Reference no: EM131053735

Assignment

Instructions:

Read this article and explain the effect of a near $100 per Barrel on oil companies?

Oil Price Hovers Near $100 a Barrel

Rally Since Early January Spurred by Pipeline Opening; 'Healthy Sign of Bottlenecks Loosening Up'

Christian Berthelsen and Nicole Friedman

Oil is flirting with the $100-a-barrel mark for the first time this year as improvements to the nation's oil infrastructure alleviate a supply glut in the middle of the country.

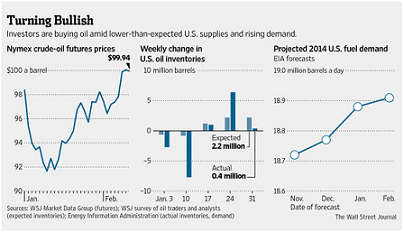

Better oil infrastructure is lifting U.S. oil prices. Here, pipelines go into storage tanks in Cushing, Okla. Dan Strumpf/The Wall Street Journal Prices for the benchmark U.S. oil contract have risen more than 9% since early January. The gains were fueled by the opening of a new pipeline connecting America's biggest oil-storage hub with the main refining zone on the Gulf Coast. In Tuesday's trading, March futures ended 12 cents lower at $99.94 a barrel on the New York Mercantile Exchange. Futures settled on Monday above $100 a barrel for the first time since December.

The rally is the latest example of how the boom in North American oil output is no guarantee of abundant-or cheap-U.S. crude. The increasing number of barrels that are making it to Gulf Coast refiners are being processed into fuels and exported to other countries. Meanwhile, a cold winter is helping to drive up consumption of distillates, a category of fuel that includes heating oil, at home.

"The recent rise is a healthy sign of some of the bottlenecks loosening up," said John Brynjolfsson, chief investment officer of hedge fund Armored Wolf LLC, which manages about $1 billion.

Mr. Brynjolfsson is wagering that U.S. oil futures on Nymex will increase, outperforming Brent, a benchmark for European crude that many investors use as a gauge of global oil prices.

Nymex crude currently trades at a discount to Brent of almost $9 a barrel, down from $15 in early January, a reflection of the difficulty in bringing oil from Cushing to where it is needed. Mr. Brynjolfsson expects the spread to continue narrowing in the next couple of months and eventually to disappear.

The gap between the two contracts was wider than $25 a barrel at times in 2011 and 2012, before much of the storage and transportation infrastructure to manage rising U.S. oil output was built.

Mr. Brynjolfsson isn't the only one betting on higher U.S. oil prices. In the aggregate, the number of bullish bets held by hedge funds and other money managers in the $163 billion U.S. oil-futures market is at a five-month high, according to the latest data from the U.S. Commodity Futures Trading Commission.

Despite climbing U.S. crude production, oil isn't as abundant as it was in the early stages of the boom. U.S. crude-oil inventories hit a 22-month low in mid-January and are still down 3.7% from a year ago. Distillate supplies hover just above a five-year low touched in November.

"This is the system rebalancing itself," said Jan Stuart, head of energy research for the fixed-income division of Credit Suisse Group AG CSGN.VX +2.11% .

Some traders and forecasters expect crude's rise to be short-lived. The U.S. Energy Information Administration in its monthly outlook released Tuesday predicted prices would average $93 a barrel in 2014. Refiners once again are ramping down as spring-maintenance season approaches, and analysts are expecting crude-oil inventories to rise. Maintenance will be "fairly heavy" in the Gulf Coast in March, reducing demand for crude shipments from Oklahoma to Texas, said Katherine Spector, head of commodities strategy at CIBC World Markets.

"We will see how much crude can continue to flow to [the Gulf Coast] even when they don't really want it, so to speak," she said. "That will be a test."

Analysts are expecting a nationwide increase in oil supplies in weekly U.S. government data to be released on Wednesday. The average forecast in a Wall Street Journal survey is for inventories to rise by 2.5 million barrels for the week ended last Friday, while fuel supplies are expected to drop.

Still, investors are betting improvements in oil infrastructure will at least temporarily result in higher U.S. oil prices.

In the past week, "there's been an enormous amount of activity" in trading the difference between Nymex and Brent oil prices, said Mark Vonderheide, managing partner of proprietary trading house Geneva Energy Markets.

The trade is "clearly being driven by the perception that the logistical problems of getting crude out of Cushing are gradually going to get solved," Mr. Vonderheide said.