Reference no: EM131175129

Business Taxation Assignment

The following tax rates and allowances are to be used in answering the questions:

|

Allowances:

Basic allowance

Married person's allowance

Single parent allowance

Child allowance - 1st to 9th child (each)

- additional allowance in the year of birth (each)

Dependent parent/grandparent allowance - basic

- additional

|

2013/14

$

120,000

240,000

120,000

70,000

70,000

19,000/38,000

19,000/38,000

|

2014/15

$

120,000

240,000

120,000

70,000

70,000

20,000/40,000

20,000/40,000

|

|

Dependent brother/sister allowance

|

33,000

|

33,000

|

|

Disabled dependant allowance

|

66,000

|

66,000

|

|

Deductions:

|

|

|

|

Self-education expenses (maximum)

|

80,000

|

80,000

|

|

Home loan interest (maximum)

|

100,000

|

100,000

|

|

Elderly residential care expenses (maximum)

|

76,000

|

80,000

|

|

Mandatory provident fund contributions (maximum)

|

15,000

|

17,500

|

|

Approved charitable donations (maximum)

|

35%

|

35%

|

|

Tax rates:

|

|

|

|

Salaries tax rates:

|

2013/14

|

2014/15 |

|

First $40,000

|

2%

|

2%

|

|

Next $40,000

|

7%

|

7%

|

|

Next $40,000

|

12%

|

12%

|

|

Remainder

|

17%

|

17%

|

|

Standard rate

|

15%

|

15%

|

|

Profits tax rate for corporations

|

16.5%

|

16.5%

|

|

Depreciation allowance rates:

Initial allowance (IA):

Plant and machinery

Industrial building (IBA)

Annual allowance (AA):

Computers

Motor cars

Furniture and fixtures

Machines

Industrial buildings (IBA)

Commercial buildings (CBA)

|

60%

20%

30%

30%

20%

10%-30%

4% or formula

4% or formula

|

Question 1

Mr. Parker was employed by a US company as the regional manager in South East Asia. His employment contract was concluded and enforceable in the USA. He was paid in the USA by the company in US dollars. For administrative convenience, Mr. Parker was seconded to the US company's wholly owned subsidiary which was registered as an overseas corporation in Hong Kong. However, as his duty was exclusively to oversee and supervise operations of various affiliated companies of the US company, most of his work performed in Hong Kong was for the benefit of these affiliated companies. During the year of assessment 2014/15, Mr. Parker spent 95 days outside Hong Kong and his annual employment income was US$100,000.

Required:

Discuss whether Mr. Parker is chargeable to salaries tax and compute his chargeable amount, if any.

Question 2

Part 1

According to tax laws, explain the meaning of "trade" and list out the factors to determine whether a trade exists.

Part 2

A Hong Kong manufacturer processes goods in his factory in Shenzhen but the final stage of processing work is done in Hong Kong. All goods are sold to European markets. Do the profits from the sale of these products have a Hong Kong source? If not, which part of the profits should be regarded as arising in or being derived from Hong Kong?

Part 3

What factors need to be considered in determining the source of profits of the following businesses?

(i) a garment manufacturing company

(ii) a car repair centre

(iii) an import and export trading company

Question 3

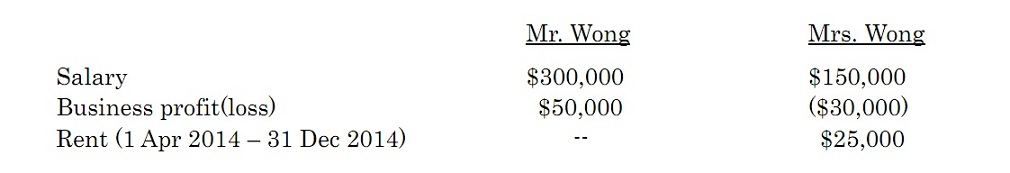

Mr. Wong and his wife lived in Hong Kong for many years. In June 2015 they migrated to Australia. Particulars of their income in Hong Kong for the year ended 31 March 2015 are as follows:

The property was owned solely by Mrs. Wong. It was left vacant after 31 December 2014 because the tenant did not renew the lease. The rates paid by Mrs. Wong for the whole year amounted to $1,000.

Mr. Wong donated $20,000 to an approved charity in June 2014. He claimed a deduction in respect of the donation in his salaries tax return only.

