Reference no: EM132983781

Question 1

Jill and Tilly Masterson share the same last name, but are not related. They met each other a number of years previously when they attended the Canadian Memorial Chiropractic College in Toronto. Last year, they discovered that both had moved to Edmonton and, over coffee, they learned that neither was happy in the practice where they work. They decided to create a partnership and go out on their own. Masterson Chiropractic Services started business at the beginning of the current year.

Jill contributed most of the capital for the new partnership, so it was determined that she will receive 75 per cent of any capital gains or dividends received by the partnership. The partnership agreement was set up at the beginning of 20XX and calls for business income to be shared equally. Because local interests are important to both of them, the partnership makes some charitable contributions, which are also shared equally per the agreement.

For the year ending December 31, 20XX, their results, prepared on a GAAP basis, are as follows:

Masterson Chiropractic Services

Partnership Income Statement

Year Ending December 31, 2OXX

Revenues $1,000,000

Expenses: $84,000

Office rent 15,000

Amortization 32,000

Office supplies 18,000

Business meals and entertainment 18,000

Charitable donation 28,000

Staff salaries 70,000

Salary to Jill 175,000

Salary to Tilly 175,000 597,000

Net Business Income $403,000

Other income:

Capital gains $15,000

Eligible Dividends Received 25,000 40,000

Accounting net income $443,000

Other Information

1. Jill and Tilly wish to deduct maximum CCA for the year, which has been calculated at $43,000.

Required

A. Calculate the amount of income from the partnership that would be included in the Net Income for Tax Purposes for Jill and Tilly.

B. Indicate the amount of any federal tax credits that would be available to Jill and Tilly as a result of their interest in the partnership.

Question 2

Jacoba Brink is currently a very successful website developer. Previously, she worked at Microsoft, and when she left there she made quite a bit of money on her stock options. About 10 years ago, she transferred a large group of investments into a trust in favour of her two children.

The fiscal year of the trust ends on December 31, and Ms. Brink has no beneficial interest in either the income or the capital of the trust.

Under the terms of the trust, her daughter Kara receives 40 per cent of all the income and her other daughter, Tatiana, receives 35 per cent of this income. Kara is aged 32 and Tatiana is 28. Both children are single and have no current sources of income other than the trust.

The undistributed income accumulates within the trust, to be paid out to the daughters at the time of death of Ms. Brink.

The income figures for the year ending December 31, 20XX, are as follows:

Interest income on GICs $300,000

Eligible dividends from Canadian corporations 675,000

Revenue from rental property 96,000

Cash expenses on rental property 42,000

The rental property was sold on October 1, 20XX, for $1.8 million. 70 per cent of the sales price was allocated to the building, and 30 percent to the land. The original cost of the apartment building was $1 million, with the same allocations. The apartment building had been transferred into the trust when it was established, and the UCC of the building is $556,000. This is the first disposition of capital property by the trust since it was established.

Required

A. Calculate the Taxable Income of the trust, and for Kara and Tatiana for the year ending 20XX.

B. Calculate the Federal Tax Payable for the trust for the year ending 20XX

Question 3

Jack Wade owns an unincorporated business appropriately named Wade Enterprises. Mr. Wade has decided that he no longer needs to spend all of the business income he receives each year, and would like to take advantage of the tax deferral possibilities by transferring his business into a corporation. He would like to transfer all of the assets currently in the business into his new corporation, Wade Ltd. He had determined that a December 31 year end will work for the corporation.

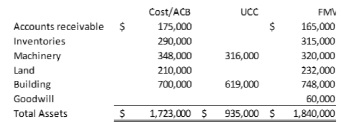

On January 1, 20)x, Wade Enterprises has no liabilities. The tax values (ACB or UCC) and fair market values (FMV) of the assets of Wade Enterprises are listed below:

The transfer to Wade Ltd. will take place on January 1, 20XX, and an election will be made under Section 85 of the Income Tax Act. Wade Ltd. will issue $1,125,000 in new debt to Mr. Wade.

As part of the transfer, the company will issue preferred stock with a fair market value of $250,000, and common stock with a fair market value of $300,000. All of the shares will be issued to Mr. Wade. Assume Wade Ltd. does not have a balance in its General Rate Income Pool (GRIP) at any time for the purposes of this question.

Required

A. Calculate the minimum values at which the assets should be transferred to the new corporation under ITA 85. Indicate any assets that should not be transferred, and explain the appropriate treatment.

B. Assuming that Mr. Wade will elect on the values calculated in part A and go ahead with the transfer under Section 85, determine the adjusted cost base of the preferred and common shares.

C. Assuming that Mr. Wade will elect on the values calculated in part A and go ahead with the transfer under Section 85, determine the PUC reduction of the preferred and common shares.