Reference no: EM131208072

The risk assessment should be presented as a memo to file. The memo should identify the users of the financial statement and their reliance on the financial statements, the likelihood of the client having financial difficulties, and the integrity of management. During the planning phase of the audit, you met with Pinnacle’s management team and performed other planning activities. You encounter the following situations that you believe may be relevant to the audit:

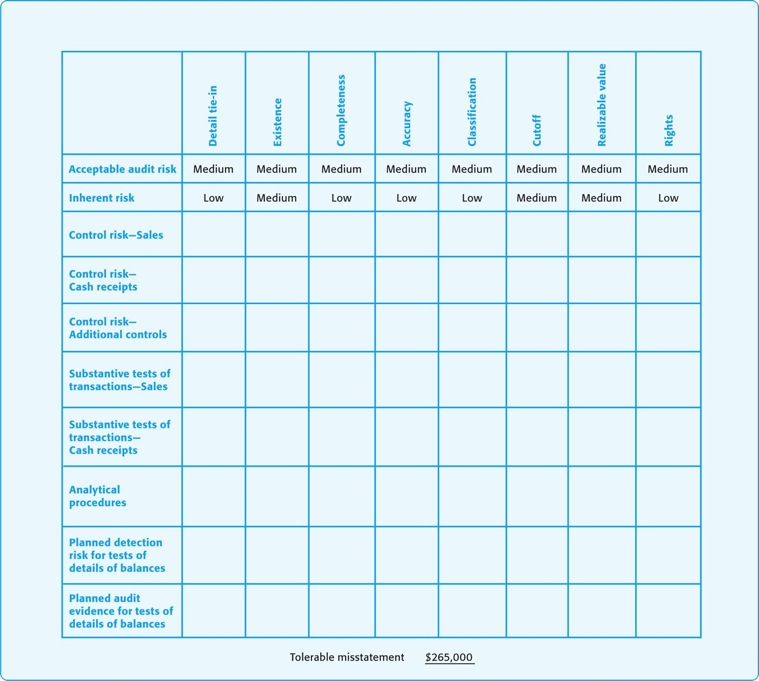

Next, your memo will establish the acceptable audit risk as low, medium, or high, with a justification for your selection. The memo should then address the inherent risk and the associated account(s) with each of the 11 situations discussed in the problem.

1. Your firm has an employee who reads and saves articles about issues that may affect key clients. You read an article in the file titled, “EPA Regulations Encouraging Solar-Powered Engines Postponed?” After reading the article, you realize that the regulations management is relying upon to increase sales of the Solar-Electro division might not go into effect for at least ten years. A second article is titled, “Stick to Diesel Pinnacle!” The article claims that although Pinnacle has proven itself within the diesel engine industry, they lack the knowledge and people necessary to perform well in the solar-powered engine industry.

2. You ask management for a tour of the Solar-Electro facilities. While touring the warehouse, you notice a section of solar-powered engines that do not look like the ones advertised on Pinnacle’s Web site. You ask the warehouse manager when those items were first manufactured. He responds by telling you, “I’m not sure. I’ve been here a year and they were here when I first arrived.”

3. You also observe that new computerized manufacturing equipment has been installed at Solar-Electro. The machines have been stamped with the words, “Product of Welburn Manufacturing, Detroit, Michigan.”

4. During discussions with the Pinnacle controller, you learn that Pinnacle employees did a significant amount of the construction work for a building addition because of employee idle time and to save costs. The controller stated that the work was carefully coordinated with the construction company responsible for the addition.

5. While reading the footnotes of the previous year’s financial statements, you note that one customer, Auto-Electro, accounts for nearly 15% of the company’s accounts receivable balance. You investigate this receivable and learn the customer has not made any payments for several months.

6. During a meeting with the facilities director, you learn that the board of directors has decided to raise a significant amount of debt to finance the construction of a new manufacturing plant for the Solar-Electro division. The company also plans to make a considerable investment in modifications to the property on which the plant will be built.

7. While standing in line at a vending machine, you see a Pinnacle vice president wearing a golf shirt with the words “Todd-Machinery.” You are familiar with the company and noticed some of its repairmen working in the plant earlier. You tell the man you like the shirt and he responds by saying, “Thank you. My wife and I own the company, but we hire people to manage it.”

8. After inquiry of the internal audit team, you realize there is significant turnover in the internal audit department. You conclude the turnover is only present at the higher-level positions.

9. While reviewing Pinnacle’s long-term debt agreements, you identify several restrictive covenants. Two requirements are to keep the current ratio above 2.0 and debt-to-equity below 1.0 at all times.

10. The engagement partner from your CPA firm called today notifying you that Brian Sioux, an industry specialist and senior tax manager from the firm’s Ontario office, will be coming on-site to Pinnacle’s facilities to investigate an ongoing dispute between the Internal Revenue Service and Pinnacle.

11. A member of your CPA firm, who is currently on-site in Detroit at the Welburn division, calls you to see how everything is going while you are visiting Solar-Electro in Texas. During your conversation, he asks if you know anything about the recent intercompany loan from Welburn to Solar-Electro.

|

What is balance of account at the end of the six year

: Lamb Company deposited $15,000 annually for 6 years in an account paying 5% interest compounded annually. What is the balance of the account at the end of the 6th year?

|

|

New sprinkler system economically attractive

: RealTurf is considering purchasing an automatic sprinkler system for its sod farm by borrowing the entire $45,000 purchase price. The loan would be repaid with four equal annual payments at an interest rate of 12%/year. Show the internal rate of retu..

|

|

What are the capital balances of each partner

: The capital accounts of Trent Henry and Paul Chavez have balances of $148,600 and $84,200, respectively. LeAnne Gilbert and Jen Faber are to be admitted to the partnership. On December 31, journalize the entries to record the admission of (1) Gilbert..

|

|

Analyze the benefits and limitiations of ratio analysis

: Essay should critically analyze the benefits and limitiations of ratio analysis, explaining what factors impact the meaningfulness of such measures and what new practices or theories may be emergeing regarding the application of ratio and financial s..

|

|

Regulations encouraging solar-powered engines postponed

: The risk assessment should be presented as a memo to file. The memo should identify the users of the financial statement and their reliance on the financial statements, the likelihood of the client having financial difficulties, and the integrity of ..

|

|

Calculate the ratios with and without the bond issue

: Your company's summarized financial information for the beginning and projected end of the current year is as follows: Beginning of the Year End of the Year (projected) Assets $90,000 $100,000 Liabilities 30,000 30,000 Equity 60,000 70,000 Net Income..

|

|

Instance of earnings mismanagement and fraud

: Search the internet and find an instance of "Earnings Mismanagement" and "Fraud". Tell us: the company name, when they did it, describe in detail what they did, and tell us if anyone got in trouble. Don't use a company that someone has already used.

|

|

The idea of comprehensive income

: A common concept that many students struggle with is the idea of comprehensive income. In your own words, explain what this concept means. Can you provide direct examples of items that affect comprehensive income but are not reflected on the income s..

|

|

Why do you think that these subtotals are important

: Unlike the single-step income statement, the multi-step income statement has a number of sub-totals. Why do you think that these subtotals are important? Perhaps pick one and argue why investors and creditors would find that subtotal decision useful.

|