Reference no: EM13850243

1. Suppose you work summers house-sitting for people while they are away on vacation. Most of your customers pay you immediately after you finish a job. A few ask you to send them a bill. It is now June 30 and you have collected $600 from cash paying customers. Your remaining customers owe you $1,400.

Requirements

R1. How much service revenue would you have under the a. cash basis? b. accrual basis?

R2. Which method of accounting provides more information about your housesitting business?

2. The Michelle Cook Law Firm uses a client database. Suppose Michelle Cook paid $5,000 for a computer.

Requirements

R1. Describe how the business should account for the $5,000 expenditure under

a. the cash basis. b. the accrual basis.

R2. State why the accrual basis is more realistic for this situation.

3. Arizona Magazine sells annual subscriptions for the 12 monthly magazines mailed out each year. The company collects cash in advance and then mails out the magazines to subscribers each month.

Requirement

R1. Apply the revenue principle to determine a. when Arizona Magazine should record revenue for this situation. b. the amount of revenue Arizona Magazine should record for the magazines mailed out January through March.

4. Suppose on January 1 you prepaid apartment rent of $4,200 for the full year.

Requirement

R1. At September 30, what are your two account balances for this situation?

5. On April 1 your company prepaid six months of rent, $4,800.

Requirement

R1. What type of adjusting entry is this?

6. Consider the facts presented in problem #5.

Requirements

R1. Prepare the journal entry for the April 1 payment.

R2. Prepare the adjusting entry required at April 30.

R3. Post to the two accounts involved and show their balances at April 30.

7. On December 1 your company paid cash of $51,300 for computers that are expected to remain useful for four years. At the end of four years, the value of the computers is expected to be zero, so depreciation is $12,825 per year.

Requirements

R1. Post the purchase of December 1 and the depreciation on December 31 to T-accounts for the following accounts: Computer Equipment, Accumulated Depreciation-Computer Equipment, and Depreciation Expense-Computer Equipment. Show their balances at December 31. (Assume that the journal entries have been completed.)

R2. What is the computer equipment's book value on December 31?

8. Harris Travel borrowed $48,000 on September 1, 2011, by signing a one-year note payable to Street One Bank. Harris interest expense for the remainder of the fiscal year (September through November) is $888.

Requirements

R1. Make the adjusting entry to accrue interest expense at November 30, 2011. Date the entry and include its explanation.

R2. Post to the T-accounts of the two accounts affected by the adjustment.

9. Modern Magazine collects cash from subscribers in advance and then mails the magazines to subscribers over a one-year period.

Requirements

R1. Journalize the entry to record the original receipt of $100,000 cash.

R2. Journalize the adjusting entry that Modern Magazine makes to record the earning of $5,000 of subscription revenue that was collected in advance. Include an explanation for the entry.

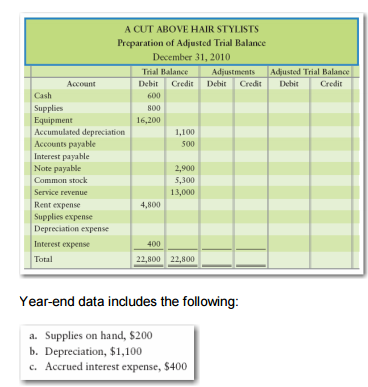

10. A Cut Above Hair Stylists has begun the preparation of its adjusted trial balance as follows:

Year-end data includes the following:

Requirement

R1. Complete A Cut Above's adjusted trial balance. Key each adjustment by letter.

11. Refer to the data in problem #10.

Requirement

R1. Compute A Cut Above's net income for the year ended December 31, 2010.

12. Refer to the data in problem #10.

Requirement

R1. Compute A Cut Above's total assets at December 31, 2010.

13. The trial balance of Dynaclean Air Purification System, Inc., at December 31, 2011, and the data needed for the month-end adjustments follow.

Adjustment data at December 31:

Requirements

R1. Journalize the adjusting entries.

R2. The unadjusted balances have been entered for you in the general ledger accounts. Post the adjusting entries to the ledger accounts.

R3. Prepare the adjusted trial balance.

R4. How will Dynaclean Air Purification System use the adjusted trial balance?

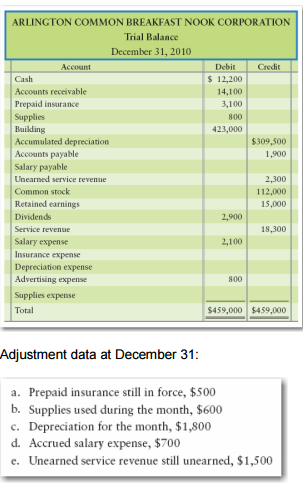

14. The trial balance of Arlington Common Breakfast Nook Corporation at December 31, 2010, and the data needed for the month-end adjustments follow.

Adjustment data at December 31:

Requirements

R1. Journalize the adjusting entries.

R2. The unadjusted balances have been entered for you in the general ledger accounts. Post the adjusting entries to the ledger accounts.

R3. Prepare the adjusted trial balance.

R4. Prepare the income statement, statement of retained earnings, and balance sheet for the business for the month ended December 31, 2010.

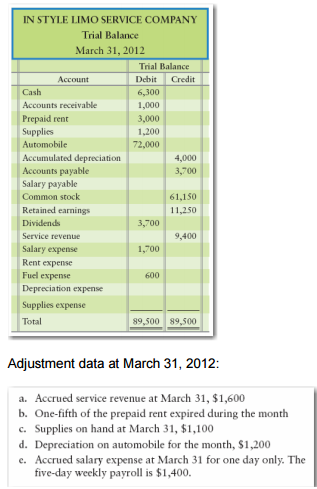

15. Consider the unadjusted trial balance of In Style Limo Service Company at March 31, 2012,

and the related month-end adjustment data.

Adjustment data at March 31, 2012:

Requirements

R1. Write the trial balance on a work sheet, using Exhibit 3-9 as an example, and prepare theadjusted trial balance of In Style Limo Service Company at March 31, 2012. Key each adjusting entry by letter.

R2. Prepare the Income Statement and the Statement of Retained Earnings for the month ended

March 31, 2012, and the Balance Sheet at that date.