Reference no: EM132215885

Questions -

Q1. Term Structure (Assume annual compounding.) You are given the following prices for US treasury STRIPS:

|

Bond

|

Maturity in Years

|

Price

|

Spot

|

Forward

|

|

A

|

1

|

97.32

|

|

|

|

B

|

2

|

94.77

|

|

|

|

C

|

3

|

92.09

|

|

|

|

D

|

4

|

89.29

|

|

|

a. Use these prices to compute spot, forward and annuity rates for each maturity. Show me example calculations for spot, forward and annuity rates.

b. Calculate the price of a four-year, 2% coupon bond (with annual coupons and identical payment dates as the zeros above) that would not allow arbitrage.

c. What is the yield to maturity on the 4 year 2% coupon bond?

d. If the bond is part b has a market price of 100, show how to earn arbitrage.

Q2. You have a friend who is planning for their retirement and they are incredibly risk averse. They expect to live for 40 years and want to spend $100,000 (in today's dollars) per year during their retirement years. They have asked you to help them construct a bond portfolio that meets their retirement objectives. Assume that inflation will average 3% annually over the next 40 years.

a. In principle, what characteristics would you recommend for your friend to build into the design of their portfolio? Assume that you have all bonds of all maturities available to you? This is an answer in words.

b. Suppose that your client has saved $3,000,000 for their retirement and that the fol-lowing spot rates are found in the market today:

|

Maturity in Years

|

Spot Rate

|

|

1-10

|

4.00%

|

|

11-20

|

5.00%

|

|

21-30

|

5.50%

|

|

31-40

|

5.75%

|

If your friend can only purchase 1 zero coupon bond today to fund his retirement which one and how much of it will you buy? Will this portfolio be a Ronco device ('set it and forget it-)?

c. If your friend can purchase two bonds for their investment portfolio what would you recommend to get the most out their retirement portfolio given the constraints they have on their behavior?

d. Demonstrate how well your portfolio would perform if all rates permanently in-creased by 1.00% across the term structure.

e. Demonstrate how a "twist" or change in slope of the term structure would impact your portfolio.

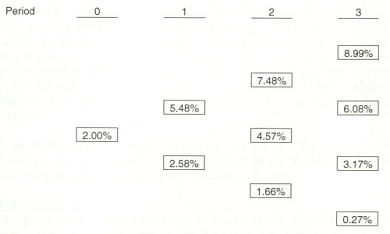

Q3. The one-year spot rate is 4.00%, the two-year spot rate is 5.00%, the three-year spot rate is 5.5%, the four-year spot rate is 6.1% and the single-step volatility estimate is 2.00% per year. All of these rates are continuously compounded.

a. Using these data construct an arbitrage-free rate tree using the Salomon model. Assume annual time steps and continuous compounding - which is implicit in the Salomon model.

b. Using the rate tree generated from the Salomon model, determine the value of a 1-year European Call option on a 4-year zero-coupon bond. The strike price of the call option is $84.00.

c. Use your rate tree to determine the quote on a 6.00% interest rate cap.

Q4. Company ABC has a swap on their books where they are paying fixed and they want to know what it would cost to get out of the swap. Most swaps allow you to get out by paying the counterparty the market value of the swap. It's called a swap termination fee. Use the following no arbitrage rate tree to determine the market value of the swap that has a fixed rate leg of 5.5% and four years remaining to maturity. The current short-term rate is 2% and the rate tree provides the evolution of the short-term rate in the future.