burden of the tax on sellers is $_______

f) The amount of tax revenue received by the government is equal to $__________

g) The amount of deadweight loss as a result of the tax is $__________

h) The tax results in a loss of consumer surplus that amounts to $_________

i) The tax results in a loss of producer surplus that amounts to $_________

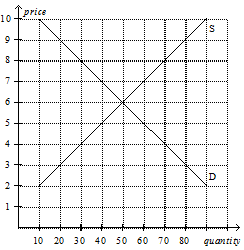

10a. Refer to Figure above: Which of the following price controls would cause a shortage of 20 units of the good?

|

a.

|

a price ceiling of $4

|

|

b.

|

a price ceiling of $5

|

|

c.

|

a price floor of $7

|

|

d.

|

a price floor of $8

|

10b. Refer to Figure above: Which of the following price controls would cause a surplus of 20 units of the good?

|

a.

|

a price ceiling of $4

|

|

b.

|

a price ceiling of $5

|

|

c.

|

a price floor of $7

|

|

d.

|

a price floor of $8

|

10c. Refer to Figure above. Suppose a price ceiling of $5 is imposed on this market. As a result,

|

a.

|

the quantity of the good supplied decreases by 20 units.

|

|

b.

|

the demand curve shifts to the left so as to now pass through the point (quantity = 40, price = $5).

|

|

c.

|

buyers' total expenditure on the good decreases by $100.

|

|

d.

|

the price of the good continues to serve as the rationing mechanism.

|

10d. Refer to Figure above. Suppose a price floor of $7 is imposed on this market. As a result,

|

a.

|

buyers' total expenditure on the good decreases by $20.

|

|

b.

|

the supply curve shifts to the left so as to now pass through the point (quantity = 40, price = $7).

|

|

c.

|

the quantity of the good demanded decreases by 20 units.

|

|

d.

|

the price of the good continues to serve as the rationing mechanism.

|