Reference no: EM131330539

Intermediate Accounting Assignment

Part 1

1) The receipt of interest on loans would be reported on a statement of cash flows under the:

A) Financing

B) operating activities

C) investing activities

D) Interest received on loans would not be reported on a statement of cash flows.

2) Interest paid on debt would be reported on a statement of cash flows under the:

A) investing activities

B) Operating activities

C) financing activities

D) Interest paid on debt would not be reported on a statement of cash flows.

3) The purchase of treasury stock would be reported on a statement of cash flows as a:

A) cash outflow under the financing activities

B) cash inflow under the financing activities

C) cash inflow under the investment activities

D) cash inflow under the operating activities

4) The declaration of dividends by the board of directors would be reported on a statement of cash flows as a(n):

A) cash outflow under the financing activities

B) cash inflow under the financing activities

C) cash outflow under the investing activities

D) activity that would not be reported on a statement of cash flows

5) The purchase of held-to-maturity securities would be reported on a statement of cash flows as:

A) operating activities

B) Investing activities

C) Financing activities

D) Held-to-maturity securities would not be reported on a statement of cash flows.

6) The statement of cash flows is presented as of a specific date in time.

A) True

B) False

7) Investments that do not require cash can be reported on a separate schedule under the statement of cash flows.

A) True

B) False

8) MNO Co. began the year with $84,700 in Accounts Receivable and ended the year with $80,700 in Accounts Receivable. Sales for the year were $2,500,000. The cash collected from customers during the year amounted to:

A) $2,580,700

B) $2,496,000

C) $2,504,000

D) $2,584,700

9) Jerry Corporation sold some of its used equipment for $65,000. The indirect method statement of cash flows shows an addition to net income of $6,000. The accumulated depreciation on the equipment to date of sale was $63,000. The original cost of the equipment was:

A) $69,000

B) $122,000

C) $134,000

D) $71,000

10) The full disclosure principle, as adopted by the accounting profession, is best described by which of the following?

a. Disclosure of any financial facts significant enough to influence the judgment of an informed reader.

b. All information related to an entity's business and operating objectives is required to be disclosed in the financial statements.

c. Information about each account balance appearing in the financial statements is to be included in the notes to the financial statements.

d. Enough information should be disclosed in the financial statements so a person wishing to invest in the stock of the company can make a profitable decision.

11) Events that occur after the December 31, 2011 balance sheet date (but before the balance sheet is issued) and provide additional evidence about conditions that existed at the balance sheet date and affect the realizability of accounts receivable should be

a. used to record an adjustment to Bad Debt Expense for the year ending December 31, 2011.

b. discussed only in the MD&A (Management's Discussion and Analysis) section of the annual report.

b. disclosed only in the Notes to the Financial Statements.

c. used to record an adjustment directly to the Retained Earnings account

12) Which of the following post-balance-sheet events would generally require disclosure, but no adjustment of the financial statements?

a. Retirement of the company president

b. Settlement of litigation when the event that gave rise to the litigation occurred prior to the balance sheet date.

c. Issue of a large amount of capital stock

d. Employee strike

13) Minimum components of an interim financial report includes

a. a condensed statement of financial position

b. a condensed statement of financial position, a condensed statement of comprehensive income.

c. a condensed statement of financial position, a condensed statement of comprehensive income, a condensed statement of cash flows

d. a condensed statement of financial position, a condensed statement of comprehensive income, a condensed statement of cash flows, and a set of selected footnote disclosures

14) If the financial statements examined by an auditor lead the auditor to issue an opinion that contains an exception that is not of sufficient magnitude to invalidate the statement as a whole, the opinion is said to be

a. unqualified.

b. exceptional.

c. adverse.

d. qualified.

15) The MD&A section of a company's annual report is to cover the following three items:

a. income statement, balance sheet, and statement of owners' equity.

b. income statement, balance sheet, and statement of cash flows.

c. liquidity, capital resources, and results of operations.

d. changes in the stock price, mergers, and acquisitions.

16) Which of the following best characterizes the difference between a financial forecast and a financial projection?

a. Forecasts include a complete set of financial statements, while projections include only summary financial data.

b. A forecast is normally for a full year or more and a projection presents data for less than a year.

c. A forecast includes data which can be verified about future expectations, while the data in a projection is not susceptible to verification.

d. A forecast attempts to provide information on what is expected to happen, whereas a projection may provide information on what is not necessarily expected to happen.

Problem

The following information was extracted from the accounting records of ABC Enterprises, Inc.:

a. Net income, $49,200

b. Depreciation on equipment, $3,600

c. Purchased long-term investments, $6,600

d. Sold property, plant, and equipment for $45,900 (amount includes a loss of $7,700)

e. Issued long-term note payable to acquire equipment, $15,400

f. Payment on long-term note payable, $42,000

g. Issued common stock for cash, $5,100

h. Declared and paid cash dividend, $27,100

i. Bonds payable into common stock, $140,000

Increases (decreases) in selected accounts were as follows:

|

Accounts receivable

|

(2,500)

|

|

Interest receivable

|

(800)

|

|

Inventory

|

7,400

|

|

Prepaid expenses

|

800

|

|

Accounts payable

|

2,400

|

|

Income tax payable

|

(600)

|

|

Accrued liabilities

|

(1,400)

|

|

Interest payable

|

900

|

|

Salaries payable

|

(1,710)

|

December 31, 2014 cash was $51,400.

Prepare the statement of cash flows, in proper format, on a separate sheet of paper, for ABC Enterprises for the year ended December 31, 2015, using the indirect method and including a schedule of noncash investing and financing activities, if necessary.

Part 2

The following information is available for the pension plan of Jones Company for the year 2014.

|

Actual and expected return on plan assets

|

$ 15,000

|

|

Benefits paid to retirees

|

40,000

|

|

Contributions (funding)

|

90,000

|

|

Interest/discount rate

|

10%

|

|

Prior service cost amortization

|

8,000

|

|

Projected benefit obligation, January 1, 2014

|

500,000

|

|

Service cost

|

60,000

|

Instructions

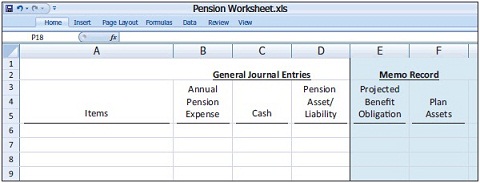

(a) Construct a new pension worksheet to submit in Excel or Word format, using the sample worksheet below. Complete sheet.

(b) Prepare the journal entry to record pension expense and the employer's contribution to the pension plan in 2014.

(a)

(b) Prepare the journal required journal entry.

There was an omission with the pension data. The pension fund was fully funded at the beginning of the year.