Reference no: EM131792306

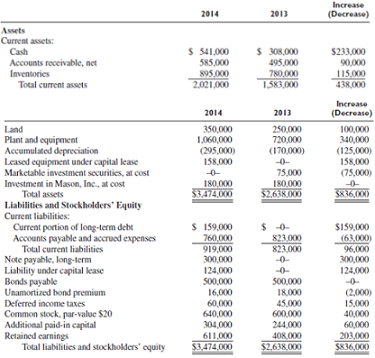

Question: Presented next are the balance sheet accounts of Bergen Corporation as of December 31, 2014 and 2013.

Additional Information:

• On January 2, 2014, Bergen sold all of its marketable investment securities for $95,000 cash.

• On March 10, 2014, Bergen paid a cash dividend of $50,000 on its common stock. No other dividends were paid or declared during 2014.

• On April 15, 2014, Bergen issued 2,000 shares of its common stock for land having a fair value of $100,000.

• On May 25, 2014, Bergen borrowed $450,000 from an insurance company. The underlying promissory note bears interest at 15% and is payable in three equal annual installments of $150,000. The first payment is due on May 25, 2015.

• On June 15, 2014, Bergen purchased equipment for $392,000 cash.

• On July 1, 2014, Bergen sold equipment costing $52,000, with a book value of $28,000 for $33,000 cash.

• On December 31, 2014, Bergen leased equipment from Tilden Company for a 10-year period. Equal payments under the lease are $25,000 due on December 31 each year. The first payment was made on December 31, 2014. The present value at December 31, 2014, of the 10 lease payments is $158,000. Bergen appropriately recorded the lease as a capital lease. The $25,000 lease payment due on December 31, 2015, will consist of $9,000 principal and $16,000 interest.

• Bergen's net income for 2014 is $253,000.

• Bergen owns a 10% interest in the voting common stock of Mason, Inc. Mason reported net income of $120,000 for the year ended December 31, 2014, and paid a common stock dividend of $55,000 during 2014.

Required: Prepare a cash flow statement for Bergen using the indirect method for 2014.

|

What protocol would need to be in place at your agency

: Post a brief description of the article you selected that addresses social work action planning for working with clients who express suicidal ideations.

|

|

Prepare journal entries to record income taxes

: Prepare journal entries to record income taxes for 20X2 and 20X3. Assume in 20X2, management believed the company would benefit from the loss contingency

|

|

Prepare an income statement and retained earnings statement

: In June, the company issued no additional stock, but paid dividends of $2,000. Prepare an income statement and Retained Earnings Statement for the month of June

|

|

Discussion about the set of competencies and skills

: Posting provides significant detail including multiple relevant examples, evidence from the readings and other scholarly sources, and discerning ideas.

|

|

Prepare a cash flow statement for bergen

: Bergen owns a 10% interest in the voting common stock of Mason, Inc. Mason reported net income of $120,000 for the year ended December 31, 2014.

|

|

Discuss what code provisions cause the suspensions

: How much of the loss is suspended and what Code provisions cause the suspensions

|

|

Calculate the net income for the year

: Three different companies each purchased trucks on January 1, 2016, for $50,000. Each truck was expected to last four years or 200,000

|

|

Explain the importance of interdisciplinary healthcare teams

: The advent of the new millennium came with a new positive attitude towards the importance of interdisciplinary healthcare teams.

|

|

Prepare reliant companys statement of cash flows

: Prepare Reliant Companys statement of cash flows for the year ended December 31

|