Reference no: EM131161402 , Length:

TASK 1 - Questions and Answers

1. You have a client who has not reported their company car expenses. They had forgotten to get a couple of receipts and decided not to worry about it. You are to write a statement for the client that outlines what types of expenses are allowable under taxation law and what receipts should be collected.

2. If you had a client who claimed an accelerated method of depreciation that resulted in a claim that was double the allowable amount ($90,000) what would the impact be and how would you explain this to the client?

3. Prepare a spreadsheet to present a cash flow forecast summary to a client for the forthcoming financial year. Make sure you include the company details and increasing cash balances. Include recomo nclations for the client in a statement.

4. What are two measures of budgetary control?

5. How can you control expenditure on wages, vehicles and telephone?

6. How should on accountant ensure they are clear in their recommendations?

7. Prepare a financial plan extract that summarises the scope of a client's objectives.

8. Summarise the following data for the following financial performance table.

| Account |

2014 |

2015 |

$ Difference |

Percent |

Common Size (per cent or sales income) |

|

|

|

|

|

2014 |

2015 |

| Income from |

$230,000 |

$320,000 |

$90,000 |

39 |

100 |

100 |

| Costs from sales |

$115,000 |

$165,000 |

$50,000 |

43 |

50 |

51.6 |

| Wage Costs |

$30,000 |

$45,000 |

$15,000 |

50 |

13 |

14 |

| Transport Costs |

$25,000 |

$35,000 |

$10,000 |

40 |

10.9 |

10.9 |

| Marketing Costs |

$15,000 |

$20,000 |

$5,000 |

33 |

6.5 |

6.3 |

| Total costs |

$185,000 |

$265,000 |

$80,000 |

43 |

80.4 |

82.8 |

| Profit |

$45,000 |

$55,000 |

$10,000 |

22 |

19.6 |

17.2 |

Task 2 - Financial and Business Performance Application

Your task is to research and discuss the following questions:

Where possible use practical examples and contextualize your answers to business practices for the

business you work in, a business you have access to or a simulated business. Where possible, participation in discussion with the client for clarification (your Assessor will fulfil this role where access to other is not possible.

1. In regards to taxation legislation how are business expenses treated?

2. what allowance is there for a business that manages on behalf of a trust?

3. Discuss the term "forecast returns" and what they are used for?

4. What is a not for profit organization and how do they abide by financial policies where they are required to prepare statutory returns?

5. What methods can you use to present a client's performance objectives?

6. Discuss the two methods of cash flow control?

7. When preparing a business's performance information what legislative acts do you need to consider?

8. If you needed information on financing who would you refer to?

Present your answers as an itemised report.

Task 3 - Case Study

Scenario

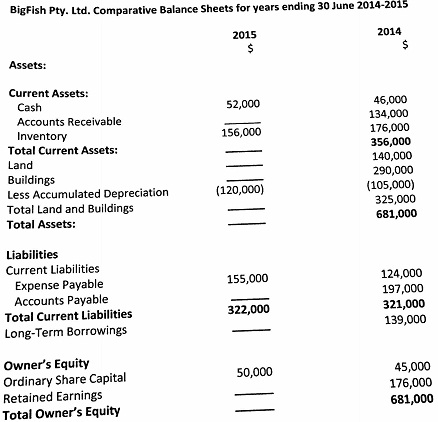

You have been asked to prepare the end of financial year reporting for BigFish Pty Ltd. Your task is to list each report that needs to be included for taxation purposes and a description of the contents of these reports. You should also outline each task you will be expected to perform. You should prepare a financial report and include it with your assessment using the following information:

Additional Information:

- Profit for the year ending 31 June 2014 was $88,448

- Profit for year ended 31 June 2015 was $94,000

- Cash received from customers totalled $330,000

- Cash paid for inventory totalled $170,000

- Cash paid for expenses totalled $20,000

- Dividends paid during the year were: $67,000

- During the year, accounts receivable decreased by $10,000

- Cost of new buildings acquired during the year $125,000

- No buildings were deposed of

- Land account was not affected by any transactions, but the fair market value of the land as of 31 June 2014 was $178,000

- Note that expenses included Entertainment Expense of 6,000

Bigfish management had the following aims for 2015:

- To reduce liabilities by 5%

- To increase profits by 8%

Were these goals met? Were they exceeded? Did they fall short? 1. Prepare a statement of Financial Position

- Include appropriate diagrams and graphs to highlight relevant information

- Ensure compliance with AASB standards (visit

https://www.aasb.gov.au/Pronouncements/Current-standards.aspx)

- It is advisable to have clear understanding of the standards before you start your assessment.

- Students with diverse background and academic status can obtain benefits by downloading and reading: Financial Instruments: Disclosures from the following website. https://www.aasb.gov.au/admin/file/content105/c9/AASB7_08-05_COMPdec13_01-14.pdf.

2. Prepare a statement of Financial Performance

- As above, include relevant diagrams and graphs and ensure compliance with relevant legislation and statutory compliance guidelines. Please confirm with your trainer if you are not clear about the statutory compliance.