Reference no: EM131824249

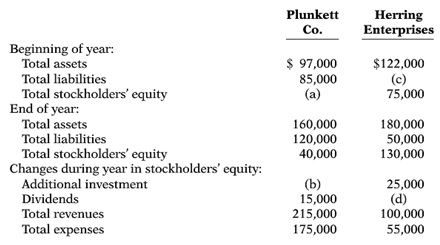

Question 1: Two items are omitted from each of the following summaries of balance sheet and income statement data for two corporations for the year 2015, Plunkett Co. and Herring Enterprises.

Instructions

Determine the missing amounts.

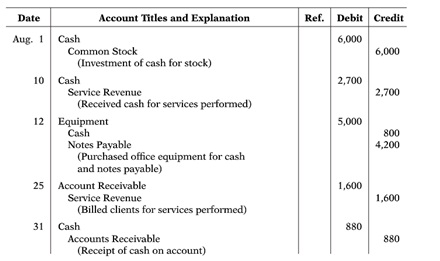

Question 2: Selected transactions from the journal of Kati Tillman, investment broker, are presented below.

Instructions

a) Post the transactions to T-accounts.

b) Prepare a trial balance at August 31, 2015.

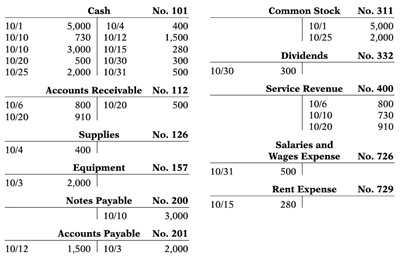

Question 3: Presented below is the ledger for Higgs Co.

Instructions

a) Reproduce the journal entries for the transactions that occurred on October 1, 10, and 20, and provide explanations for each.

b) Determine the October 31 balance for each of the accounts above, and prepare a trial balance at October 31, 2015.

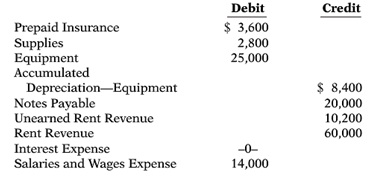

Question 4: The ledger of Perez Rental Agency on March 31 of the current year includes the selected accounts, shown below, before quarterly adjusting entries have been prepared.

An analysis of the accounts shows the following.

1. The equipment depreciates $400 per month.

2. One-third of the unearned rent revenue was earned during the quarter.

3. Interest totaling $500 is accrued on the notes payable for the quarter.

4. Supplies on hand total $900.

5. Insurance expires at the rate of $200 per month.

Instructions

Prepare the adjusting entries at March 31, assuming that adjusting entries are made quarterly. Additional accounts are Depreciation Expense, Insurance Expense, Interest Payable, and Supplies Expense.

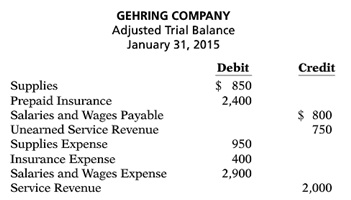

Question 5: A partial adjusted trial balance of Gehring Company at January 31, 2015, shows the following.

Instructions

Answer the following questions, assuming the year begins January 1.

a) If the amount in Supplies Expense is the January 31 adjusting entry, and $1,000 of supplies was purchased in January, what was the balance in Supplies on January 1?

b) If the amount in Insurance Expense is the January 31 adjusting entry, and the original insurance premium was for one year, what was the total premium and when was the policy purchased?

c) If $3,500 of salaries was paid in January, what was the balance in Salaries and Wages Payable at December 31, 2014?

Problems

Question 6: On August 31, the balance sheet of La Brava Veterinary Clinic showed Cash $9,000, Accounts Receivable $1,700, Supplies $600, Equipment $6,000, Accounts Payable $3,600, Common Stock $13,000, and Retained Earnings $700. During September, the following transactions occurred.

