Reference no: EM131701673

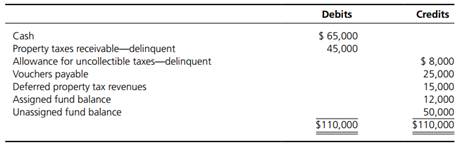

Question: (Journal entries for selected transactions and events) The General Fund postclosing trial balance of the City of Harlan Heights showed the following balances on December 31, 2012:

Prepare entries to record the following transactions and events for calendar year 2013:

1. Harlan collected $40,000 of delinquent property taxes during 2013. The balance of the delinquent property taxes outstanding at the beginning of the year was written off as uncollectible.

2. The Assigned fund balance at the beginning of the year represented outstanding encumbrances that were allowed to lapse at year-end. The purchase orders that had been encumbered will be honored and charged against 2013 appropriations.

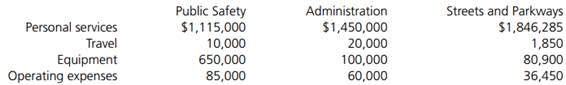

3. Harlan adopted the following budget at the beginning of 2013:

4. Property taxes were levied in the amount of $575,000 to provide revenues of $550,000 after allowing $25,000 for estimated uncollectible taxes.

5. As a result of appealing their assessments, taxpayers received reductions in their tax bills of $20,000. Harlan collected property taxes of $530,000 during 2013.

6. All remaining unpaid taxes were declared delinquent. The comptroller concluded that all delinquencies would be paid and that no allowance for uncollectible taxes would be needed. The comptroller also estimated that $15,000 of the delinquencies would be collected during the first 60 days of 2014.

7. The pension appropriation was based on the actuary's estimate, but the mayor, after conferring with the council, paid only $40,000 to the Pension Trust Fund.

8. In accordance with policy regarding bus fares, a subsidy of $20,000 was paid to the Mass Transit Authority.

9. To balance the budget for 2014, the approved budget contained an appropriation of $35,000 from the anticipated fund balance at December 31, 2013.