Reference no: EM13176703

Question 1

Traditionally, the role of an accountant is to capture and record financial information. Has this role changed? Why or why not?

Question 2

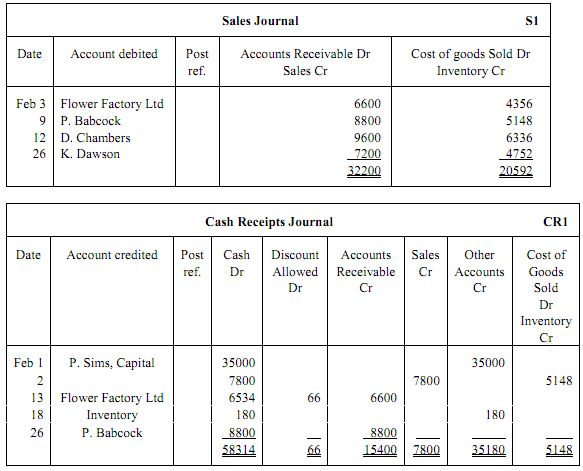

Presented below are the sales and cash receipts journals for Garden Growers for its first month of operations.

In addition, the following transactions have not been journalised for February 2012. Feb 6 Purchased inventory on account from Aussie Seed Supplies Ltd for $4800, term 1/7, n/30.

9 Purchased inventory on account from Gardenia Grove Pty Ltd for $40000, terms 1/10, n/30.

9 Paid cash of $1200 for purchase of supplies.

12 Paid $4752 to Aussie Seed Supplies Ltd in payment for $4800 invoice, less 1% discount.

15 Purchased equipment for $9600 cash.

16 Purchased inventory on account from Rose's Garden $2880, terms 2/7, n/30.

17 Paid $35640 to Gardenia Grove Pty Ltd in payment of $36000 invoice, less 1% discount.

20 Withdrew cash of $1700 from business to pay for personal electricity bill.

21 Purchased inventory on account from J. Able for $8800, terms 1/7, n/30.

28 Paid $2880 to Rose's Garden in payment of $2880 invoice.

Required

a. Open the following accounts in the general ledger. (Note steps a & d can be combined, you do not have to show ledgers twice.)

101 Cash

112 Accounts Receivable

120 Inventory

126 Supplies

157 Equipment

158 Accumulated Depreciation - Equipment

201 Accounts Payable

301 P. Sims, Capital

306 P. Sims, Drawings

401 Sales

405 Discount Received

505 Cost of Goods Sold

614 Discount Allowed

631 Supplies Expense

711 Depreciation Expense

b. Journalise each transaction that has not been journalised into either a one-column purchases journal, or a cash payments journal.

c. Post to the accounts receivable and accounts payable subsidiary ledgers. Follow the sequence of transactions as shown in the problem.

d. Post the individual entries and totals to the general ledger.

e. Prepare a trial balance as at 28 February 2013.

f. Determine that the subsidiary ledgers agree with the control accounts in the general ledger.

g. The following adjustments at the end of February are necessary.

1. A count of supplies indicates that $280 is still on hand.

2. Depreciation on equipment for February is $250.

Prepare the adjusting entries and then post the adjusting entries to the general ledger.

h. Prepare an adjusted trial balance as at 28 February 2013.

All journals should be prepared using Microsoft Excel, or similar spreadsheet software.

|

Calculate e(c)- cov(xy)- var(c)

: X and Y are two random variables. The average value of X is 40,000 and X has a standard deviation of 12,000. The average value of Y is 45,000 and the standard deviation of Y is 18,000. The correlation between X and Y is 0.80.

|

|

Difference in profit under each of the alternatives

: What is the difference in profit under each of the alternatives if the clocks are to be sold for $21 each to Target?

|

|

Explain what is the difference between electron geometry

: What is the difference between electron geometry and molecular geometry? How can knowing both assist in determining whether a molecule is polar or nonpolar?

|

|

Define and draw the best lewis structure

: Draw the best Lewis structure, and resonance contributors of equal energy (if any), for the molecule H2SO3 1- How many valence electrons are in your Lewis drawing

|

|

Prepare a trial balance as at 28 february 2013

: Prepare an adjusted trial balance as at 28 February 2013 and all journals should be prepared using Microsoft Excel, or similar spreadsheet software.

|

|

State how long is the third half-life of the reaction

: A products, the general rate law is: rate = k[A]2. How long is the third half-life of the reaction if [A]0 is 0.080 M and the first half-life is 22 minutes?

|

|

Compute the molar concentration

: Calculate the molar concentration of H3PO4 in this solution: Calculate the number of grams of this solution required to hold 87.5 g H3PO4:

|

|

State hydrochloric acid is added to a solution

: Consider the reaction that occurs when a solution containing hydrochloric acid (HCl) is added to a solution containing the weak base methylamine (CH3NH2).

|

|

How to calculate monthly payment

: For the same loan described under Q1, the individual decides that instead of selling the house after the 71st payment, to keep it and shorten the pay off period by increasing the montly payment by $150 each month. What is the number of months re..

|