Reference no: EM131157611

1. (General Model of Deposit Creation) In this question, you are required to describe the changes in the balance sheets for a general deposit-creation model.

Suppose an occurrence of the Fed's open market purchase proceed as follows:

1. The Fed decided to purchase $100 millions of securities from Bank A.

2. Bank A holds 10% of its increase in liquidity as required reserves, 40% as excess reserves, and use 50% as loans to Borrower A.

3. Borrower A holds 50% of her liquidity as currency and 50% as deposits in Bank B.

4. Bank B holds 10% of its increase in liquidity as required reserves, 40% as excess reserves, and use 50% as loans to Borrower B.

5. Borrower B holds 50% of her liquidity as currency and 50% as deposits in Bank C.

6. Finally, Bank C holds all of its increase in liquidity as reserves (required reserves plus excess reserves). Hence the deposit creation process stops here.

Notice that the required reserve ratio, r, the excess reserve ratio, e, and the currency ratio, c, are the same for all the banks and borrowers, and are given by r = 0.1, e = 0.4, and c = 1.0. Answer the following questions.

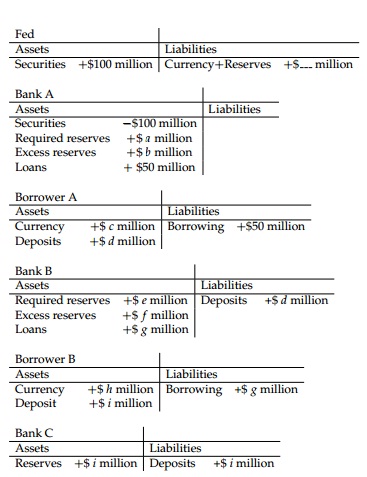

(a) The following balance sheet records the changes in compositions of assets and liabilities for each market participants. Fill the numbers in a-i.

(b) By computing the increase in currency and reserves (a + b + c + e + f + h + i), confirm that the increase in monetary base is $100 million and thus the Fed balance sheet balances.

(c) Next compute the increase in money supply (increase in monetary base+d + i).

(d) By dividing the increase of money supply by the increase in monetary base, compute the money multiplier in this example.

(e) Using the ratios r = 0.1, e = 0.4, and c = 1, compute the theoretical money 2 multiplier (i.e., use the formula in chapter-15 slides).

2. (Demand and Supply Analysis in The Market for Reserves) This question asks you to elaborate on demand and supply analysis in the market for reserves (liquidity).

(a) The demand curve for reserves is derived from the trade-off of banks between lending/borrowing from the federal funds market and holding excess reserves.

i. Suppose that the federal funds rate iff is above the interest rate ier for excess reserves, that is, iff > ier. Explain why in this case the demand curve is downward-sloping.

ii. Suppose that the federal funds rate is below the interest rate for excess reserves, that is, iff < ier. In this case, there is an arbitrage opportunity and banks' demand for reserves explodes to infinity. Explain why.

(Hint: Note that banks can borrow liquidity at the federal funds rate iff and use the money to increase their holdings of reserves)

Since the demand for reserves goes to infinity at iff < ier, the demand curve must be flat at iff = ier.

(b) The supply curve for reserves is simply the amount of reserve supplied to the market. The amount of reserves consists of the two parts: nonborrowed reserves (NBR) and borrowed reserves (BR). The nonborrowed reserves is the amount of liquidity supplied by the Fed. The borrowed reserves is the amount of liquidity which banks decides to borrow from the Fed.

i. Suppose the federal funds rate is below the discount rate id , that is, iff < id . In this case, the amount of borrowed reserves must be zero. Explain why.

ii. Next consider the case in which the federal funds rate is above the discount rate, that is, iff > id . In this case, again there is an arbitrage opportunity for banks. Explain why.

From b)i, we see that the supply of reserves is equal to the amount of nonborrowed reserves, which is kept fixed unless there is a policy intervention by the Fed.

From b)ii, the supply for reserves goes to infinity at iff > id .

Hence the supply curve must be flat at iff = id.

(c) Discuss how the increase in the following variables shifts demand or supply curve (or both). More explicitly, please answer whether an increase in a variable shifts a curve or not. If the curve shifts, then explain why the shift occurs and which direction the shift occurs. If the curve does not shift, then explain why the shift does not occur.

Example: An increase in reserve requirement ratio shifts the demand curve to the right and does not shift the supply curve. This increase shifts the demand curve to the right because, for any given federal funds rate, banks have to increase their reserve holdings. The supply curve does not shift because a change in reserve requirement does not change the actual amount of liquidity supplied in the market.

i. Nonborrowed reserves.

ii. Discount rate.