Reference no: EM131317525

Eastern Trucking Company needs to expand its facilities. To do so, the firm must acquire a machine costing $80,000. The machine can be leased or purchased. The firm is in the 40 percent tax bracket, and its after-tax cost of debt is 5.4 percent. The terms of the lease and purchase plans are as follows:

Lease. The leasing arrangement requires beginning-of-year payments of $16,900 over five years. The lessor will pay all maintenance costs; the lessee will pay insurance and other costs. The lessee will exercise its option to purchase the asset for $20,000 paid along with the final lease payment. Purchase.

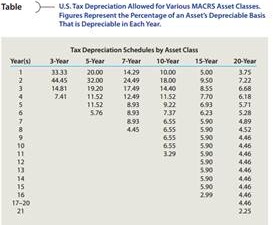

If the firm purchases the machine, its cost of $80,000 will be financed with a five-year, 9 percent loan requiring equal end-of-year payments of $20,567. The machine will be depreciated under MACRS using a fi ve-year recovery period.

(See Table for applicable MACRS percentages.) The firm will pay $2,000 per year for a service contract that covers all maintenance costs; the firm will pay insurance and other costs.

The firm plans to keep the equipment and use it beyond its five-year recovery period.

a. Determine the after-tax cash outflows of Eastern Trucking under each alternative.

b. Find the present value of the after-tax cash outflows for each alternative using the after-tax cost of debt.

c. Which alternative, lease or purchase, would you recommend? Why?

|

What is required policy mix use is-lm diagram

: Now the government wants to change the composition of demand toward investment and away from consumption without, allowing aggregate demand to beyond full employment. What is required policy mix use IS-LM diagram to show your policy proposal?

|

|

Total interest will you paying over life of mortgage

: You hope to buy your dream car 5 years from now. Today, that car costs $88,000 but you expect the price to increase by an average of 5% per year over the next five years. How much will your dream car cost by the time you are ready to buy it? Referrin..

|

|

Data exchange between dummy interface and ppp program

: PPP Data Path Completion using Dummy Network Interface Term Project. Complete data path through PPP: Add/modify transmission/reception functions in dummy network interface. Implement data exchange between dummy interface and PPP program and Create a ..

|

|

Calculate the after tax cash outflows

: Calculate the after-tax cash outflows associated with each alternative.- Calculate the present value of each cash outflow stream using the after-tax cost of debt.

|

|

Determine the after tax cash outflows of eastern trucking

: Determine the after-tax cash outflows of Eastern Trucking under each alternative.- Find the present value of the after-tax cash outflows for each alternative using the after-tax cost of debt.

|

|

Requires an initial fixed asset investment

: Summer Tyme, Inc., is considering a new 6-year expansion project that requires an initial fixed asset investment of $2.862 million. The fixed asset will be depreciated straight-line to zero over its 6-year tax life, after which time it will be worthl..

|

|

Identify three key marketing skills that will benefit you

: Identify the most significant political, economic, and social forces that you believe are influencing changes in health care marketing today. Identify three key marketing skills that will benefit you in the future.

|

|

What does your willingness to pay for these vacations

: You are trying to decide where to go on vacation. In country A, your risk of death is 1 in 20,000, and you’d pay $5,000 to go on that vacation. In country B, your risk of death is 1 in 30,000, and you’d pay $5,600 to go on that vacation. Supposing th..

|

|

What is socially optimal level of firm pollution reduction

: Two firms are ordered by the federal government to reduce their pollution levels. Firm A’s marginal costs associated with pollution reduction is MC = 150 + 3Q. Firm B’s marginal costs associated with pollution reduction is MC = 10 + 9Q. The marginal ..

|