Reference no: EM13796766

1. True or False. The before-tax cost of debt, which is lower than the after-tax cost, is used as the component cost of debt for purposes of developing the firm's WACC.

2. True or False. When estimating the cost of equity by use of the DCF method, the single biggest potential problem is to determine the growth rate that investors use when they estimate a stock's expected future rate of return. This problem leaves us unsure of the true value of rs.

3. With its current financial policies, Flagstaff Inc. will have to issue new common stock to fund its capital budget. Since new stock has a higher cost than reinvested earnings, Flagstaff would like to avoid issuing new stock. Which of the following actions would REDUCE its need to issue new common stock?

a. Increase the percentage of debt in the target capital structure.

b. Increase the proposed capital budget.

c. Reduce the amount of short-term bank debt in order to increase the current ratio.

d. Reduce the percentage of debt in the target capital structure.

e. Increase the dividend payout ratio for the upcoming year.

4. Which of the following statements is CORRECT?

a. WACC calculations should be based on the before-tax costs of all the individual capital components.

b. Flotation costs associated with issuing new common stock normally reduce the WACC.

c. If a company's tax rate increases, then, all else equal, its weighted average cost of capital will decline.

d. An increase in the risk-free rate will normally lower the marginal costs of both debt and equity financing.

e. A change in a company's target capital structure cannot affect its WACC.

5. Kenny Electric Company's noncallable bonds were issued several years ago and now have 20 years to maturity. These bonds have a 9.25% annual coupon, paid semiannually, sells at a price of $1,075, and has a par value of $1,000. If the firm's tax rate is 40%, what is the component cost of debt for use in the WACC calculation?

a. 4.35%

b. 4.58%

c. 4.83%

d. 5.08%

e. 5.33%

6. To estimate the company's WACC, Marshall Inc. recently hired you as a consultant. You have obtained the following information. (1) The firm's noncallable bonds mature in 20 years, have an 8.00% annual coupon, a par value of $1,000, and a market price of $1,050.00. (2) The company's tax rate is 40%. (3)

The risk-free rate is 4.50%, the market risk premium is 5.50%, and the stock's beta is 1.20. (4) The target capital structure consists of 35% debt and the balance is common equity. The firm uses the CAPM to estimate the cost of common stock, and it does not expect to issue any new shares. What is its WACC?

a. 7.16%

b. 7.54%

c. 7.93%

d. 8.35%

e. 8.79%

7. From the investor's perspective, briefly describe the cash flows associated with a bond.

8. Please go to the US Treasury Department's website and obtain a graph of the current yield curve (only nominal rates; not real rates). On the same graph, please generate the yield curve from ten years ago. Please include a screenshot of your graph and briefly discuss your findings.

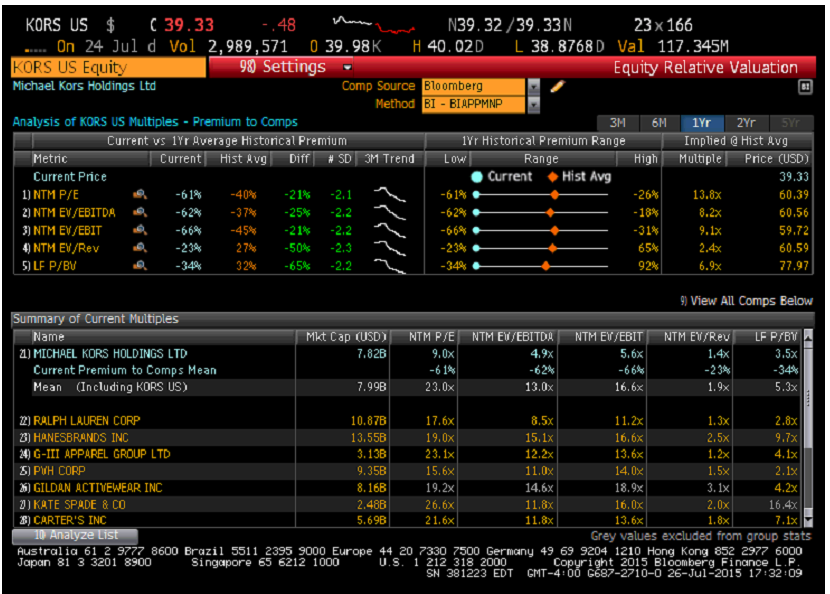

9. Please explain the Bloomberg screenshot below. Do you think that Michael Kors is overvalued or undervalued? Why or why not based on this information below?