Reference no: EM131247389

During recent years your company has made considerable use of debt financing, to the extent that it is generally agreed that the percentage of debt in the firms capital structure (either in book or market value terms) is too high.

Further use of debt will likely lead to a drop in the firms bond rating. You would like to recommend that the next major capital investment be financed with a new equity issue. Unfortunately, the firm has not been doing very well recently (nor has the market). In fact the rate of return on investment has been just equal to the cost of capital.

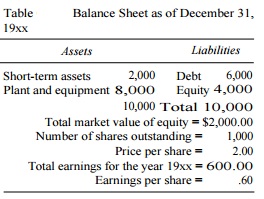

As shown in the financial statement in Table, the market value of the firms equity is less than its book value. This means that even a profitable project will decrease earnings per share if it is financed with new equity.

For example, the firm is considering a project that costs $400 but has a value of $500 (i.e., an NPV of $100), and that will increase total earnings by $60 per year. If it is financed with equity the $400 will require approximately 200 shares, thus bringing the total shares outstanding to 1200. The new earnings will be $660, and earnings per share will fall to $0.55. The president of the firm argues that the project should be delayed for three reasons.

a) It is too expensive for the firm to issue new debt.

b) Financing the project with new equity will reduce earnings per share because the market value of equity is less than book value.

c) Equity markets are currently depressed. If the firm waits until the market index improves, the market value of equity will exceed the book value and equity financing will no longer reduce earnings per share.

|

Reconstruction of this signal from its sample

: Suppose that we sample this signal with a sampling frequency F3 = 8 kHz. Examine what happens to the frequency F1 = 5 kHz.

|

|

Represent the total annual spend

: Assuming that the amounts shown represent the total annual spend, calculate the percent of spend for each category. Classify each spend category as either low or high complexity and summarize your reasoning.

|

|

How do you think it will affect the value of the firm

: That is, any cash flows left over after the firm has undertaken all profitable investments will be paid out to shareholders. This new policy will obviously increase the variability of dividends paid. How do you think it will affect the value of th..

|

|

Who are or have been effective in implementing public policy

: Select two leaders, at least one of which from your country, who are or have been effective in implementing public policy and think about similarities and differences in terms of their effectiveness in implementing public policy.

|

|

Financing the project with new equity

: During recent years your company has made considerable use of debt financing, to the extent that it is generally agreed that the percentage of debt in the firms capital structure (either in book or market value terms) is too high.

|

|

Break even if each completed unit

: A manufacturing process has a fixed cost of $150,000 per month. Each unit of product being produced contains $27 worth of material and takes $45 of labor. How many units are needed to break even if each completed unit has a value of $90?

|

|

Identify the types of descriptive statistics

: Develop a 1,050-word report in which you: Identify the types of descriptive statistics that might be best for summarizing the data, if you were to collect a sample. Analyze the types of inferential statistics that might be best for analyzing the data..

|

|

What is the role of private and public keys in encryption

: What are the key aspects of network administration and management?

|

|

List the four most popular sources of digital media

: What are the three major components of satellite radio, from a technology standpoint?

|