Reference no: EM131318038

Thorpe Company is a wholesale distributor of professional equipment and supplies. The company's sales have averaged about $900,000 annually for the three-year period 2009-2011. The firm's total assets at the end of 2011 amounted to $850,000.

The president of Thorpe Company has asked the controller to prepare a report that summarizes the financial aspects of the company's operations for the past three years. This report will be presented to the board of directors at its next meeting.

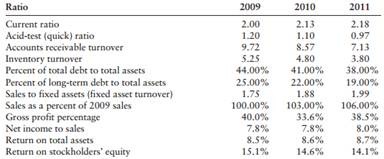

In addition to comparative financial statements, the controller has decided to present a number of relevant financial ratios that can assist in the identification and interpretation of trends. At the request of the controller, the accounting staff has calculated the following ratios for the three-year period 2009-2011:

In preparing his report, the controller has decided first to examine the financial ratios independently of any other data to determine whether the ratios themselves reveal any significant trends over the first three-year period.

Required

a. The current ratio is increasing, while the acid-test (quick) ratio is decreasing. Using the ratios provided, identify and explain the contributing factor(s) for this apparently divergent trend.

b. In terms of the ratios provided, what conclusion(s) can be drawn regarding the company's use of financial leverage during the 2009-2011 period?

c. Using the ratios provided, what conclusion(s) can be drawn regarding the company's net investment in plant and equipment?

|

How are the elements related to the whole

: How does the work resemble ocher works in plot, character, setting, or use of symbols? Does the work present archetypes such as quests, initiations, scape-goats, or withdrawals and returns? Does the protagonist undergo any kind of transformation suc..

|

|

Comment on importance of an assessment of company management

: Comment on the importance of an assessment of company management when valuing a company from the perspective of analysts and fund managers.

|

|

Calculate the eoq-formula used please

: Joe's Bar uses 800 kegs of adult beverages per year on a continuous basis (assume 365 days of operations per year). The order cost is $60.00 per order and the carrying cost is $3.00 per unit. It takes 5 days to receive a shipment after an order h..

|

|

Inventory deployment and management system

: Discuss why it is important to coordinate the arrival of procurement shipments with the dispatching of customer shipments.

|

|

Explain contributing factors for apparently divergent trend

: The current ratio is increasing, while the acid-test (quick) ratio is decreasing. Using the ratios provided, identify and explain the contributing factor(s) for this apparently divergent trend.

|

|

Formula for the delta of the option as function

: What is the formula for the delta of the option as a function of (S0, U, D, R, VU, VD)? Each month the asset could increase in value by 3% or decrease in value by inverse.

|

|

Blueprint for professional and personal growth

: Individual Reflection: Blueprint for Professional and Personal Growth-Your Future as a Manager, With Executive Summary of Class and Managerial Finance Skills

|

|

Define the term oppression and provide an example

: Define the term oppression and provide an example from a group that has experienced oppression within the U.S. society.

|

|

What was kierkegaards point about understanding life

: What was Kierkegaard's point about understanding life backward but living it forward- What should one do if one encounters a new belief that creates inconsistency in a one's set of beliefs- Bertrand Russell thought philosophy was important because..

|