Reference no: EM131288772

Exercise #1

The Dapper-Dons Partnership was formed ten years ago as a general partnership to custom tailor men's clothing. Dapper-Dons is located at 123 Flamingo Drive in City, ST, 54321. Bob Dapper manages the business and has a 40% capital and profits interest. His address is 709 Brumby Way, City, ST, 54321. Jeremy Dons owns the remaining 60% interest but is not active in the business. His address is 807 Ninth Avenue, City, ST, 54321. The partnership values its inventory using the cost method and did not change the method used during the current year. The partnership uses the accrual method of accounting. Because of its simplicity, the partnership is not subject to the partnership audit procedures. The partnership has no foreign partners, no foreign transactions, no interests in foreign trusts, and no foreign financial accounts. This partnership is neither a tax shelter nor a publicly traded partnership. No changes in ownership of partnership interests occurred during the current year. The partnership made cash distributions of $155,050 and $232,576 to Dapper and Dons, respectively, on December 30 of the current year. It made no other property distributions. Financial statements for the current year are presented in Tables C:9-1 and C:9-2. Assume that Dapper-Dons' business qualifies as a U.S. production activity and that its qualified production activities income is $600,000. Dapper-Dons, being an eligible small pass-through partnership, uses the small business simplified overall method for reporting these activities (see discussion for Line 13d of Schedules K and K-1 in the Form 1065 instructions).

Prepare a current year (2014 for this problem) partnership tax return for Dapper-Dons Partnership. You will need to complete the return using Forms 1065, Schedule K-1 for Form 1065 and 1125A for 2014 that you can access from the IRS web site (IRS.Gov). The forms are in a PDF format and should be completed by filling in the appropriate line items.

Tables on pages 2-4 of this document.

TABLE C:9-1 Dapper-Dons Partnership Income Statement for the 12 Months Ending December 31 of the Current Year (Problem C:9-57)

|

Sales

|

|

52,357,000

|

|

Returns and allowances

|

|

520.000)

|

|

|

|

|

|

52,337,000

|

|

Beginning inventory (FIFO method)

|

5 200,050

|

|

|

Purchases

|

624,000

|

|

|

Labor

|

600,000

|

|

|

Supplies

|

42,000

|

|

|

Other costs'

|

12.000

|

|

|

|

|

Goods available for sale

|

51,478,050

|

|

|

Ending inventory')

|

(146.000)

|

(1.332.050)

|

|

|

|

|

Gross profit

|

|

51,004,950

|

|

Salaries for employees other than partners (W-2 wages)

|

551,000

|

|

|

Guaranteed payment for Dapper

|

85,000

|

|

|

Utilities expense

|

46,428

|

|

|

Depreciation (MACRS depreciation is 574,311)C

|

49,782

|

|

|

Automobile expense

|

12,085

|

|

|

Office supplies expense

|

4,420

|

|

|

Advertising expense

|

85,000

|

|

|

Bad debt expense

|

2,100

|

|

|

Interest expense (all trade- or business-related)

|

45,000

|

|

|

Rent expense

|

7,400

|

|

|

Travel expense (meals cost $4,050 of this amount)

|

11,020

|

|

|

Repairs and maintenance expense

|

68.300

|

|

|

Accounting and legal expense

|

3.603

|

|

|

Charitable contributionsi

|

16.403

|

|

|

Payroll taxes

|

5.183

|

|

|

Other taxes i all trade- or business-related i

|

1.403

|

|

|

|

|

Total expenses

|

|

494.115

|

|

|

|

Operating profit

|

|

S 510,835

|

|

Other income and losses:

|

|

|

|

Gain on sale of AB stocke

|

S 18.000

|

|

|

Loss on sale of CD stock'

|

(26.075)

|

|

|

Sec. 1231 gain on sale of landg

|

5.050

|

|

|

Interest on U.S. Treasury bills for entire year (S80.000 face amount)

