Reference no: EM13828333

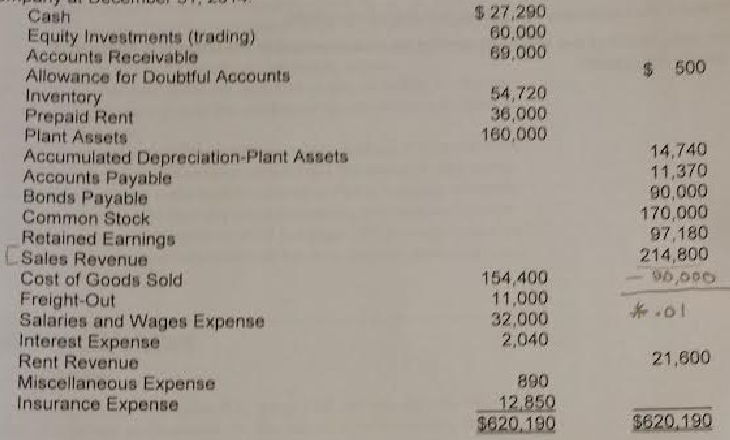

The following list of accounts and their balances represents the unadjusted trail balance of Alt.

Company at December 31, 2014:

1. The balance in the Insurance Expense account contains the premium costs of three polices

Policy 1, remaining cost of $2,550, 1-yr term, taken out on May 1, 2013;

Policy 2, original cost of $9,000; 3-yr. term, taken out on Oct, 1, 2014,

Policy 3, original coat of $1,300, 1-yr, term, taken out on Jan 1, 2014

2. On September 30, 2014, Alt received $21,600 rent from its lessee for an eighteen month lease beginning on that date.

3 The regular rate of depreciation is 10% per year. Acquisitions and retirements during a year are depreciated at half this rate. There were no purchases during the year. On December 31, 2013, the balance of the Plant and Equipment account was $220,000.

4. On December 28, 2014, the bookkeeper incorrectly credited Sales Revenue for a receipt on account in the amount of $20,000

5 At December 31,2014, salaries and wages accrued but unpaid were $4,200

6 All estimates that 1% of sates will become uncollectible.

7, On August 1, 2014, Alt purchased, as a shod-term investment, 60 $$1,000, 6% bonds of Allen Corp at par. The bonds mature on August 1, 2015. Interest payment dates are July 31 and January 31.

8. On April 30, 2014, Alt rented a warehouse for $3,000 per month, paying $36,000 in advance.

|

Banks are firms of a special nature

: Banks are firms of a special nature. Discuss the statement descriptively.

|

|

Importance of risk management

: Write on the Importance of Risk Management and Basel II norms for Financial Institutions

|

|

Which type of interview is most appropriate to use

: Isaac is a single, 40-year-old male who runs his own business. Lately, he feels tired all the time, lacks motivation and appetite, and is not enthusiastic about anything. Based on his symptoms, which type of interview is most appropriate to use

|

|

Organization analysis project outline-financial reporting

: Analysis of the regulatory environment of the country in which the chosen organization is based, identifying the major elements and regulations that affect financial reporting and how this may differ from other countries

|

|

Revenue for a receipt on account in the amount

: The regular rate of depreciation is 10% per year. Acquisitions and retirements during a year are depreciated at half this rate. There were no purchases during the year. On December 31, 2013, the balance of the Plant and Equipment account was $220..

|

|

Consumer products pricing decisions

: Consumer Products Pricing Decisions

|

|

Do the results demonstrate causation or correlation

: What type of research study is it (observational, case study, experimental method, survey, etc.)? Do the results demonstrate causation or correlation

|

|

Importance of bank relationship management

: There is a growing importance of bank relationship management. Imagine you work in the corporate finance or treasury department of a medium-sized firm that often struggles with cash flow and liquidity.

|

|

Incorporate into your mass manufacturing business

: Below is a list of items that you will need to incorporate into your mass manufacturing business. You are to create a manufacturing plant with 2 separate divisions. Each division will make one type of product (i.e. Textbooks and Pens or Shoes and Pur..

|