Reference no: EM131248282

Credit rationing, predation, and liquidity shocks:-

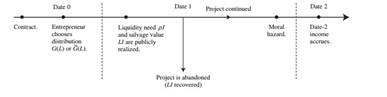

(i) Consider the fixed-investment model. An entrepreneur has cash A and can invest I1 > A in a project. The project's payoff is R1 in the case of success and 0 otherwise. The entrepreneur can work, in which case her private benefit is 0 and the probability of success is pH, or shirk, in which case her private benefit is B1 and the probability of success pL. The project has positive NPV (pHR1 > I1), but will not be financed if the contract induces the entrepreneur to shirk. The (expected) rate of return demanded by investors is 0. What is the threshold value of A such that the project is financed? In the following, let

The next three questions add a prior period, period 0, in which the entrepreneur's equity A is determined. The discount factor between dates 0 and 1 is equal to 1. (ii) In this question, the entrepreneur's date-1 (entire) equity is determined by her date-0 profit. This profit can take one of two values, a or A, such that

At date 0, the entrepreneur faces a competitor in the product market. The competitor can "prey" or "not prey." The entrepreneur's date-0 profit is a in the case of predation and A in the absence of predation. Preying reduces the competitor's profit at date 0, but by an amount smaller than the competitor's date-1 gain from the entrepreneur's date-1 project not being funded.

- What happens if the entrepreneur waits until date 1 to go to the capital market?

- Can the entrepreneur avoid this outcome? You may want to think about a credit line from a

bank. Would such a credit line be credible, that is, would it be renegotiated to the mutual advantage of the entrepreneur and his investors at the end of date 0?

(iii) Forget about the competitor, but keep the assumption that the entrepreneur's date-0 profit can take the same two values, a and A. We now introduce a date-0 moral-hazard problem on the entrepreneur's side. Assume that the entrepreneur's date-0 production involves an investment cost I0 and that the entrepreneur initially has no cash. The entrepreneur can work or shirk at date 0. Working yields no private benefit and probability of profit A equal to qH (and probability 1 - qH of obtaining profit a). Shirking yields private benefit B0 to the entrepreneur, but reduces the probability of profit A to qL = qH - ?q (0 L H

- Interpret this condition. Consider the following class of long-term contracts between the entrepreneur and investors. "The date-1 project is financed with probability 1 if the date-0 profit is A and with probability x

- What is the optimal probability x∗? (Assume

- Assuming that

is the previous contract robust to (a mutually advantageous) renegotiation?

is the previous contract robust to (a mutually advantageous) renegotiation?

(iv) Show that the entrepreneur cannot raise sufficient funds at date 0 if renegotiation at the end of date 0 cannot be prevented,