Reference no: EM13501720

Questions

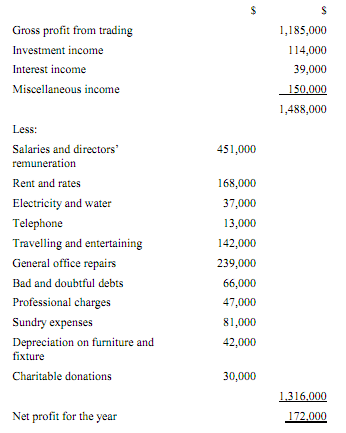

Kwong Fai Co. Ltd has been carrying on business as a garment manufacturer for many years. The income statement of the company for the year ended 31 December 2011 is as follows:

The following information relating to the above account is available:

i Depreciation charges on plant and machinery of $98,000 is included in the cost of sales.

ii Interest income:

Interest on loan to a wholly owned subsidiary resident in Hong Kong $15,000

Interest on a fixed deposit in US dollars with a local bank $24,000

iii Investment income:

Dividends from a subsidiary in Hong Kong $60,000

Rental income from property in Macau $54,000

iv Miscellaneous income:

Rent from subletting a property in Hong Kong $120,000

Gain on exchange $30,000

(realized, relating to open account with customers)

v Travelling and entertaining:

Workers' transportation costs $60,000

Travelling allowances to staff $22,000

Cost of gasoline and repairs to the managing director's car $60,000

vi General office repairs:

Electrical wiring in factory premises $200,000

Repairs to furniture and fixture $15,000

Cost of purchase of sundry utensils $24,000

($20,000 for initial purchases, other purchases are for replacement)

vii The bad debt accounts:

Increase in general provision for bad debts $7,000

Decrease in specific provision for bad debts ($41,000)

Loan to a director written off $100,000

viii Professional charges:

Audit fee $2,000

Legal fee: debt collection $15,000

Fee paid for designing a new machine $30,000

ix Sundry expenses:

Subscription to trade association $3,000

Expenses of staff dinner at the New Year $15,000

Special contribution to a recognized occupational retirement $60,000

scheme established during the year

Miscellaneous expenses (all allowable) $3,000

x Charitable donations:

Except for $2,000 which was used for purchase of raffle tickets, the others were made to various approved charitable organizations without consideration. The raffle tickets were used for lucky draw by the general staff during the annual dinner.

Required:

a For Hong Kong profits tax purposes, determine the assessable profits of Kwong Fai Co. Ltd for the year of assessment 2011/12 before

depreciation allowances.

b Briefly explain your treatments to the items in notes (vi), (vii), (ix), and (x) above.