Reference no: EM131219363

ABC, Inc., manufactures kitchen tiles. The following information is available:

Beginning cash balance for May is $500,000

The company budgeted sales at 600,000 units per month in April, June, and July and at 450,000 units in May. The selling price is $4 per unit. All sales are cash sales. That is, customers must pay ABC, Inc. before the tiles are shipped to the customer

The inventory of finished goods on April 1 was 120,000 units. The finished goods inventory at the end of each month equals 20 percent of sales anticipated for the following month. There is no work in process.

The inventory of raw materials on April 1 was 57,000 pounds. At the end of each month, the raw materials inventory equals no less than 40 percent of production requirements for the following month.

Selling expenses are 10 percent of gross sales. Administrative expenses, which include depreciation of $2,500 per month on office furniture and fixtures, total $165,000 per month.

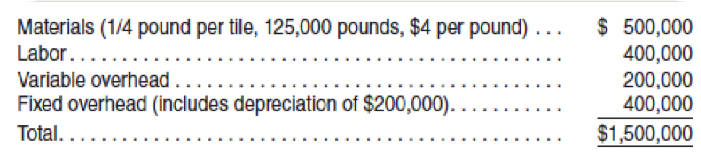

The manufacturing budget for tiles, based on normal production of 500,000 units per month, follows:

Required

1. Prepare schedules computing inventory budgets by months for:

a. Production in units for April, May, and June.

b. Raw materials purchases in pounds for April and May.

2. Prepare a Projected Operating Income Statement for May.

3. Prepare a Cash Budget for May. ABC, Inc. pays cash for all purchases.

4. Prepare a Flexible Budget for 400,000 units of sale for May.

|

Accounting treatment for cloud computing software purchases

: Using the Internet and Strayer Library, research the accounting treatment for cloud computing software purchases. Next, imagine that your company is interested in using cloud computing for all of its software purchases from a third party vendor.

|

|

Write the audit approach portion

: Objective. Express the objective in terms of the facts supposedly asserted in financial records, accounts, and statements. Control. Write a brief explanation of desirable controls, missing controls, and especially the kinds of “deviations” that could..

|

|

Advanced accounting requires many rules and regulations

: The latter come from many sources. In your Journal this week you will research two rules or regulations that pertain to Advanced Accounting topics and submit them to your Unit #1 Journal. What is the name of the rule or regulation? What agency or gov..

|

|

Prepare schedules computing inventory budgets by months

: The company budgeted sales at 600,000 units per month in April, June, and July and at 450,000 units in May. The selling price is $4 per unit. All sales are cash sales. That is, customers must pay ABC, Inc. before the tiles are shipped to the customer..

|

|

Average price received for each issued preferred share

: The shareholders’ equity section of Embrance Inc. balance sheet at December 31, 2015 is shown below. Preferred shares Authorized—200 shares Issued and outstanding—110 shares $4,290. Common shares Authorized—1,800 shares Issued and outstanding—1.200 s..

|

|

Financial assets and financial liabilities at fair value

: What is the complete ASC code that provides a table that illustrates calculation of diluted EPS for the full year 20X1? What are the three valuation techniques used when measuring financial assets and financial liabilities at fair value? In the debt ..

|

|

Important role in globalization process of world economy

: All of the following have played an important role in the globalization process of the world economy except ___. The conflict between owners, employees, suppliers, and customers of a company is known as ___.

|

|

Compute the company profit margin

: A company reported sales of $100,000; cost of goods sold of $60,000; selling, gerneral, and administrative expenses of $15,000; and income tax expense of $10,000. Compute the company's profit margin. what is the percent?

|