Reference no: EM13379752

Evaluating Absorption and Variable Costing as Alternative Costing Methods

The questions below pertain to two different scenarios involving a manufacturing company. In each scenario, the cost structure of the company is constant from year to year. Selling prices, unit variable costs, and total fixed costs are the same in every year. However, unit sales and/or unit production levels may vary from year to year.

Required:

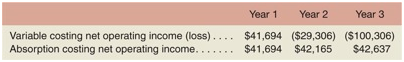

• a. Were unit sales constant from year to year? Explain.

• b. What was the relation between unit sales and unit production levels in each year? For each year, indicate whether inventories grew or shrank.

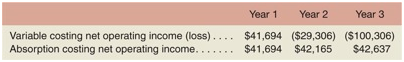

• 2. Consider the following data for scenario B:

• a. Were unit sales constant from year to year? Explain.

• b. What was the relation between unit sales and unit production levels in each year? For each year, indicate whether inventories grew or shrank.

• 3. Given the patterns of net operating income in scenarios A and B above, which costing method, variable costing or absorption costing, do you believe provides a better reflection of economic reality? Explain.