Reference no: EM131486762

The Laffer Curve

Applicable Concept: supply-side fiscal policy

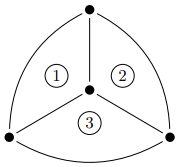

Supply-side economics became popular during the presidential campaign of 1980. This fiscal policy prescription gained prominence after supply-side economist Arthur Laffer, using his pen to draw on a paper napkin, explained what has come to be known as the Laffer curve to a Wall Street Journal journalist at a restaurant in Washington, D.C. The Laffer curve is a graph depicting the relationship between tax rates and total tax revenues. As shown in the figure, the hypothetical Laffer curve can be drawn with the federal tax rate on the horizontal axis and tax revenue on the vertical axis. The idea behind this curve is that the federal tax rate affects the incentive for people to work, save, invest, and produce, which in turn influences tax revenue. As the tax rate climbs, Laffer and other supply-siders argue that the erosion of incentives shrinks national income and total tax collections. The journalist kept the napkin and published the curve in an editorial in The Wall Street Journal. And a theory was born.

Here is how the Laffer curve works. Suppose the federal government sets the federal income tax rate at zero (point A). At a zero income tax rate, people have the maximum incentive to produce, and optimum national income would be earned, but there is zero tax revenue for Uncle Sam. Now assume the federal government sets the income tax rate at the opposite extreme of 100 percent (point D). At a 100 percent confiscating income tax rate, people have no reason to work, take business risks, produce, and earn income. People seek ways to reduce their tax liabilities by engaging in unreported or underground transactions or by not working at all. As a result, no tax revenue is collected by the Internal Revenue Service. Laffer compared this situation to Robin Hood and his band of merry men (the government) who robbed rich people (taxpayers) traveling through Sherwood Forest to give to the poor. Laffer posed this question, "Do you think that travelers continued to go through Sherwood Forest?" The answer is "no," and Robin Hood's "revenue" would fall.

Because the federal government does not want to collect zero tax revenue, Congress sets the federal income tax rate between zero and 100 percent. Assuming that the income tax rate is related to tax revenue as depicted in the figure, maximum tax revenue, Rmax, is collected at a tax rate of Tmax (point B). Laffer argued that the federal income tax rate of T (point C) in 1981 exceeded Tmax and the result would be tax revenue of R, which is below Rmax. In Laffer's view, reducing the federal income tax rate leads to an increase in tax revenue because people would increase their work effort, saving, and investment and would reduce their attempts to avoid paying taxes. Thus, Laffer argued that a cut in federal income tax rates would unleash economic activity and boost tax revenues needed to reduce the federal budget deficit. President Reagan's belief in the Laffer curve was a major reason why he thought that the federal government could cut personal income tax rates and still balance the federal budget.

The Laffer curve remains a controversial part of supply-side economics. There is still considerable uncertainty about the shape of the Laffer curve and at what point B, C, or otherwise, along the curve the U.S. economy is operating. Thus, the existence and the usefulness of the Laffer curve are a matter of dispute.

Analyze The Issue

Compare the common perception of how a tax rate cut affects tax revenues with economist Laffer's theory and please discuss it in 2-3 paragraphs.