Reference no: EM131089593

Public Affairs 854 Spring 2013 - Midterm 2

Part I: Multiple Choices

1. Along the BP schedule (with imperfect capital mobility), higher income leads to

a. a trade surplus, a higher interest rate and a capital inflow which leaves the overall balance of payments above zero.

b. a larger trade deficit (or smaller surplus), a higher interest rate and a capital inflow which leaves the overall balance of payments at zero.

c. a trade surplus, a lower interest rate and a capital outflow which leaves the overall balance of payments at zero.

d. a trade deficit, a higher interest rate and a capital inflow which leaves the overall balance of payments below zero.

e. none of the above.

2. Liberalization of financial markets can be represented as

a. a rightward shift of the BP curve.

b. increased sensitivity of capital to interest differentials.

c. a steepening of the BP curve.

d. an increase in the marginal propensity to import.

e. a lessening of interest differentials.

3. Covered interest parity

a. might hold even if uncovered interest parity doesn't hold.

b. always holds.

c. is holding if the interest differential equals the forward discount, which is the percentage gap between the forward rate and the spot exchange rate.

d. is the same as uncovered interest parity.

e. both (a) and (c) above.

4. With freely floating exchange rates, a higher degree of international capital mobility implies

a. there will be large appreciations following monetary expansion.

b. money comes into the country faster following fiscal expansion to augment the expansion in income.

c. the exchange rate will adjust to discourage net exports following a fiscal expansion.

d. fiscal expansion may lead to a balance of payments surplus.

e. none of the above.

5. The term "sterilization" refers to

a. central bank actions to nullify fiscal policy measures.

b. central bank actions that prevent foreign exchange reserve changes from altering the monetary base.

c. making sure nothing ever happens in the economy.

d. all of the above.

e. none of the above.

6. Purchasing power parity may fail to hold because of the presence of

a. tariffs and transportation costs.

b. imperfect information, contracts and momentum in consumer buying habits.

c. permanent shifts in the terms of trade between traded goods.

d. non-traded goods and services in price indices.

e. all of the above.

7. If prices are perfectly flexible, then a 10 percent increase in the money supply will

a. increase the price level by 10 percent.

b. increase income by 10 percent.

c. increase the interest rate by 10 percent.

d. increase the demand for real balances by 10 percent.

e. none of the above.

Part II: Short Answers

1. Mundell-Fleming model under floating rates.

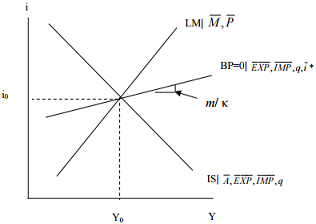

Suppose you are given a standard IS-LM-BP model under floating exchange rates:

1.1. Suppose the interest rate in the rest of the world exogenously falls. Show what happens both immediately and over time. Clearly label new equilibrium values of output and interest rates, and indicate curve shifts with arrows.

1.2. Discuss what happens economically, to the composition of output by the end when the new equilibrium has been achieved. What happens to the trade balance?

1.3. Show what happens, both immediately and over time, if the central bank wishes to keep the exchange rate constant against the rest-of-the world. Use a graph. Explain the economics of your answer.

2. Mundell-Fleming under fixed rates

Fixed exchange rate regimes with imperfect credibility of exchange rate peg. Suppose the BP=0 schedule is given by

i = -(1/κ)[((EXP)- - (IMP)- + (KA)-) + (n+v)q] + i-* + Δse+1 + (m/κ)Y

Where κ = ∞.

2.1 Suppose the expected increase in the foreign interest exchange rate goes from zero to 50% chance of no change, and 50% chance of 10% increase. Show what happens in an IS-LM-BP=0 graph.

2.2 In order to keep the exchange rate fixed, what must the central bank do. Be explicit about the actions that must be taken. Can the central bank keep the home interest rate lower than the foreign?

3. UIP. Suppose Δset+10 (iUSt,10 - iUKt,10), that is the ten year expected depreciation equals the ten year interest differential. Suppose the US ten year rate is 5% and the UK ten year rate is 10%. If UIP holds, what is the expected value of the dollar/pound exchange rate in ten years, relative to today's value?

4. PPP. Suppose US inflation is 6% and UK inflation is 2%. What does relative PPP (in growth rates) imply the exchange rate change will be? Do you believe it will equal this value? Why or why not.