Reference no: EM13833742

Question 1: On December 31, 20X8, Melkor Corporation acquired 80 percent of Sydney Company's common stock for $160,000. At that date, the fair value of the non-controlling interest was $40,000. Of the $75,000 differential, $10,000 related to the increased value of Sydney's inventory, $20,000 related to the increased value of its land, and $25,000 related to the increased value of its equipment that had a remaining life of 10 years from the date of combination. Sydney sold all inventory it held at the end of 20X8 during 20X9. The land to which the differential related was also sold during 20X9 for a large gain. At the date of combination, Sydney reported retained earnings of $75,000 and common stock outstanding of $50,000. In 20X9, Sydney reported net income of $60,000, but paid no dividends. Melkor accounts for its investment in Sydney using the equity method. Based on the preceding information, the amount of goodwill reported in the consolidated financial statements prepared immediately after the combination is:

- $0

- $32,500

- $26,000

- $20,000

Question 2: On January 1, 20X8, Ramon Corporation acquired 75 percent of Tester Company's voting common stock for $300,000. At the time of the combination, Tester reported common stock outstanding of $200,000 and retained earnings of $150,000, and the fair value of the non-controlling interest was $100,000. The book value of Tester's net assets approximated market value except for patents that had a market value of $50,000 more than their book value. The patents had a remaining economic life of ten years at the date of the business combination. Tester reported net income of $40,000 and paid dividends of $10,000 during 20X8. What balance will Ramon report as its investment in Tester at December 31, 20X8, assuming Ramon uses the equity method in accounting for its investment?

- $318,750

- $317,500

- $330,000

- $326,250

Question 3: Company X acquires 100 percent of the voting shares of Company Y for $275,000 on December 31, 20X8. The fair value of the net assets of Company X at the date of acquisition was $300,000. This is an example of a(n):

- positive differential.

- bargain purchase.

- extraordinary loss.

- revaluation adjustment.

Question 4: On December 31, 20X8, Mercury Corporation acquired 100 percent ownership of Saturn Corporation. On that date, Saturn reported assets and liabilities with book values of $300,000 and $100,000, respectively, common stock outstanding of $50,000, and retained earnings of $150,000. The book values and fair values of Saturn's assets and liabilities were identical except for land which had increased in value by $10,000 and inventories which had decreased by $5,000. What amount of differential will appear in the eliminating entries required to prepare a consolidated balance sheet immediately after the business combination, if the acquisition price was $240,000?

- $0

- $40,000

- $25,000

- $5,000

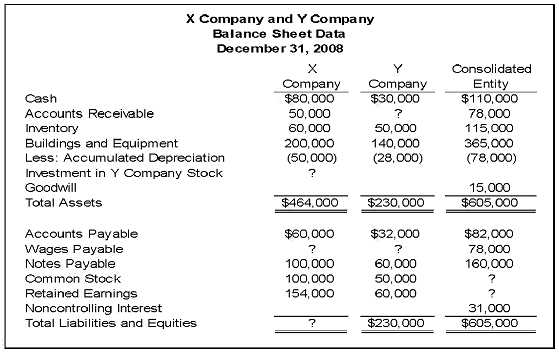

Question 5: On December 31, 20X8, X Company acquired controlling ownership of Y Company. A consolidated balance sheet was prepared immediately. Partial balance sheet data for the two companies and the consolidated entity at that date follow:

During 20X8, X Company provided consulting services to Y Company and has not yet been paid for them. There were no other receivables or payables between the companies at December 31, 20X8. Based on the information given, what is the amount of unpaid consulting services at December 31, 20X8, on work done by X Company for Y Company?

- $0

- $10,000

- $5,000

- $15,000

Question 6: Rohan Corporation holds assets with a fair value of $150,000 and a book value of $125,000 and liabilities with a book value and fair value of $50,000. What balance will be assigned to the noncontrolling interest in the consolidated balance sheet if Helms Company pays $90,000 to acquire 75 percent ownership in Rohan and goodwill of $20,000 is reported?

- $50,000

- $30,000

- $40,000

- $20,000

Question 7: Which of the following is true? When companies employ push-down accounting:

- the subsidiary revalues assets and liabilities to their fair values as of the acquisition date.

- a special account called Revaluation Capital will appear in the consolidated balance sheet.

- all consolidation elimination entries are made on the books of the subsidiary rather than in consolidated worksheets.

- the subsidiary is not substantially wholly owned by the parent.

Question 8: Consolidated financial statements are being prepared for Behemoth Corporation and its two wholly-owned subsidiaries that have intercompany loans of $50,000 and intercompany profits of $100,000. How much of these intercompany loans and profits should be eliminated?

- intercompany loans - $0; intercompany profits - $0

- intercompany loans - $50,000; intercompany profits - $0

- intercompany loans - $50,000; intercompany profits - $100,000

- intercompany loans - $0; intercompany profits - $100,000

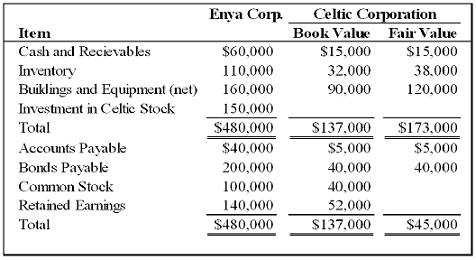

Question 9: Enya Corporation acquired 100 percent of Celtic Corporation's common stock on January 1, 20X9. Summarized balance sheet information for the two companies immediately after the combination is provided:

Based on the preceding information, the amount of differential associated with the acquisition is:

- $0.

- $58,000.

- $22,000.

- $36,000.

Question 10: Tanner Company, a subsidiary acquired for cash, owned equipment with a fair value higher than the book value as of the date of combination. A consolidated balance sheet prepared immediately after the acquisition would include this difference in:

- goodwill.

- retained earnings.

- deferred charges.

- equipment.