Reference no: EM13176733

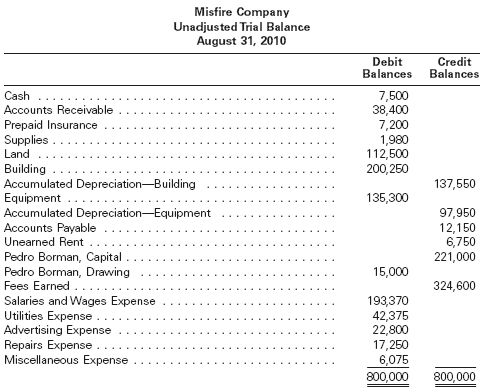

Misfire Company is a small editorial services company owned and operated by Pedro Borman. On August 31, 2010, the end of the current year,

Misfire Company's accounting clerk prepared the unadjusted trial balance shown on the next page.

The data needed to determine year-end adjustments are as follows:

(a) Unexpired insurance at August 31, $1,800.

(b) Supplies on hand at August 31, $750.

(c) Depreciation of building for the year, $2,000.

(d) Depreciation of equipment for the year, $5,000.

(e) Rent unearned at August 31, $2,850.

(f) Accrued salaries and wages at August 31, $2,800.

(g) Fees earned but unbilled on August 31, $12,380.

�

Instructions

1. Journalize the adjusting entries. Add additional accounts as needed.

2. Determine the balances of the accounts affected by the adjusting entries, and prepare an adjusted trialbalance.

|

What are the main points that the report identifies

: What are the main points that the report identifies and why do you think this is so and how do you think this report would benefit business entities, what type of entities and why?

|

|

How much money to withdraw

: If he deposits %5000 each year, how much will his daughter be able to withdraw each year starting in year 18 and continuing through year 22? Assume the account earns interest at 8% a year.

|

|

Explain rational business price and production decisions

: Evaluate the result in (2) from perspectives of efficiency and equity drawing upon price/cost margins for your explanation. You may want to also consider issues involving the stability of collusive cartels.Then tell us what that means for rational ..

|

|

Determine the lost social welfare

: Consider a market where supply and demand are given by QXS = -14 + PX and QXd = 91 - 2PX. Suppose the government imposes a price floor of $42, and agrees to purchase any and all units consumers do not buy at the floor price of $42 per unit.

|

|

Determine balances of accounts affected by adjusting entries

: Journalize the adjusting entries. Add additional accounts as needed and determine the balances of the accounts affected by the adjusting entries, and prepare an adjusted trialbalance.

|

|

Describe possible economic policies

: Select any four of the six summary statements and explain in detail the significance and possible causes of each item. Be sure to use the economic concepts and polices discussed in your textbook where applicable. Identify possible economic policie..

|

|

What happens in market for autoworkers

: Suppose the market for autoworkers is in equilibrium when the automakers purchase capital goods to produce more fuel efficient automobiles and these capital goods are a substitute for workers. What happens in market for autoworkers?

|

|

Determine the worth of annual deposits

: Determine the present worth of 5 annual deposits of $1,200 at the end of years 1 through 5, followed by 4 equal annual withdrawals of $700 at the end of years 4 through 7. Note that both years 4 and 7 will have a depsoit and a withdrawal. Interest..

|

|

Who has to comply with accounting standards

: Who has to comply with accounting standards? How is this determined and where can I find accounting standards?

|