Reference no: EM131102970

To achieve this unit a student must:

- Apply relevant forecasting techniques to obtain information for decision making.

- Examine and apply the financial appraisal techniques used to evaluate potential investment decisions.

- Interpret financial statements for planning and decision making.

Background

Honeycomb is a public sector biological research laboratory in UK. Its objective is to apply the latest scientific research to the development of new drugs. After a new drug is developed, Honeycomb may either produce the drug itself or license it to some private pharmaceutical companies.

Task 1

Two years ago, Honeycomb spent £100,000 in a research project. A post-audit has performed recently on the research project. The research result was quite promising but the audit committee commented that the project was overspent. Honeycomb disagreed on the accusation of overspending because the project scope has been expanded and the inflation rate at UK was high during the research period.

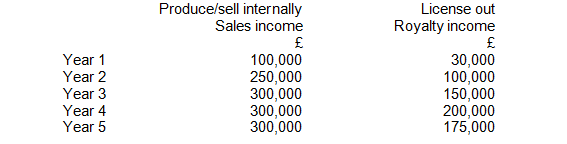

Now, Honeycomb is working on a study on the financial viability of applying the research result to the development of a new drug. If Honeycomb continue to apply the result, it has to spend £250,000 immediately to complete the research. After completion, Honeycomb may either produce and sell the new drug itself or license it out. The respective sales income and royalty income of the two alternatives are listed below:

If Honeycomb produces the drug, it will incur costs of materials and labour, which are estimated to be 65% of sales. If Honeycomb chooses to license it out, no cost will be incurred at all throughout the years.

Honeywell is owned by the Medical Faculty of a University, which has a policy to charge its venture, including Honeycomb, a nominal rent of £15,000 per year.

Honeycomb needs to borrow a loan to finance the £250,000. Honeycomb can borrow at a favourable rate of 10%. On the other hand, the Weighted Average Cost of Capital (WACC) of Honeycomb is 12%.

You are the financial analyst of Honeycomb. Write a report to the Finance Office of the University to advise the following issues:

(a) Select with reasons appropriate and relevant financial information for use in the process of making the strategic decision on investment in the development of the new drug. If you feel that the financial information available is not sufficient, you should explain them clearly in the report. (LO2.2)

(b) Honeycomb is in the public sector. You have to discuss the differences in choosing AND using appraisal methods between Honeycomb and an organisation in private sector. (LO 2.1)

(c) Use EACH of the current appraisal methods (accounting rate of return, payback method, net present value, and internal rate of return) to analyse the above two competing alternatives and make justifiable decisions. You have to clearly specify the choices you make under EACH method and your final decision by jointly considering all the analysis. (LO 2.1)

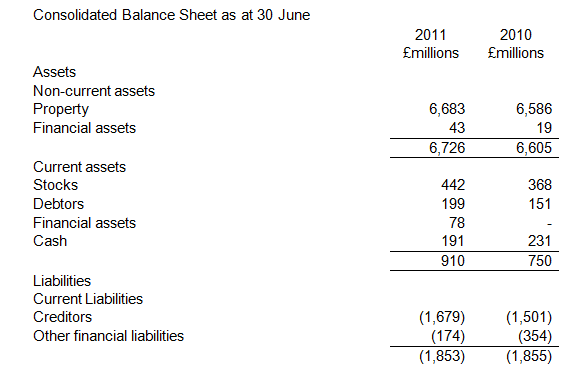

(d) Identify and appraise the possible, not just existing, sources of funds available to Honeycomb, and make proposals for obtaining funds for the drug project. You should consider in conjunction with the financial statements of Honeycomb at Appendix I. (LO 1.2)

(e) Make recommendations based on the post-audit appraisal in light of the research project two year ago and its relevance to the current analysis of the two alternatives. (LO 2.3)Task 2

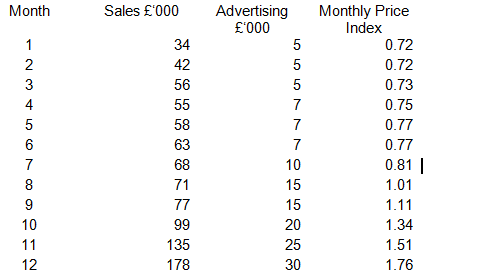

Honeycomb has another drug that was launched a year ago. The company would like to set an appropriate level of advertising budget for next year (Year 2). The product manager has collected the Year 1 sales and advertising data as follows:

The product manager has calculated the correlation coefficient to be 0.961.

