Reference no: EM131153681

Questions:-

Management of Mittel Rhein AG of Köln, Germany, would like to reduce the amount of time between when a customer places an order and when the order is shipped.

For the first quarter of operations during the current year the following data were reported:

|

|

|

|

|

Inspection time

|

0.4

|

days

|

|

Wait time (from order to start of production)

|

15.1

|

days

|

|

Process time

|

3.4

|

days

|

|

Move time

|

1.2

|

days

|

|

Queue time

|

3.5

|

days

|

|

Required:

1. Compute the throughput time. (Round your answer to 1 decimal place.)

2. Compute the manufacturing cycle efficiency (MCE) for the quarter.

(Round your answer to the nearest whole percentage (i.e., 0.12 should be entered as 12).)

3. What percentage of the throughput time was spent in non-value-added activities?

(Round your answer to the nearest whole percentage (i.e., 0.12 should be entered as 12).)

4. Compute the delivery cycle time.

(Round your intermediate calculations and final answer to 1 decimal place.)

5. If by using Lean Production all queue time during production is eliminated, what will be the new MCE?

(Do not round intermediate calculations. Round your answer to the nearest whole percentage

(i.e., 0.12 should be entered as 12).)

[The following information applies to the questions displayed below.]

Fitness Fanatics is a regional chain of health clubs.

The managers of the clubs, who have authority to make investments as needed, are evaluated based largely on return on investment (ROI). The company's Springfield Club reported the following results for the past year:

|

|

|

|

|

Sales

|

$

|

910,000

|

|

Net operating income

|

$

|

32,760

|

|

Average operating assets

|

$

|

100,000

|

|

2. Required information

Required:

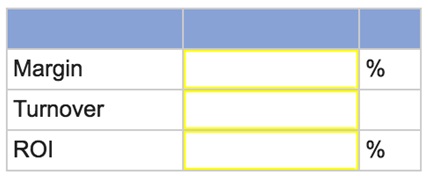

1. Compute the Springfield club's return on investment (ROI). (Round your Turnover answer to 2 decimal places. Round your Margin and ROI percentage answers to 2 decimal places (i.e., 0.1234 should be entered as 12.34).)

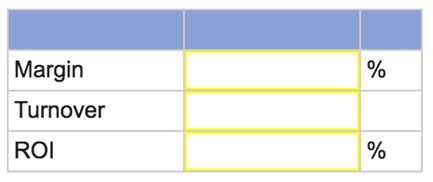

2. Assume that the manager of the club is able to increase sales by $91,000 and that, as a result, net operating income increases by $8,281. Further assume that this is possible without any increase in operating assets. What would be the club's return on investment (ROI)? (Round your Turnover answer to 2 decimal places. Round your Margin and ROI percentage answers to 2 decimal places (i.e., 0.1234 should be entered as 12.34).)

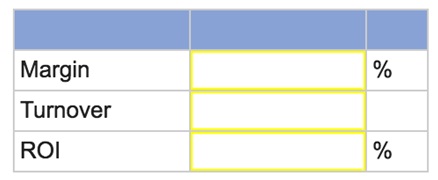

3. Assume that the manager of the club is able to reduce expenses by $3,640 without any change in sales or operating assets. What would be the club's return on investment (ROI)? (Round your Turnover answer to 2 decimal places.

Round your Margin and ROI percentage answers to 2 decimal places (i.e., 0.1234 should be entered as 12.34).)

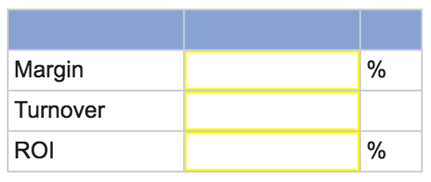

4. . Assume that the manager of the club is able to reduce operating assets by $30,000 without any change in sales or net operating income. What would be the club's return on investment (ROI)?

(Round your Turnover answer to 2 decimal places. Round your Margin and ROI percentage answers to 2 decimal places (i.e., 0.1234 should be entered as 12.34).)