Reference no: EM13144996

Problem 1:

Additional facts:

The taxpayer exchanges property in 2010 with a fair market value of $5,500,000 that has a basis of $750,000. The property is also subject to a mortgage of $2,500,000. The taxpayer receives like-kind replacement property with a value of $6,500,000 that is subject to a mortgage of $1,000,000. In order to balance the equities in the exchange, the taxpayer contributes additional funds as needed.

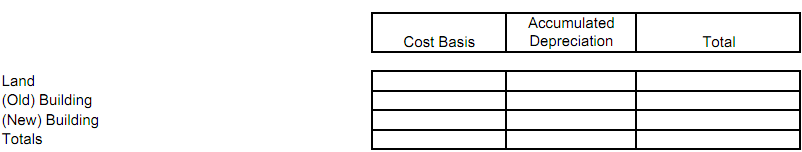

Adjusted basis of the relinquished property is composed of the following amounts:

The fair market value of the land and building of the replacement property are as follows:

Answer the following questions:

a) How much is the realized gain?

b) How much is the total boot, if any?

c) Is there mortgage boot? If so, how much?

d) How much new money was contributed by the taxpayer to balance the equities?

e) What is the total basis of the like-kind property received?

f) Provide the following basis* items immediately after the exchange for the like-kind property received:

Problem 2:

Answer the following questions:

How much is the realized gain?

How much is the total boot, if any?

Is there mortgage boot? If so, how much?

How much boot will be recognized in the following periods, if any?

The taxpayer exchanges property in 2010 with a fair market value of $5,500,000 that has a basis of $750,000. The property is also subject to a mortgage of $2,500,000. The taxpayer receives like-kind replacement property with a value of $3,000,000 that is subject to a mortgage of $1,000,000. In order to balance the equities in the exchange, the taxpayer receives an installment note in the amount of $1,000,000. The installment note payments will be received in two $500,000 installments with the first being paid in 2011 and the latter in 2012 (ignore interest rules for purposes of the problem).

2010

2011

2012

What is the basis in the like-kind property received?

What is the basis in the not like-kind property received (the installment note)?

|

Why do not bacteria grow throughout an agar medium

: Why don't bacteria (escpecially motile forms) grow throughout an agar medium, which is 97% water?

|

|

Calculate the net cash provided by operating activities

: October Corporation reported net income of $46,000 in 2012. Depreciation expense was $17,000 and unrealized holding losses on temporary investments (FV-NI) were $3,000. The following accounts changed as indicated in 2012:

|

|

Probability that second day-s stock price is more than first

: The stock price on the next day can either go up by $10 with probability 40% or go down by $10 with probability 60%. What is the probability that the 2nd day's stock price is $50 given that the 1st day's price is $60?

|

|

Write a response to these congress-people explaining

: Write a response to these Congress-people explaining the importance of neutrality in financial accounting and reporting.

|

|

How much is the realized gain

: What is the basis in the like-kind property received and what is the basis in the not like-kind property received

|

|

Income of the partnership

: In the first year of the partnership, its cash-basis incom was $100,000, $50,000 of which was the collection of the transferred receivables. When is the income of the partnership reported and by whon?

|

|

How has the concept of asset impairment changed accounting

: How has the concept of asset impairment changed accounting for long lived assets under the historical cost model?

|

|

What is the probability that john and martha first child

: John and Martha are contemplating having children, but John's brother has galactosemia (an autosomal recessive disease) and Martha's great-grandmother also had galactosemia.

|

|

Determining end of the taxable year

: Given the following partnership activity for the year, determine each partner's adjusted basis in Quick and Reddy at the end of the taxable year.

|