Honeycomb wants some assistance in forecasting the Year 2 sales based on the Year 1 data. As the financial analyst, the product manager asks you to write him a memo on the following:

(a) Draw a scatter graph showing the relationship of sales and advertising. The graph should be properly labelled.

(b) Calculate the coefficient of determination and comment on it as well as on the correlation coefficient.

(c) Produce a table showing the three-month moving averages of the data.

(d) Prepare a forecast of sales for the first three months of year 2 assuming that advertising spending is the same as that in Year 1. Explain fully the method that you have used and any assumptions that you have made.

(e) Evaluate the appropriateness and limitation of the above forecasting models

(f) Discuss how the accuracy of future forecasts of the company might be improved. (LO 1.1)

Task 3

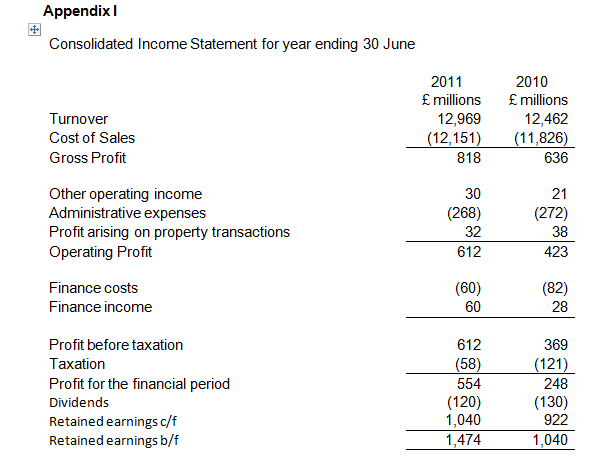

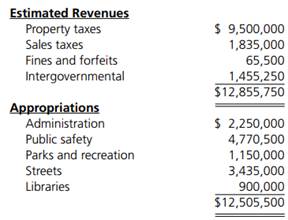

Honeycomb has just completed its financial statements for the year ended 30 June 2011 (see Appendix I). You are required to write a financial review based on the statements to the Finance Office of the University in the capacity of financial analyst of Honeycomb.

(a) Analyse the financial statements using 10 ratios to assess the financial viability of Honeycomb. You have to explain why each of the ratios is relevant to the performance, solvency, liquidity, or efficiency of Honeycomb. Working on the ratios should be shown clearly. (LO 3.1)

(b) Carry out a performance audit of Honeycomb in light of the ratios calculated at Task 3(a), including reference to internal and external factors. (LO 3.2)

(c) Discuss the limitations of financial statements and suggest the use of other appropriate calculations that may improve the quality and the understanding of financial statements with reference to Honeycomb. (LO 3.3)

(d) Make recommendations on the strategic portfolio of Honeycomb based on the interpretation of financial and ancillary information. (LO 3.4)

Outcomes and assessment criteria -

Outcomes

|

Assessment criteria

To achieve each outcome a learner must demonstrate the ability to:

|

1. Apply relevant forecasting techniques to obtain information for decision marking

|

1.1 Select and use appropriate forecasting methods to enable cost and revenue forecasts to be constructed for an organisation, adjusting for expected movements such as price changes

1.2 Identify and appraise the sources of funds available to an organisation, and make proposals for obtaining funds for a specific project or resource

|

2. Examine and apply the financial appraisal techniques used to evaluate potential investment decisions

|

2.1 Use current appraisal methods to analyse competing investment projects in the public and private sector and make justifiable decisions

2.2 Select appropriate and relevant financial information for use in the process of making strategic decisions on investment

2.3 Make recommendations based on a post-audit appraisal on the appropriateness of selected investment project decisions

|

|

3. Interpret financial statements for planning and decision making

|

3.1 Analyse financial statements using relevant techniques to assess the financial viability of an organisation

3.2 Carry out a performance audit of an organisation including reference to internal and external factors

3.3 Use appropriate calculations to improve the quality of financial information used

3.4 make recommendations on the strategic portfolio of an organisation based on the interpretation of financial and ancillary information

|