Reference no: EM131210698

Problem 1:

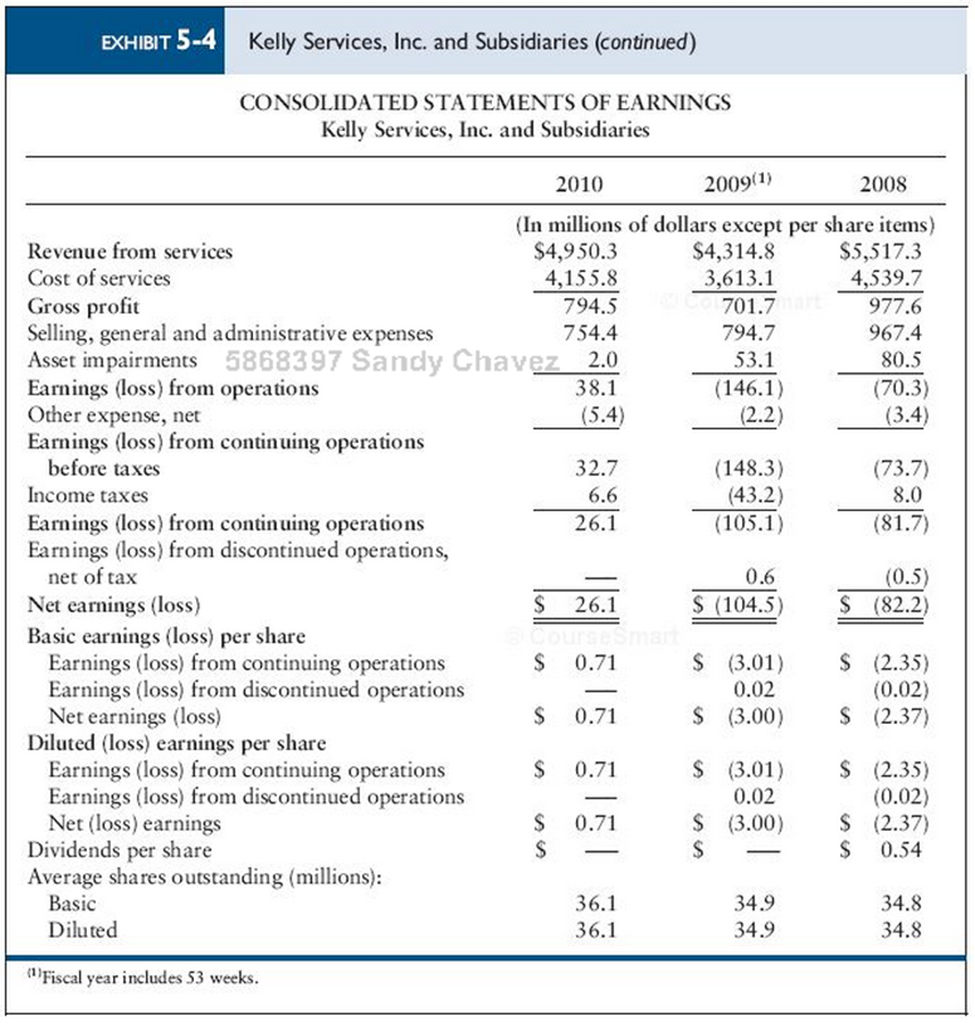

The Kelly Services, Inc., and Subsidiaries balance sheets from its 2010 annual report are presented in Exhibit 5-4.

Required

a. Using the balance sheets, prepare a vertical common-size analysis for 2010 and 2009. Use total assets as a base.

b. Using the balance sheets, prepare a horizontal common-size analysis for 2010 and 2009. Use 2009 as the base.

c. Comment on significant trends that appear in (a) and (b).

Problem 2:

Rapid Retail Comparative Statements of Income

December 31 Increase (Decrease)

(In thousands of dollars) 2011 2010 Dollars Percent

Net sales $30,000 $28,000

Cost of goods sold 20,000 19,500

Gross profit 10,000 8,500

Selling, general and

administrative expense 3,000 2,900

Operating income 7,000 5,600

Interest expense 100 80

Income before taxes 6,900 5,520

Income tax expense 2,000 1,600

Net income $ 4,900 $ 3,920

Required

a. Complete the increase (decrease) in dollars and percent.

b. Comment on trends.

Problem 3: Multiple Choice Questions:

a. Which of the following statements is incorrect?

1. Ratios are fractions expressed in percent or times per year.

2. A ratio can be computed from any pair of numbers.

3. A very long list of meaningful ratios can be derived.

4. There is one standard list of ratios.

5. Comparison of income statement and balance sheet numbers, in the form of ratios, should not be done.

b. A figure from this year's statement is compared with a base selected from the current year.

1. Vertical common-size statement

2. Horizontal common-size statement

3. Funds statement

4. Absolute figures

5. Balance sheet

c.Fremont Electronics has income of $1 million. Columbus Electronics has income of $2million. Which of the following statements is a correct statement?

1. Columbus Electronics is getting a higher return on assets employed.

2. Columbus Electronics has higher profit margins than does Fremont Electronics.

3. Fremont Electronics could be more profitable than Columbus Electronics in relation to resources employed.

4. No comparison can be made between Fremont Electronics and Columbus Electronics.

5. Fremont Electronics is not making good use of its resources.

d. Industry ratios should not be considered as absolute norms for a given industry because of all but which of the following?

1. The firms have different accounting methods.

2. Many companies have varied product lines.

3. Companies within the same industry may differ in their method of operations.

4. The fiscal year-ends of the companies may differ.

5. The financial services may be private independent firms.

e. Which of the following is a publication of the federal government for manufacturing, mining, and trade corporations?

1. Annual Statement Studies

2. Standard & Poor's Industry Surveys

3. Almanac of Business and Industrial Financial Ratios

4. Industry Norms and Key Business Ratios

5. The Department of Commerce Financial Report

f. Which service represents a compilation of corporate tax return data?

1. Annual Statement Studies

2. Standard & Poor's Industry Surveys

3. Almanac of Business and Industrial Financial Ratios

4. Industry Norms and Key Business Ratios

5. The Department of Commerce Financial Report

g. Which service includes over 800 different lines of business?

1. Annual Statement Studies

2. Standard & Poor's Industry Surveys

3. Almanac of Business and Industrial Financial Ratios

4. Industry Norms and Key Business Ratios

5. The Department of Commerce Financial Report

h. Which analysis compares each amount with a base amount for a selected base year?

1. Vertical common-size

2. Horizontal common-size

3. Funds statement

4. Common-size statement

5. None of these

i. Suppose you are comparing two firms in the coal industry. Which type of numbers would be most meaningful for statement analysis?

1. Relative numbers would be most meaningful for both firms, especially for interfirmcomparisons.

2. Relative numbers are not meaningful.

3. Absolute numbers would be most meaningful.

4. Absolute numbers are not relevant.

5. It is not meaningful to compare two firms.

j. Management is a user of financial analysis. Which of the following comments does not represent a fair statement as to the management perspective?

1. Management is not interested in the view of investors.

2. Management is interested in liquidity.

3. Management is interested in profitability.

4. Management is interested in the debt position.

5. Management is interested in the financial structure of the entity.