Throughout the year ended 31 March 2015 Mr. Wong remitted $8,000 monthly to Australia for his sons and parents because his two sons (aged 19 and 24) were studying full time at a college there and his parents also lived there.

Before leaving Hong Kong for Australia Mr. Wong and his wife paid all the salaries tax, profits tax and property tax for the year of assessment 2014/15. He now wishes to elect for personal assessment for that year.

Required:

(a) State with reasons whether or not Mr. Wong is eligible to elect for personal assessment for the year of assessment 2014/15 while he is living in Australia.

(b) Calculate the amount of tax (if any) refundable to Mr. Wong under personal assessment for the year of assessment 2014/15. You should show separately your calculation of the salaries tax, profits tax and property tax already paid by Mr. Wong and his wife. Assume that Mr. Wong was nominated to claim child and dependent parent allowances, if any, under salaries tax.

Question 4

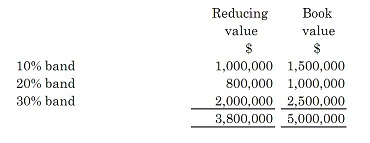

Mr. Kwan succeeded to his father's weaving and garment manufacturing business on 1 January 2013. The business closes its accounts on 31 December each year. The book value and reducing value of its plant and machinery as at 31 December 2012 were as follows:

Additional information:

(i) A weaving machine was acquired on 15 September 2013 on hire-purchase terms. The cash price was $500,000 and the down payment was $150,000. The monthly installments, $40,000 each, ran from 15 October 2013 to 15 July 2014 inclusive. The business also incurred installation costs of $50,000 for the machine.

(ii) A motor car purchased in June 2012 by the business at a cost of $120,000 was sold after one year for $150,000. The car was used wholly for business purposes before disposal.

(iii) A personal computer which was acquired by Mr. Kwan at a cost of $20,000 in May 2011 for private use was transferred to business use following his succession to the business.

(iv) Two room air-conditioning units installed in the business office were given to the general manager of the business as a gift on 10 January 2014. The Commissioner considered the market value of the units at that date to be $3,000.

(v) A brand new motor car costing $300,000 was acquired in July 2013. It was used partly for business purposes and partly for private purposes by Mr. Kwan. It was agreed that the extent of non-business use was 30% in the year of assessment 2013/14 and 40% in the following year.

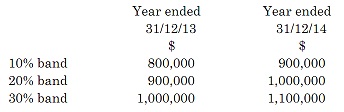

(vi) Cost of other additions to plant and machinery:

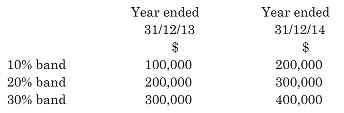

(vii) Sales proceeds of other plant and machinery (all below cost):

(viii) Annual depreciation rates:

Air-conditioning units 20%

Motor car 30%

Personal computer 30%

Weaving machine 30%

Required:

Compute the amount of depreciation allowance Mr. Kwan was entitled to claim for the years of assessment 2013/14 and 2014/15.

Question 5

Mr. Wood, who is not a Hong Kong resident, held the post of Regional Financial Manager for the Far East area by an American manufacturing company. He is stationed at the regional office of the company in Hong Kong. His employer pays him the remuneration to his bank account in America, and Mr. Wood has given standing instruction to his banker to remit the salary from his bank account in America to a bank account in Hong Kong. He estimates that he has to travel outside Hong Kong for half of the year. He is required to report to both the Hong Kong office and the head office in America.

His remuneration is in the region of HK$1,000,000, and his employer told him that he is free to design his remuneration package. Mr. Wood would rent a flat in Hong Kong, and he estimates that the monthly rent would be HK$20,000. Mr. Wood also, in his own name, purchased a flat in Hong Kong. He would like to let the flat for earning rental income.

As his wife is not living with him in Hong Kong, he would employ a local domestic helper at a monthly salary of HK$5,000. He likes to travel and would incur about HK$100,000 on trips with his family each year. His children are studying in America. Every year's summer holiday, Mr. Wood's wife and children usually come to Hong Kong to meet him and have a family gathering. Because of this, he would

like a buy a car for easy travelling in Hong Kong.

He wishes to get your advice on how to minimize his Hong Kong tax liability.

Required:

Prepare a report advising Mr. Wood on how to minimize his Hong Kong tax liability. In the report, you should state any factors that may need to be considered for Hong Kong tax authority to accept your tax arrangement. (ignore any overseas tax that may incur due to the tax arrangement)