1. Paid $2,900 cash for accounts payable due.

2. Collected $1,300 of accounts receivable.

3. Purchased additional equipment for $2,100, paying $800 in cash and the balance on account.

4. Recognized revenue of $7,300, of which $2,500 is collected in cash and the balance is due in October.

5. Declared and paid a $400 cash dividend.

6. Paid salaries $1,700, rent for September $900, and advertising expense $200.

7. Incurred utilities expense for month on account $170.

8. Received $10,000 from Capital Bank on a 6-month note payable.

Instructions

a) Prepare a tabular analysis of the September transactions beginning with August 31 balances. The column headings should be as follows: Cash + Accounts Receivable + Supplies + Equipment = Notes Payable + Accounts Payable + Common Stock + Retained Earnings + Revenues - Expenses - Dividends.

b) Prepare an income statement for September, a retained earnings statement for September, and a balance sheet at September 30.

Question 7:. Julia Dumars is a licensed CPA. During the ?rst month of operations of her business, Julia Dumars, Inc., the following events and transactions occurred.

May 1 Stockholders invested $20,000 cash in exchange for common stock.

2 Hired a secretary-receptionist at a salary of $2,000 per month.

3 Purchased $1,500 of supplies on account from Vincent Supply Company.

7 Paid of?ce rent of $900 cash for the month.

11 Completed a tax assignment and billed client $2,800 for services performed.

12 Received $3,500 advance on a management consulting engagement.

17 Received cash of $1,200 for services performed for Orville Co.

31 Paid secretary-receptionist $2,000 salary for the month.

31 Paid 40% of balance due Vincent Supply Company.

Julia uses the following chart of accounts: No. 101 Cash, No. 112 Accounts Receivable, No. 126 Supplies, No. 201 Accounts Payable, No. 209 Unearned Service Revenue, No. 311Common Stock, No. 400 Service Revenue, No. 726 Salaries and Wages Expense, and No. 729 Rent Expense.

Instructions

a) Journalize the transactions.

b) Post to the ledger accounts.

c) Prepare a trial balance on May 31, 2015.

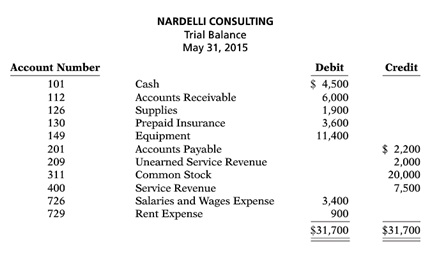

Question 8: A.Deanna Nardelli started her own consulting ?rm, Nardelli Consulting, on May 1, 2015. The trial balance at May 31 is as follows.

In addition to those accounts listed on the trial balance, the chart of accounts for Nardelli Consulting also contains the following accounts and account numbers: No. 150 Accumulated Depreciation-Equipment, No. 212 Salaries and Wages Payable, No. 631 Supplies Expense, No. 717 Depreciation Expense, No. 722 Insurance Expense, and No. 732 Utilities Expense.

Other data:

1. $900 of supplies have been used during the month.

2. Utilities expense incurred but not paid on May 31, 2015, $250.

3. The insurance policy is for 2 years.

4. $400 of the balance in the unearned service revenue account remains unearned at the end of the month.

5. May 31 is a Wednesday, and employees are paid on Fridays. Nardelli Consulting has two employees, who are paid $900 each for a 5-day work week.

6. The equipment has a 5-year life with no salvage value. It is being depreciated at $190 per month for 60 months.

7. Invoices representing $1,700 of services performed during the month have not been recorded as of May 31.

Instructions

a) Prepare the adjusting entries for the month of May. Use J4 as the page number for your journal.

b) Enter the totals from the trial balance as beginning account balances and place a check mark in the posting reference column. Post the adjusting entries to the ledger accounts.

c) Prepare an adjusted trial balance at May 31, 2015.