Reference no: EM131182144

Economics 102: Macroeconomic Theory Assignment

1. A World of Low Real Interest Rates

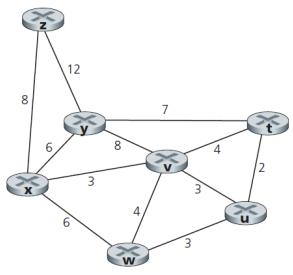

In this exercise we show how demographics and a lower long-run growth rate of output can help understand the low level of real interest rates that we see in many developed countries.

1.1 Motivation

Read the article "We're in a Low-Growth World. How Did We Get Here?", by Neil Irwin: https://nyti.ms/2aIWeW5. Summarize it in three tweets or less (1 tweet=140 characters).

1.2 Demographics

Consider an economy populated by a representative household that lives for two periods, t = 1, 2. This household is composed of Nt identical members in period t, and decides how much to consume or save in order to maximize the sum of utilities of her members. Hence, the preferences of the household are given by:

where (c1, c2) is the consumption bundle of a member of this household (they are identical, so they all consume the same bundle).

The income of the household is given by (y1, y2). Assume this is a closed economy, so the household's savings have to be in zero net supply:

at = 0 for t = 1, 2

The real interest rate is determined endogenously and must be such that the asset market clears.

a) Set up the maximization problem of the household and find her Euler equation.

b) Solve for the demands (c1, c2).

c) Solve for r*2, the equilibrium real interest rate. How does r*2 depend on N2/N1, the growth rate of the population? Provide intuition.

1.3 The Labor Force Participation Rate

A large fraction of the decrease in employed workers is explained not by low population growth, but by the retirement of the baby-boomers. We can interpret that in the context of out models as an increase in the utility derived from leisure. Can this explain low real interest rates?

Consider a representative consumer that lives for two periods, t = 1, 2. In each period he has to decide how much to consume (ct), to work (Lt) and to save (at). For each unit of the good that she saves in t, she receives 1 + rt goods the next period. Initially, the consumer starts with wealth a1 = 0. Her preferences are characterized by the utility function:

u(c1, L1, c2, L2) = ln (c1 - γ1((L1)2/2)) + βln(c2 - γ2((L2)2/2))

with β > 0, γ1 > 0, γ2 > 0. We will consider later the case where the profits of the firm that the consumer owns equal 0. Then, her only income is her wage compensation in each period, wtLt. Also assume that there's a representative firm with the production technology yt = AtNt, At > 0.

a) Set up the maximization problem of the consumer and derive the first order conditions.

b) Solve for the optimal allocation (c1, L1, c2, L2).

c) Set up the problem of the firm. Solve for the supplies of goods (y1; y2) and demands for labor (N1, N2). Show that the profits of the firm in each period, π1 and π2, have to equal 0 in equilibrium.

d) Define the competitive equilibrium.

e) Solve for all the equilibrium quantities and prices.

f) Give an interpretation for γ1 and γ2. How does r2 depend on them? Use the model to argue that a low expected labor force participation rate can explain the low real interest rates we see in the present.

2. Income and Substitution Effects with CES Preferences

Until now we have explained the response of quantities after changes in prices using the sign of the income and substitution effects. In this exercise we derive the explicit formula for these effects for a family of preferences that is widely used in Macroeconomics:

The notation is the following. We define W as the present value of lifetime income.

W ≡ y1 + (y2/1+r2)

ct (r2, W) is the Marshallian demand for consumption in period t, and ht (r2, u) the Hicksian demand.

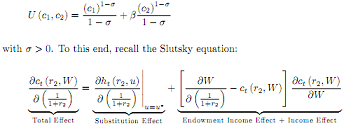

The left hand side, ∂ct(r2, W)/∂(1/1+r2), measures the total effect of a change in the price (1/1+r2).

The first term on the right, ∂ht (r2, u)/∂(1/1+r2), ,measures the substitution effect. Recall that the Hicksian demand is derived from the dual problem of minimizing expenditure subject to attaining a fixed level of utility. For the Slutsky equation, this fixed level of utility is u*, the level of utility attained in the utility maximization problem.

Finally, the second term on the right has two components. (∂ct(r2, W)/∂W) measures the change in the quantity consumed after a change in lifetime income W. Hence, -ct(r2, W)(∂ct(r2, W)/∂W) measures the income effect, whereas (∂W/∂(1/1+r2))(∂ct(r2, W)/∂W) measures the endowment income effect (the value of the endowment changes after a change in r2).

a) Derive the Marshallian demands {ct (r2, W)}t=12.

b) Use the Euler equation to show that the elasticity of the gross growth rate of consumption c2/c1 with respect to the gross real interest rate 1 + r2 is constant and equal to 1 = σ (hence the CES name for these preferences: constant elasticity of substitution).

c) Derive the Hicksian demands {ht (r2, u)}t=12.

d) Verify that the Slutsky equation holds: compute each of the four terms and show that they add up.

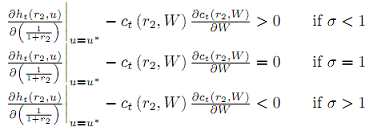

e) Show how the relative size of the income and substitution effects depends on σ. In particular, show that:

f) Show that the total income effect, as measured by [(∂W/∂(1/1+r2)) - ct (r2, W)] (∂ct(r2, W)/∂W, is positive if the consumer is a lender in the first period, and negative if she is a borrower.