|

2.000

|

|

|

Dividends from 15%-owned domestic corporation

|

11.000

|

9.975

|

|

|

|

|

Net income

|

|

S 520.810

|

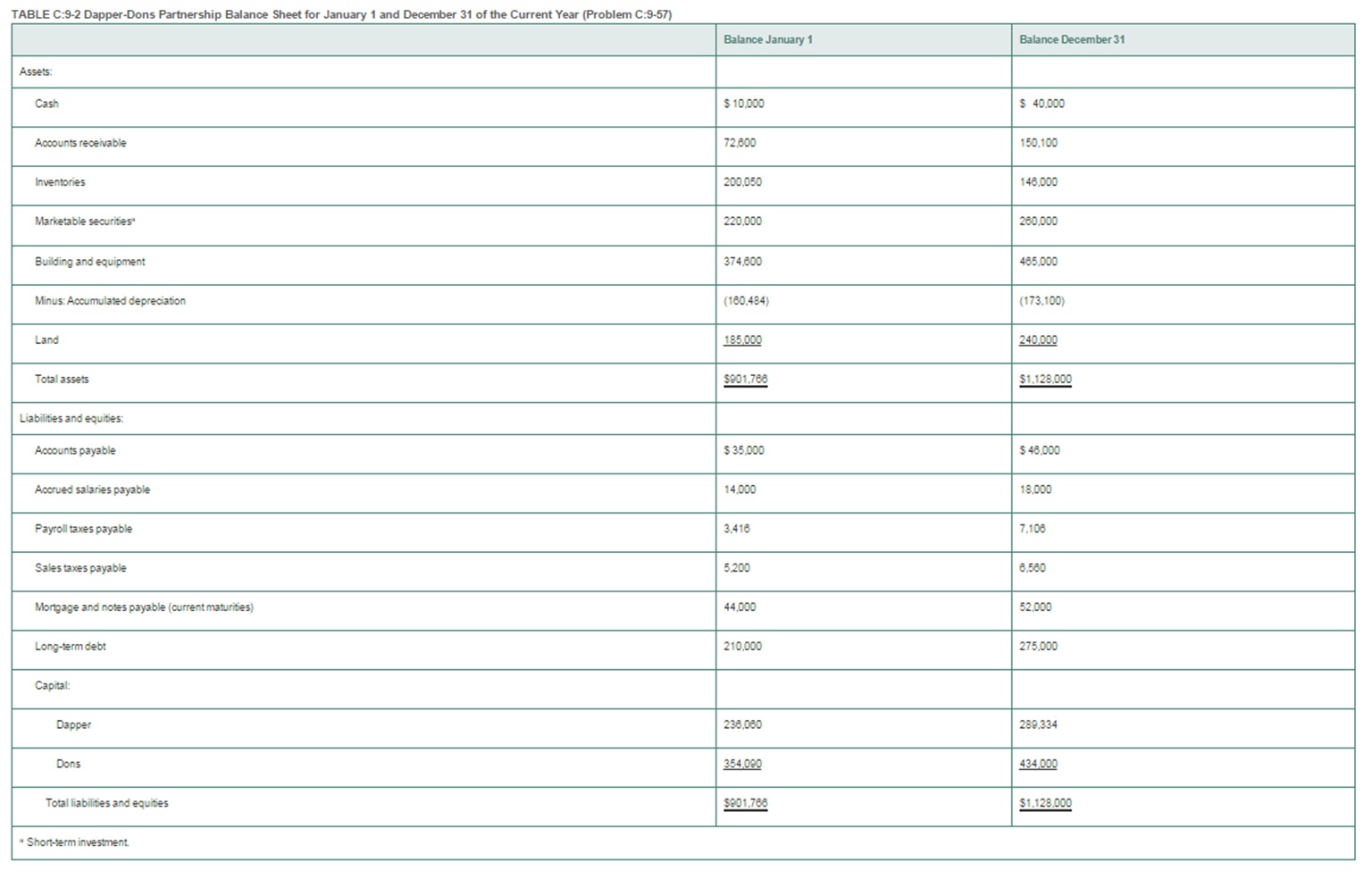

TABLE C:9-2 Dapper-Dons Partnership Balance Sheet for January 1 and December 31 of the Current Year (Problem C:9-57)

Exercise #2

The AB Partnership pays its only liability (a $100,000 mortgage) on April 1 of the current year and terminates that same day. Alison and Bob were equal partners in the partnership but have partnership bases immediately preceding these transactions of $110,000 and $180,000, respectively, including his or her share of liabilities. The two partners receive identical distributions with each receiving the following assets:

|

Assets

|

Partnership's Basis

|

FMV

|

|

Cash

|

$ 20.000

|

$ 20,000

|

|

Inventory

|

33,000

|

35,000

|

|

Receivables

|

10.000

|

8,000

|

|

Building

|

40.000

|

60.000

|

|

Land

|

15.000

|

!QIN

|

|

|

|

Total

|

$118.000

|

$133.000

|

|

|

|

The building has no depreciation recapture potential. What are the tax implications to Alison, Bob, and the AB Partnership of the April 1 transactions (i.e., basis of assets to Alison and Bob, amount and character of gain or loss recognized, etc.)? Assume that no Sec. 754 election is in effect.

