Reference no: EM1317987

Question 1: Write a short essay of 350-400 words for each of the following questions. Where possible, illustrate with an appropriate example in your answer. You must support your discussion with appropriate references.

a) ‘Risk aversion implies only risk-free investments will be undertaken by corporate managers’.

Critically evaluate this statement (indicate whether you agree or disagree in your answer).

b) What is the distinction between nominal and real interest rates? Why is this distinction important?

c) Explain why evaluating mutually exclusive projects with IRR and NPV methods can be problematic.

Question 2:a) John has invented a new household device that would earn him $10,000 per annum for the next 10 years. Given a rate of interest of 8% per year, would John be willing to sell his invention today for $100,000?

b) An investment will pay $200 at the end of each of the next 3 years, $300 at the end of year 4, $500 at the end of year 5 and $500 at the end of year 6. Given that other investments of equal risk earn 10% per annum, calculate the present value and future value of this investment.

c) You intend to invest into a fund for a period of 10 years. Find the interest rate at which regular deposits of $1,000 will accumulate to $25,000 at the end of the investment period. The deposits are made at the end of every year. Estimate the interest rate using the interpolation method.

Question 3: The Crystal Glass Company is proposing the construction of a new plant in east Brisbane. The plant has an annual capacity of 100,000 tones and will cost $100 million to build. Profits on the plant will be taxed at a rate of 30 per cent. The company expects its new plant to produce 90,000 tones of plate-glass per year. The annual revenues of $59.4 million based on an anticipated selling price of $660 per tonne will allow the company to gain 12 per cent market share in the first year of operation. Fixed costs are expected to average $12 million annually while variable costs are estimated to be around $140 per tonne. The plant will be fully depreciated on a straight-line basis over ten years, with an estimated salvage value of $2 million at the end of the project. The required rate of return on the project is taken as 12 % per year due to the high degree of systematic risk associated with a cyclical product like plate-glass.

Calculate the NPV of the project and explain if the company should go ahead with the proposed project.

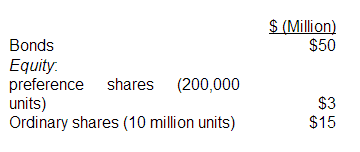

Question 4: Western Communications Ltd’s bonds will mature in five years with a total face value of $50 million, paying a half yearly coupon rate of 10% per annum. The yield on the bonds is 15% per annum. The market value for the company’s preference share is $5.0 per unit while the ordinary share is currently worth $3.0 per unit. The preference share pays a dividend of $0.5 per share. The beta coefficient for the ordinary share is 1.2 and retained earnings are expected to be more than sufficient to fund the ordinary equity component of any new investment. The market risk premium is estimated to be 13% per annum and the risk-free rate is 4% per annum. The company is subject to a 30% corporate tax rate. The balance sheet values for bond and equity are shown below:

a) Explain the three steps involved in the calculation of cost of capital for Western Communications.

b) Calculate Western Communications’ after-tax weighted average cost of capital.

c) Western Communications is considering raising more capital for a new project. Should the company use more equity or debt?

In your answer, discuss the effect of using more equity or debt on the company’s cost of capital.