Reference no: EM13380939

Question 1

The underlier is trading at a spot price of $100. The ten year riskless interest rate is trading at 10% p.a., continuously compounded. What is the strike price that makes the value of a European vanilla Call option on the underlier with a maturity of ten years equal to the value of a European vanilla Put option on the underlier with a maturity of ten years? Show all working.

Question 2

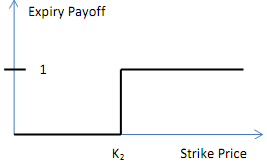

Two European vanilla Call options on the same underlier and with the same maturity are trading in the market. Option 1 has strike price K1 and is trading at $1.00, Option 2 has strike price K2 and is trading at $0.75. Option 3 is a European option on the same underlier and with the same maturity as the vanilla options. It is trading in the market at $0.15, and it has the expiry payoff shown below (a payoff of $1 is received by the buyer if the underlier is trading greater than or equal to K2 on expiry and zero otherwise):

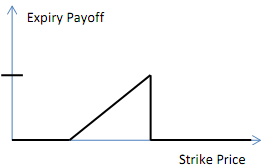

(i) Use the three options to construct a European option with expiry payoff shown below. Complete a table like the one below to show the details of the replication portfolio. Please show all working (diagrammatic workings are acceptable provided strike prices and the y-intercept are clearly shown on your diagram(s)).

(ii) What is the no-arbitrage value of the European option on the underlier with expiry payoff shown diagrammatically in question (i) above?

Question 3

A trader buys a vertical spread by buying a Call option with a strike price of $50 and selling a Call option with a strike price of $70. The trader also sells a vertical spread by selling a Call option with a strike price of $70 and buying a Call option with a strike price of $90. All options are European, on the same underlier and have the same maturity.

(i) Draw the expiry payoff diagram for the trader's total portfolio. Make sure you annotate the diagram fully.

(ii) What are the no-arbitrage lower and no-arbitrage upper boundaries for the value of the trader's total portfolio?