Exercise #3

ABC Company a limited liability company (LLC) organized in the state of Florida, reports using a calendar tax year-end. The LLC chooses to be taxed as a partnership. Alex, Bob, and Carrie (all calendar year tax payers) own ABC equally, and each has a basis of $40,000 in his or her ABC interest on he first day following results for the current year's operation:

|

Operating income

|

630.000

|

|

Short-term capital gain

|

12.000

|

|

Long-term capital loss

|

6.000

|

Each owner received a $12,000 cash distribution during the current year.

a. What are the amount and character of the income, gain, and loss Alex must report on his tax return as a result of ABC's operations?

b. What is Alex's basis in his ownership interest in ABC after the current year's operations?

Part -2:

Exercise #1

Mike and Nancy are equal shareholders in MN Corporation, an S corporation. The corporation, Mike, and Nancy are calendar year taxpayers. The corporation has been an S corporation during its entire existence and thus has no accumulated E&P. The shareholders have no loans to the corporation. The corporation incurred the following items in the current year:

|

Sales

|

5300,000

|

|

Cost of goods sold

|

140.000

|

|

Dividends on corporate investments

|

10,000

|

|

Tax-exempt interest income

|

3,000

|

|

Sec. 124S gain (recapture) on equipment sale

|

22.000

|

|

Sec. 1231 gain on equipment sale

|

12.000

|

|

Long-term capital gain on stock sale

|

8,000

|

|

Long-term capital loss on stock sale

|

7,000

|

|

Short-term capital loss on stock sale

|

6.000

|

|

Depreciation

|

18,000

|

|

Salary to Nancy

|

20,000

|

|

Meals and entertainment expenses

|

7,800

|

|

Interest expense on loans allocable to:

|

|

|

Business debt

|

32,000

|

|

Stock investments

|

6.400

|

|

Tax-exempt bonds

|

1,800

|

|

Principal payment on business loan

|

9,000

|

|

Charitable contributions

|

2,000

|

|

Distributions to shareholders (S1S.000 each)

|

30,000

|

a. Compute the S corporation's ordinary income and separately stated items.

b. Show Mike's and Nancy's shares of the items in Part a.

c. Compute Mike's and Nancy's ending stock bases assuming their beginning balances are $100,000 each. When making basis adjustments, apply the adjustments in the order outlined on pages C:11-24 and C:11-25 of the text.

Exercise #2

Redfern Corporation, a calendar year taxpayer, has been an S corporation for several years. Rod and Kurt each own 50% of Redfern's stock. On July 1 of the current year (assume a non-leap year), Redfern issues additional common stock to Blackfoot Corporation for cash. Rod, Kurt, and Blackfoot each end up owning one-third of Redfern's stock. Redfern reports ordinary income of $125,000 and a short-term capital loss of $15,000 in the current year. Eighty percent of the ordinary income and all the capital loss accrue after Blackfoot purchases its stock. Redfern makes no distributions to its shareholders in the current year. What income and losses do Redfern, Blackfoot, Rod, and Kurt report as a result of the current year's activities?

Exercise #3

Bottle-Up, Inc., was organized on January 8, 2005, and made its S election on January 24, 2005. The necessary consents to the election were filed in a timely manner. Its address is 1234 Hill Street, City, ST 33333. Bottle-Up uses the calendar year as its tax year, the accrual method of accounting, and the first-in, first-out (FIFO) inventory method. Bottle-Up manufactures ornamental glass bottles. It made no changes to its inventory costing methods this year. It uses the specific identification method for bad debts for book and tax purposes. Herman Hiebert and Melvin Jones own 500 shares each. Both individuals materially participate in Bottle-Up's single activity. Herman Hiebert is the tax matters person. Financial statements for Bottle-Up for the current year are shown in Tables C - 2 through C - 4. Assume that Bottle-Up's business qualifies as a U.S. production activity and that its qualified production activities income is $90,000. The S corporation uses the small business simplified overall method for reporting these activities (see discussion for Line 12d of Schedules K and K-1 in the Form 1120S instructions). Prepare a 2014 S corporation tax return for Bottle-Up, showing yourself as the paid preparer.

You will need to complete the return using Forms 1120 S, Schedule K-1 for Form 1120 S and 1125A for 2014 that you can access from the IRS web site (IRS.Gov). The forms are in a PDF format and should be completed by filling in the appropriate line items.

Attachment:- Bottle-Up Inc.pdf