Reference no: EM13337392

Question 1

1. R. Sparks, an interior decorator, started a business by investing $10,000 cash. The business would record this transaction:

a. Debit Cash $10,000, Credit Revenue $10,000

b. Debit Cash $10,000, Credit R. Sparks, Capital $10,000

c. Credit Cash $10,000, Debit R. Sparks, Capital $10,000

d. Credit Cash $10,000, Debit Revenue $10,000

2. R Sparks business purchases a used car for $6,000 cash. The business would record this transaction:

a. Debit Car expense $6,000, Credit Cash $6,000

b. Debit Cash 6,000, Credit Car expense $6,000

c. Debit Assets: car $6,000, Credit Cash $6,000

d. Debit Cash $6,000, Credit Assets: car $6,000

3. R. Sparks business purchases a one year liability insurance policy effective immediately for $1,200 cash. The business would record this transaction:

a. Debit Asset: Prepaid insurance $1,200, Credit cash $1,200

b. Debit Insurance expense $1,200, Credit cash $1,200

c. Debit Cash $1,200, Credit Prepaid Insurance $1,200

d. Debit Cash $1,200, Credit Insurance Expense $1,200

4. R. Sparks business purchases six months of supplies on account for $550. The business would record this transaction:

a. Debit Supplies Expense $550, Credit Cash $550

b. Debit Supplies Expense $550, Credit Accounts Payable $550

c. Debit Asset: Supplies $550, Credit Cash $550

d. Debit Asset: Supplies $550, Credit Accounts Payable $550

5. R. Sparks business billed customers $2,100 for services performed. The business would record this transaction:

a. Debit Accounts Receivable $2,100, Credit Service Revenues $2,100

b. Debit Cash $2,100, Credit Service Revenues $2,100

c. Debit Service Revenues $2,100, Credit Cash $2,100

d. Debit Service Revenues $2,100, Credit Accounts Receivable $2,100

6. R. Sparks withdrew from his business $300. The business would record this transaction:

a. Debit Cash $300, Credit Draws $300

b. Debit Draws $300, Credit Cash $300

c. Debit Draw expense $300, Credit Cash $300

d. Debit Cash $300, Credit Accounts Payable $300

7. R. Sparks business received payment from customers previously billed $1,000. The business would record this transaction:

a. Debit Cash $1,000, Credit Accounts Receivable $1,000

b. Debit Cash $1,000, Credit Accounts Payable $1,000

c. Debit Accounts receivable $1,000, Credit Service revenue $1,000

d. Debit Service revenue $1,000, Credit Cash $1,000.

8. R. Sparks business received $800 cash in advance for services to be performed next quarter.

The business would record this transaction:

a. Debit Accounts Receivable $800, Credit Unearned Revenue $800

b. Debit Cash $800, Credit Earned Revenue $800

c. Debit Cash $800, Credit Unearned revenue $800

d. Debit Unearned revenue $800, Credit Cash $800

9. R. Sparks business had purchased office supplies for $1,000 and had recorded the purchase as Asset: Office Supplies. At month end, when preparing the financial statements, an inventory shows that $700 of office supplies is still on hand.

The business would record and adjusting entry for this transaction:

a. Debit Office supplies expense $700, credit Asset: Office Supplies $700

b. Debit Office supplies expense $300, credit Asset: Office Supplies $300

c. Debit Asset: Office supplies $700, Credit Office supplies expense $700

d. Debit Asset: Office supplies $300, Credit Office supplies expense $700

10. R. Sparks business had purchased a one year insurance policy for $1,200. The business had recorded the cost of $1,200 to the asset: Prepaid Insurance. An adjusting entry for the

One month expiration of insurance would be:

a. Debit Prepaid Insurance $1,200, Credit Cash $1,200

b. Debit Prepaid Insurance $1,200, Credit Insurance expense $1,200

c. Debit Insurance expense $100, Credit Prepaid Insurance $100

d. Debit Prepaid Insurance $100, Credit Insurance expense $100

Question 2

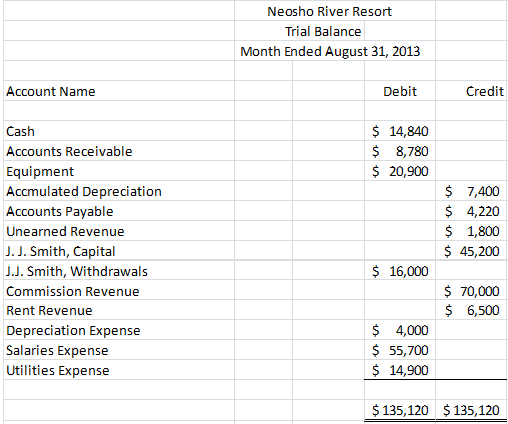

Multiple Choice Questions on Trial Balance

1. Neosho River Resort's total assets are:

a. $ 14,840

b. $ 44,520

c. $ 37,120

d. $135,120

2. Neosho River Resort's total liabilities are:

a. $ 4,220

b. $ 6,020

c. $ 13,420

d. $ 76,020

3. Neosho River Resort's net income is:

a. $135,120

b. $70,000

c. $76,500

d. $ 1,900

4. Neosho River Resort's total revenue is:

a. $ 76,500

b. $ 70,000

c. $ 1,900

d. $ 44,520

5. Neosho River Resort's total expenses is:

a. $ 70,600

b. $ 74,600

c. $ 1,900

d. $ 55,700

6. Neosho River Resort's ending Owner's Equity is:

a. $135,120

b. $ 47,100

c. $ 31,100

d. $ 16,000

7. Neosho River Resort's total Liabilities and Owner's Equity is:

a. $135,120

b. $ 37,120

c. $ 31,100

d. $ 6,020

8. In preparing their financial statements, Neosho River Resort would prepare which statement first?

a. Balance Sheet

b. Changes to Owner's Equity

c. Income Statement

d. Either the Income Statement or Changes to Owner's Equity

9. In order to prepare the Changes to Owner's Equity statement, Neosho River Resort must calculate:

a. Total Asset Balance

b. Total Liability Balance

c. Ending equity balance

d. Net Income

10. Drawings would be:

a. Added in the Changes to Owner's equity statement

b. Subtracted on the income statement

c. Added on the income statement

d. Subtracted in the Changes to Owner's equity statement

Question 3 Using the adjusted trial balance listed below, prepare a single-step Income Statement and simple Balance Sheet for Smith Delights Bakery for the year ended December 31, 2011.

Smith Delights Bakery

Adjusted Trial Balance

December 31, 2011

Debit Credit

Cash 45,500

Accounts Receivable 4,500

Supplies 12,500

Furniture 15,000

Accumulated Depr - Furn 2,500

Equipment 45,000

Accumulated Depr - Equip 5,000

Accounts Payable 11,200

Notes Payable 45,000

Smith, Capital 75,000

Smith, Withdrawals 3,000

Service Revenue 56,500

Advertising Expense 6,200

Depreciation Expense 5,500

Rent Expense 18,000

Supplies Expense 7,500

Telephone Expense 3,000

Utilities Expense 8,000

Wages Expense 21,500

Totals 195,200 195,200