Reference no: EM131318210

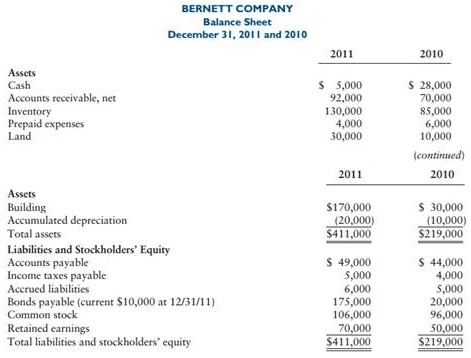

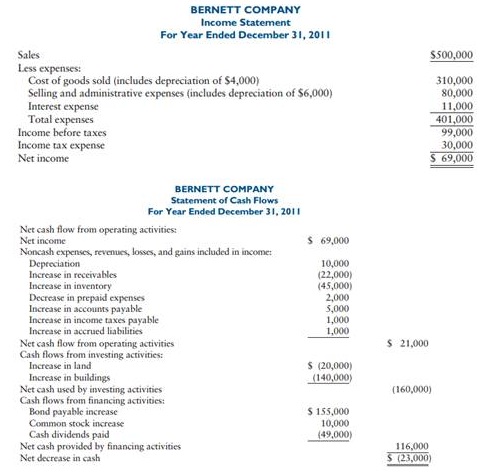

The balance sheet for December 31, 2011, income statement for the year ended December 31, 2011, and the statement of cash flows for the year ended December 31, 2011, of Bernett Company are shown in the following balance sheet.

The president of Bernett Company cannot understand why Bernett is having trouble paying current obligations. He notes that business has been very good, as sales have more than doubled, and the company achieved a profit of $69,000 in 2011.

Required

a. Comment on the statement of cash flows.

b. Compute the following liquidity ratios for 2011:

1. Current ratio

2. Acid-test ratio

3. Operating cash flow/current maturities of long-term debt and current notes payable

4. Cash ratio

c. Compute the following debt ratios for 2011:

1. Times interest earned

2. Debt ratio

3. Operating cash flow/total debt

d. Compute the following profitability ratios for 2011:

1. Return on assets (using average assets)

2. Return on common equity (using average common equity)

e. Compute the following investor ratio for 2011: Operating cash flow/cash dividends.

f. Give your opinion as to the liquidity of Bernett.

g. Give your opinion as to the debt position of Bernett.

h. Give your opinion as to the profitability of Bernett.

i. Give your opinion as to the investor ratio.

j. Give your opinion of the alternatives Bernett has in order to ensure that it can pay bills as they come due.

|

Prepare the statement of cash flows for the year ended

: Prepare the statement of cash flows for the year ended December 31, 2011, using the indirect method for net cash flow from operating activities.

|

|

Understanding a real-time and time-critical system

: ITECH 7410: Software Engineering Methodologies Assignment. The purposes of the assignment: Understanding a real-time and time-critical system. Understanding Entity Relationship Diagram and Data Flow Diagram in terms of a real time software system

|

|

Develop work breakdown structure from refine scope statement

: Develop a work breakdown structure (WBS) from the refined scope statement. Best practices to finish a project on time, on budget. How to develop a project network? What are the Hammock Activities

|

|

Determine the required moles of steam

: Determine the moles of solvent required per mole of VOC free carrier gas if the exiting gas stream is to contain only 0.2 mol % VOC and if 1.5 times the minimum solvent is used.

|

|

Compute the times interest earned

: Compute the Times interest earned, Debt ratio, Operating cash flow/total debt, Return on assets and Return on common equity.

|

|

Prpare a new product that would appeal to your market

: Choose the target market for your product, and describe your target market in detail. Create a new product that would appeal to your market.

|

|

Goal of the firm and how a manager decisions

: Explain the goal of the firm and how a manager decisions in the areas of working capital management and capital structure act to achieve this goal? Please provide source?

|

|

Why do we need bcg matrix

: How do you categorize various Monsanto's products/services into one of four categories of BCG matrix (Cash Cows, Stars, Question Marks, and Dogs)? Why do you think so? Please make your own BCG matrix and write explanations of the model.

|

|

Interest rate parity holds

: Suppose 90-day investments in France have a 6% annualized return and a 1.5% quarterly (90-day) return. In the U.S., 90-day investments of similar risk have a 4% annualized return and a 1% quarterly (90-day) return. In the 90-day forward market, 1 ..

|