Reference no: EM13377461

Portfolio Project: Kelly Consulting Practice Set

You are given the following information below:

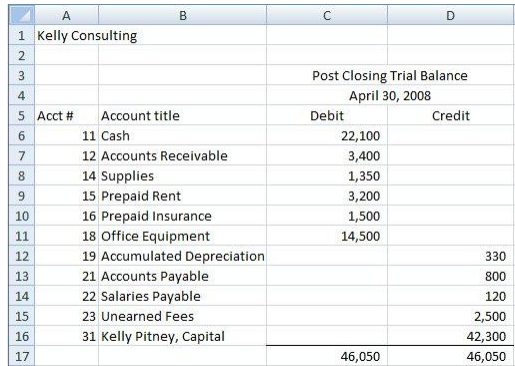

- Post closing trial balance for April 30, 2008

- Transactions for the month of May 2008

- Adjustments for May 31,2008

- Insurance was purchased for a one-year period, starting on March 1, 2008.

- Rent was prepaid on January 1, 2008, for a one-year period, starting on January 1.

- Office equipment has a 5 year life, with a $2,500 salvage value.

- A supplies inventory count shows an ending balance of $1,235.

- Assume that the receptionist works 5 days a week and earns an even amount per day. The May 28th payroll pays her up to May 28th (Wednesday).

The following can be downloaded from the Module 8 Assignment page or the Course Information page

1. Journal page to copy and use

2. Ledger page to copy and use

3. Portfolio Project Excel Spreadsheet template with accounts pre-entered

Kelly Consulting Transactions for May 2008

May 3 Received cash from clients as an advance payment for services to be provided and recorded it as unearned fees, $1,550.

May 5 Received cash from clients on account, $1,750.

May 9 Paid cash for a newspaper advertisement, $100

May 13 Paid Office Station Co. for part of the debt incurred on April 5, $400

May 15 Recorded services provided on account for the period May 1-15, $5,100.

May 16 Paid part-time receptionist for two weeks' salary including the amount owed on April 13, $750.

May 17 Recorded cash from cash clients for fees earned during the period May 1-16, $7,380

May 20 Purchased supplies on account, $500.

May 21 Recorded services provided on account for the period May 16-20, $2,900.

May 25 Recorded cash from cash clients for fees earned for the period May 17-23, $4,200.

May 27 Received cash from clients on account, $6,600.

May 28 Paid part-time receptionist for two weeks' salary, $750.

May 30 Paid telephone bill for May, $150.

May 31 Paid electricity bill for May, $225.

May 31 Recorded cash from cash clients for fees earned for the period May 25-31, $2,875.

May 31 (a) Recorded services provided on account for the remainder of May, $2,200.

May 31 (b) Kelly withdrew $7,500 for personal use.

May 31 (c) Supplies on hand total $1,000.

May 31 (d) Prepaid rent of $1,200 has expired.

May 31 (e) Prepaid insurance of $1,000 has expired

May 31 (f) Record depreciation for office equipment $500.

May 31 (g) Unearned fees totaling $2,500 have been earned.

Instructions are as follows:

1. Record the ending balances from the April 30 post closing trial balance into the ledger sheets or alternatively, you may create T-accounts on an Excel spreadsheet.

2. Record journal entries for the May transactions on the journal sheets given or create a spreadsheet configured as a journal sheet.

3. Post the journal entries to the ledger sheets or if you created T-accounts post the entries to your T-accounts.

4. Enter the ending balances from the ledger or T-accounts on to the worksheet trial balance columns.

5. Enter the adjustments directly on to the worksheet.

6. Extend to the adjusted trial balance columns.

7. Extend to the financial statement columns.

8. Prepare the financial statements.

9. Enter the closing entries on to the worksheet.

10. Prepare the post closing trial balance for May.